31 July 2025

Quarterly Activities and Cash Flow Report

for the quarter ended 30 June 2025

Atlantic Lithium advances discussions to seek revised fiscal terms of the Mining Lease

in respect of the Ewoyaa Lithium Project

Atlantic Lithium Limited (AIM: ALL, ASX: A11, GSE: ALLGH, OTCQX: ALLIF, "Atlantic Lithium" or the "Company"), the Africa-focused lithium exploration and development company targeting the delivery of Ghana's first lithium mine, is pleased to release its Quarterly Activities and Cash Flow Report for the period ended 30 June 2025 .

Highlights

Project Development:

- The Company has progressed discussions with key stakeholders, including government representatives, to secure fiscal terms for the Mining Lease of its flagship Ewoyaa Lithium Project ("Ewoyaa" or the "Project") in Ghana that reflect the current lithium price environment.

o The Company welcomes recent comments made by the Minister of Lands and Natural Resources in parliament, in which it was confirmed that Cabinet had authorised that revised terms of the Mining Lease be negotiated and presented for review, per the necessary process for parliamentary ratification.

o With all of the necessary regulatory approvals secured, ratification of the Mining Lease by Ghana's parliament serves as the final step in the Project's permitting process to enable the advancement of the Project.

- Additional work underway to enhance the design and engineering of the Project, focused on maintaining a technically sound and capital-efficient operation whilst reducing operating costs and the Project's peak funding requirement, intended to support the development of the Project.

Exploration:

- Discovery of spodumene pegmatite in outcrop and float at both of the Company's 100%-owned Agboville and Rubino exploration licences in Côte d'Ivoire.

o Low-cost exploration across the two licences is being undertaken concurrently with the development of Ewoyaa in line with the Company's ambitions to develop a pipeline of projects to support long-term growth.

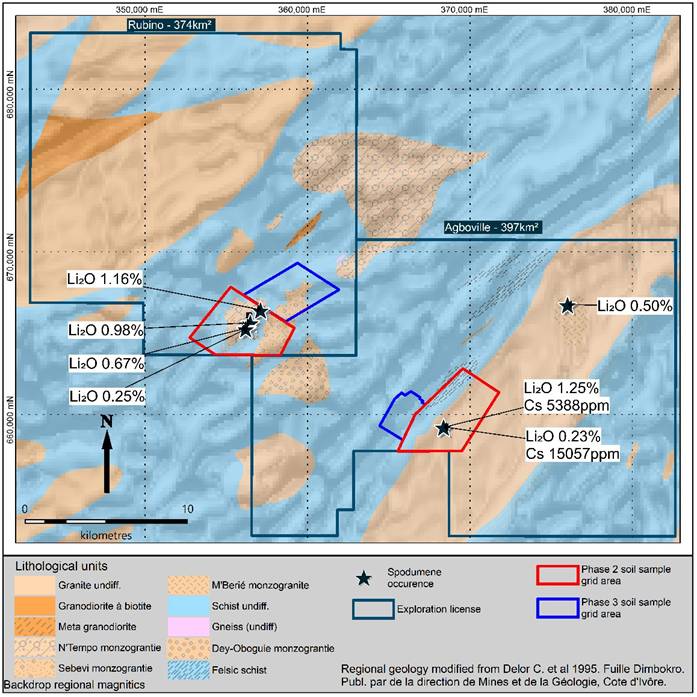

- Impressive results returned from Phase 2 soil sampling completed at the Rubino licence, which have identified pronounced lithium anomalies over a 2.5km by 2.0km area.

- Completion of Phase 3 soil geochemical sampling undertaken over the Agboville and Rubino licences, with analysis underway.

Corporate:

- Additional cost-saving measures implemented to enable the Company to focus resources on advancing Ewoyaa towards Project FID.

o Measures have included Neil Herbert stepping down from Executive Chairman to Non-Executive Chairman, salary reductions for key leadership personnel, and a further reduction in headcount.

- Cash on hand at end of quarter was A$5.4m.

Commenting, Keith Muller, Chief Executive Officer of Atlantic Lithium, said :

"I am pleased to report on the progress made in our discussions with the Ghanaian government to seek fiscal terms in respect of the Ewoyaa Mining Lease that reflect the current lithium pricing environment and that enable the Project to deliver value for shareholders and significant benefits for Ghana and Ghanaians.

"Through these discussions, we are working alongside our Ghanaian stakeholders to chart a path to delivering a robust operation at Ewoyaa, capable of withstanding prolonged periods of weakened lithium pricing, and achieving our shared goal of first production of spodumene in Ghana.

"We welcome the recent comments made by the Hon. Minister of Lands and Natural Resources in parliament in which it was confirmed that revised terms would be negotiated and presented for review, per the necessary ratification process. We continue to support the process where possible.

"While we await parliamentary ratification of the Mining Lease, we continue to manage costs to ensure that the Company can survive the current lithium downturn and be in the best position to capitalise on a price recovery. We have made further cuts to this end, including Neil Herbert stepping down from his role as Executive Chairman to assume the position of Non-Executive Chairman, salary reductions for key management personnel, a rationalisation of headcount, and a reduction in spending across activities that are not currently considered critical to advancing the Project towards Project FID.

"Aside from our progress at Ewoyaa, we also have reported encouraging early results from our initial exploration programmes in Côte d'Ivoire, where we have discovered spodumene pegmatite in outcrop and float at both of the Company's 100%-owned Agboville and Rubino exploration licences. We believe that our exploration activities at Agboville and Rubino offer attractive upside potential at a low cost. While Ewoyaa remains our focus, the two licences present highly prospective tenure for lithium discovery and align with the Company's aim of building a pipeline of projects to support long-term growth.

"We look forward to providing further updates in due course."

Authorised for release by Amanda Harsas, Finance Director and Company Secretary, Atlantic Lithium Limited.

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company's obligations under Article 17 of MAR.

June Quarter Activities

During the period, the Company continued to advance its flagship project, the Ewoyaa Lithium Project, through the permitting phase towards production. The Definitive Feasibility Study ("DFS") for the Project outlines a low capital and operating cost profile, with near-term production potential.1 The Project is on track to become Ghana's first operating lithium mine.

Ewoyaa, located in the pro-mining jurisdiction of Ghana, West Africa, approximately 100km southwest of the capital of Accra, comprises eight main deposits, including Ewoyaa, Okwesikrom, Anokyi, Grasscutter, Abonko, Kaampakrom, Sill and Bypass. The Project is well located to operational infrastructure, including being within 1km of the Takoradi - Accra N1 highway, 110km from the Takoradi deep-sea port and adjacent to grid power (refer Figure 1 ).

Figure 1: Location of the Ewoyaa Lithium Project, Ghana

Concurrent to its activities at Ewoyaa, the Company continues to undertake low-cost exploration across the contiguous Agboville and Rubino exploration licences, which are 100% owned through its wholly-owned Ivorian subsidiary Khaleesi Resources SARL ("Khaleesi"), in the mining-friendly jurisdiction of Côte d'Ivoire in West Africa.

The Agboville and Rubino licences, which cover 396.89 km² and 374.18 km² respectively, provide the Company with exclusive rights to conduct lithium exploration over highly prospective tenure for lithium discovery.

Leveraging synergies with its existing operations in Ghana, the Company is applying its proven track record of lithium exploration, discovery and evaluation in tropical weathering environments, as demonstrated at Ewoyaa, to its exploration portfolio in Côte d'Ivoire.

Project Development

Ewoyaa Mining Lease

The Company continues to await the ratification of the Mining Lease in respect of the Project by Ghana's parliament. With all of the necessary regulatory approvals now secured, parliamentary ratification serves as the final step of the permitting process and will enable the Company to advance the financing of the Project.

The Company has engaged key stakeholders in Ghana, including government representatives, to seek fiscal terms of the Mining Lease that reflect the current lithium price environment and that ensure that the Project delivers value for shareholders and long-term benefits for Ghana and Ghanaians.

Post-period, the Company welcomed the comments made in parliament by the Minister of Lands and Natural Resources, Hon. Emmanuel Armah-Kofi Buah, in which the Minister confirmed that Cabinet had authorised that revised terms of the Mining Lease be negotiated and presented for review by Cabinet, and by Parliament thereafter, per the necessary process for parliamentary ratification. While acknowledging the exceptional support from residents of the Project's catchment area within the Central Region for the advancement of the Project, the Minister highlighted, in particular, the importance of the number of jobs that will be created at Ewoyaa among the significant benefits that the Project is expected to generate locally.

The Company remains confident that ratification of the Mining Lease will be forthcoming in accordance with due parliamentary process, however, shareholders should note that there can be no certainty that the Company will be able to secure more favourable terms or that Ghana's parliament will indeed ratify the Mining Lease.

Project Optimisation

Additional work, comprising a series of cost-benefit analyses and process comparisons, is being undertaken to identify and implement further optimisations to the Project's design and engineering. The work is focused on maintaining a technically sound and capital-efficient operation whilst reducing operating costs and the Project's peak funding requirement to support the development of the Project, ensuring it remains resilient in a lower commodity price environment and that is also positioned to capitalise on future commodity price recoveries and events of positive commodity price volatility.

Exploration

C ô te d'Ivoire

Granted in May 2024, the Company is undertaking low-cost exploration at its Agboville and Rubino exploration licences in Côte d'Ivoire. The licences, which are located c. 80km north of Abidjan, the port and commercial capital of Côte d'Ivoire, are well-serviced with existing infrastructure, including excellent paved highways and an operating railway linking Burkina Faso's capital city of Ouagadougou and the port of Abidjan (refer Figure 2 ).

Figure 2: Location of the Agboville and Rubino licences held 100% by the Company's wholly-owned subsidiary Khaleesi Resources SARL in Côte d'Ivoire and existing operational infrastructure.

Mapping and rock-chip sampling

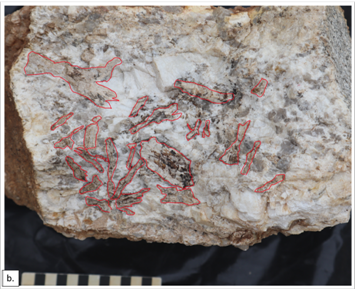

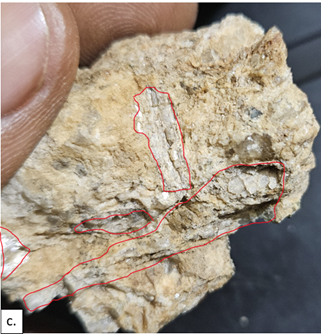

The Company announced during the period that geological mapping completed by the Company's geologists over the Agboville and Rubino exploration licences had discovered a number of spodumene pegmatite occurrences in both licences as rock float and a single rare outcrop, with spodumene visually observed in hand specimen despite varying degrees of weathering exhibited (refer announcement of 22 May 2025 ). Mapping was undertaken as part of the first pass geological appraisal of priority areas of the two licences, over which historical government data suggest lithium-caesium-tantalum (LCT) pegmatite could occur.

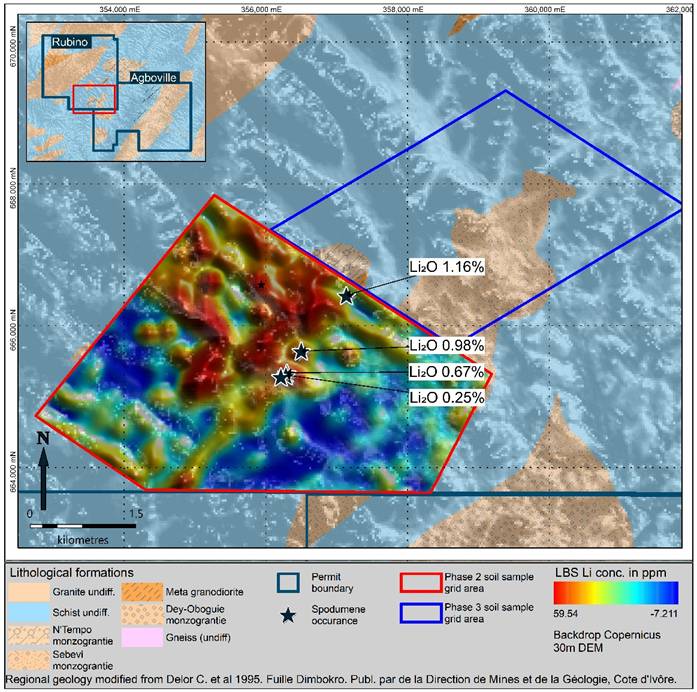

Rock-chip samples were collected during mapping at several locations where pegmatite was encountered and submitted for assay. The elevated assay values of lithium and other elements, above 0.2% Li2O and up to 1.25% Li2O, from these pegmatite rock-chip samples confirm the Company's visual spodumene observations and the prospectivity of the licences (refer Figure 3 ) . Not all pegmatite samples sent for assay returned anomalous assay results. In some cases, anomalous lithium and caesium assays returned from first-pass reconnaissance mapping resulted in the discovery of spodumene pegmatite float when geologists re-visited the sample site to ground truth the anomalous assay results.

Figure 3: Map showing spodumene pegmatite discoveries within the Agboville and Rubino licences with associated lithia and caesium (Cs) values from rock-chip assays. Extent of recent Phase 2 and 3 soil sampling grids are also shown.

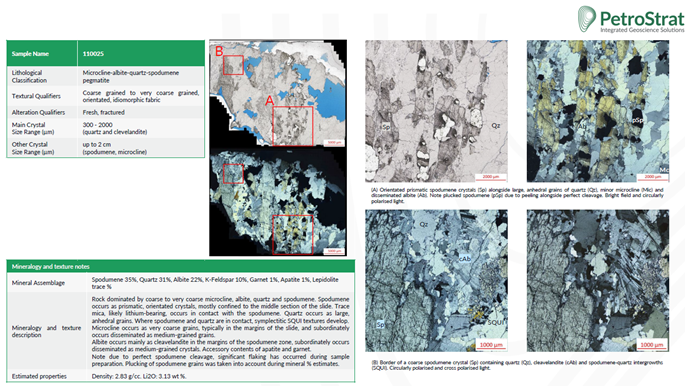

Figure 4: Photographs of spodumene pegmatite hand specimens discovered in the Rubino exploration licence by the Company's geologists. a) Sample 110009 - Weathered surface of spodumene pegmatite float with spodumene crystals 10mm to 50mm in length (outlined in red), estimated to be 10-15% of the surface area of the rock sample. b) Sample 110009 - Broken surface of weathered spodumene pegmatite with spodumene crystals 10mm to 60mm in length (outlined in red), estimated to form 10-15% of the rock sample. c) Sample 110018 - Moderate to strongly weathered spodumene pegmatite with individual spodumene crystals 10mm to 30mm in length (outlined in red), estimated to form 15-20% of the rock sample. d) Sample 110032 (Petrography sample 110025 - see below) - Spodumene pegmatite with pink-brown coloured spodumene crystals ranging in length from 2mm to 15mm (outlined in red), estimated to form 25-30% of the rock sample.

NOTE : Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations.

One spodumene pegmatite float sample (Sample 110025, refer Figure 4d ) from the Rubino licence was sent to PetroStrat in the United Kingdom for thin section preparation and description to confirm the visual observation of spodumene in hand specimen and to identify any other lithium-bearing mineral phases present. The petrographic report on this single sample confirmed the field observation of spodumene and that it is the only significant lithium-bearing mineral present (lepidolite recorded as trace) in the thin section. Other lithium-bearing mineral phases could be present in other samples and areas of the permits and detailed mineralogy will be determined during later stages of the exploration programme.

Figure 5: Petrographic summary of spodumene pegmatite sample 110025 from the Rubino licence by PetroStrat (UK) confirming the field visual observation of spodumene. A photograph of this rock sample is shown in Figure 3d.

Soil Sampling

Soil geochemical sampling was undertaken using 100m by 100m spaced grid over the most prospective areas identified by mapping and rock-chip sampling completed by the Company and also over historical mineral occurrences in both the Agboville and Rubino licence areas.

Soil sampling was completed in two sampling phases in each tenement; Phase 2 consisting of 3,235 sample sites (1,594 sites sampled at Agboville and 1,641 sites sampled at Rubino) and Phase 3 consisting of 1,512 sample sites (442 samples at Agboville and 1,070 samples at Rubino), the extent of which are shown in Figure 3 . The total number of soil samples collected within the Rubino Phase 3 grid increased to 1,070 after the geological team was granted permission to sample a tract of agricultural land that had recently changed ownership. The Phase 1 soil sampling programme was a baseline soil programme undertaken along selected sections during reconnaissance mapping, where different sample depths and sieve fractions were tested and the results of which help set the best parameters for subsequent grid soil programmes.

Only the Rubino Phase 2 soil results have been received to date and the lithium-in-soil values clearly delineate pronounced anomalies (refer Figure 6 ) extending over a 2.5km by 2.0km area where anomalous lithium values between 210ppm and a peak value of 806ppm define the most significant anomalies. These lithium anomalies have distinct geometries, with a particularly pronounced 2.5km-long linear cluster of anomalies whose NE-SW orientation follow interpreted local geological contacts between granodiorite and metasediments and also the prominent regional tectonic trend in this part of the Birimian. There is a close spatial relationship between the pronounced linear lithium-in-soil anomalies and the location of spodumene pegmatite float and outcrop discovered in the Rubino licence. These lithium-in-soil anomalies remain open towards the northeast, where the Company awaits results of the Rubino Phase 3 soil sampling programme.

Figure 6: Rubino Phase 2 Li (ppm) in soil grid results with spodumene pegmatite discovery sites and associated rock-chip lithia assays.

Next Steps

Additional mapping is underway to support the evaluation of the anomalies identified by the Rubino Phase 2 soil results. Once all the remaining Phase 2 (Agboville) and Phase 3 (Agboville and Rubino) soil sampling results are received, surface mapping and follow-up auger drill programmes will be planned to map the source of the anomalies below the laterite at surface, with the ultimate goal to define potential reverse circulation and diamond drill targets. Extending the soil sampling with Phase 4 towards the north and over other prospective areas will also be planned.

Interest in Tenements

At the end of the quarter ending 30 June 2025, the Company had an interest in the following tenements:

| Tenement Number |

Tenement |

Principal |

Grant Date/ |

Expiry Date |

Term |

Change during Quarter |

|

Ghana |

|

|

|

|

|

|

|

| PL3/67 |

Apam East |

Obotan Minerals Company Limited |

06.11.23 |

05.11.26 |

3 years |

None |

|

| PL3/92 |

Apam West |

Obotan Minerals Company Limited |

06.11.23 |

05.11.26 |

3 years |

None |

|

| RL 3/55 |

Mankessim |

Barari DV Ghana Limited |

27.07.21 |

26.07.24* |

3 years |

None |

|

| PL3/102 |

Saltpond |

Joy Transporters Limited |

06.11.23 |

05.11.26 |

3 years |

None |

|

| PL3/109 |

Mankessim South |

Green Metals Resources Limited |

06.11.23 |

05.11.26 |

3 years |

None |

|

| PL3/106 |

Cape Coast |

Joy Transporters Limited |

15.11.21 |

14.11.24* |

3 years |

None |

|

| RML-N-3/181 |

Senya Beraku |

Green Metals Resources Limited (100% Atlantic) |

09.11.23 |

08.11.26 |

3 years |

None |

|

| PL-I-3/15 |

Bewadze |

Green Metals Resources Limited |

09.11.23 |

08.11.26 |

3 years |

None |

|

| ML-3/239 |

Mankessim Mining Lease |

Barari DV Ghana Limited (90% Atlantic) |

20.10.23 |

19.10.38 |

15 years |

None |

|

| |

Ekrubaadze PL |

Green Metals Resources Limited |

03.10.23 |

Application |

|

None |

|

| |

Asebu (Winneba North) |

Green Metals Resources Limited (100% Atlantic) |

28.06.21 |

Application |

|

None |

|

| |

Mankwadze (Winneba South) |

Green Metals Resources Limited (100% Atlantic) |

28.06.21 |

Application |

|

None |

|

| |

Mankwadzi |

Obotan Minerals Company Limited |

15.03.18 |

Application |

|

None |

|

| |

Onyadze |

Green Metals Resources Limited |

23.08.21 |

Application |

|

None |

|

Ivory Coast |

|

|

|

|

|

|

|

| PR695 |

Rubino |

Khaleesi Resources SARL |

22.05.24 |

21.05.28 |

4 years |

None |

|

| PR694 |

Agboville |

Khaleesi Resources SARL |

08.05.24 |

07.05.28 |

4 years |

None |

|

* A renewal application has been submitted to the relevant Government mining department and the Group has no reason to believe the renewal will not be granted.

Corporate

Leadership Streamlining

During the period, the Company announced that Neil Herbert would be stepping down from his position as Executive Chairman to become Non-Executive Chairman and that his remuneration would be reduced in line with his new role. The change to the Company's leadership structure, which sees the management of the Company consolidated under the leadership of Chief Executive Officer ("CEO") Keith Muller, is aimed at reducing costs, as well as streamlining the Company's decision-making, intended to improve operational efficiency as the Company nears the development of the Project. The Board thanks Mr. Herbert for his valuable contributions to the direction of the Company during his tenure as Executive Chairman and welcomes his continued guidance in his new role of Non-Executive Chairman.

Cash Conservation

The Company has implemented further strategic initiatives, through the period and subsequently, to appropriately manage capital in light of the ongoing delay to the ratification of the Mining Lease in respect of the Project and subdued lithium market environment.

As part of these initiatives, and in addition to the aforementioned change to Mr. Herbert's role, CEO Keith Muller and Finance Director and Company Secretary Amanda Harsas have both accepted a temporary 10% voluntary reduction in salary, effective 1 July 2025 and concluding 12 months thereafter. After the 12-month period, the salaries of Mr. Muller and Ms. Harsas will revert to their previous remuneration amounts, unless earlier agreed with the Company following Board approval.

The Company has also further reduced spending across non-essential business support functions, such as Marketing, Administration and Finance, and made additional redundancies to its workforce in Australia in roles that are not currently aligned with the immediate activities required to advance the Project. All exploration activities in Ghana have been halted, with only low-cost exploration programmes taking place in Côte d'Ivoire to ensure the terms of the Company's Agboville and Rubino exploration licences are met.

These initiatives have enabled the Company to reduce its expenditure to focus capital on Project-critical activities that ensure the continued advancement of Ewoyaa towards Project FID.

Cash Flow

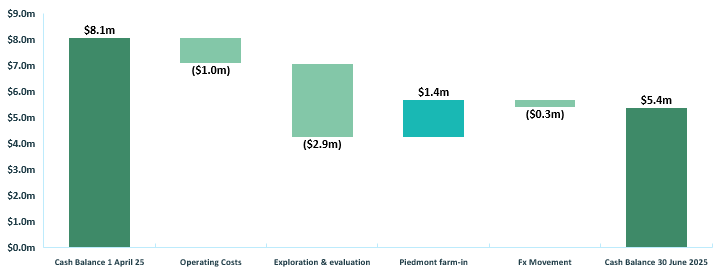

Figure 1: Net cash flows for June 2025 quarter (AUD)

Note: Exploration & Evaluation refers to spend of $2.7m in Ghana and $0.2m in Côte d'Ivoire. Operating Costs refers to corporate costs that are not directly related to Exploration and Evaluation activities.

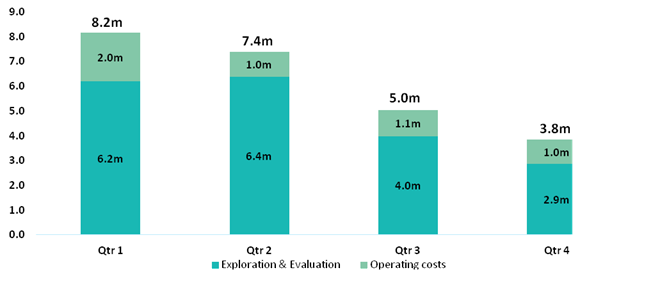

Figure 2: Total cash outflows per quarter for FY2025 (AUD)

Note: Exploration & Evaluation refers to activities in both Ghana and Côte d'Ivoire. Operating Costs refers to corporate costs that are not directly related to Exploration and Evaluation activities. Refer to item 2.5 in Appendix 5B for information on Piedmont's reimbursements for funding of the Project and the Company's Ghana portfolio.

Project Development Financing and Offtake

The Company has held discussions with a range of commercial banks, export credit agencies and alternative finance providers to explore, subject to Project permitting and prevailing market conditions, options to obtain project debt financing to support development and construction funding requirements beyond current joint venture and direct project investment arrangements. A debt financing approach to funding the development of the Project is preferred by the Company in the current lithium pricing environment to maximise shareholder returns whilst reducing shareholder dilution and preserving upside potential in the event of a lithium price recovery, and for tax efficiency purposes.

The Company has also maintained engagement with parties across the battery metals supply chain regarding potential long-term Ewoyaa concentrate offtake agreements. Despite current market conditions, there remains high levels of interest and demand from battery supply chain participants to secure reliable spodumene concentrate supply under long-term offtake agreements. Securing long-term offtake partnerships is expected to be a key component in supporting the overall financing solution for the Project.

Project Joint Venture Arrangements

Under the Project's current funding and joint venture arrangements, Piedmont Lithium Inc. ("Piedmont") is required to contribute the first US$70m of Development Costs as defined in the Project Agreement as sole funding to complete its earn-in to 50% of the Company's Project ownership, with all Development Costs and other Project expenditure equally shared by both the Company and Piedmont thereafter.

Current expenditure relating to the Project is being jointly funded by the Company and Piedmont. At the time of this report, the Company has made claims for Development Costs as defined under the Project Agreement with Piedmont. Atlantic Lithium claims that Piedmont is liable to sole fund Development Costs under the Project Agreement. Piedmont denies that it is liable to sole fund Development Costs at this time as the contractual preconditions in the Project Agreement for their sole funding obligation have, in their view, not been met. On that basis, Piedmont has instead contributed 50% of those Development Costs claimed by the Company. The balance of the Development Costs the Company has claimed from Piedmont is in dispute and remains outstanding. The Company remains engaged in discussions with Piedmont concerning these amounts and an established process exists within the Project Agreement for resolution including good faith negotiations and referral to arbitration.

During the period of April 2025 to June 2025, Piedmont contributed a total of US$0.93m (A$1.45m) towards the funding of the Project and the Company's Ghana portfolio.

MIIF Project-level Investment

The Company continues to engage with representatives of the Minerals Income Investment Fund ("MIIF"), Ghana's sovereign minerals fund, to finalise MIIF's US$27.9m investment in the Company's Ghanaian subsidiaries to acquire a 6% contributing interest in the Company's Ghana portfolio, which constitutes Stage 2 of its Strategic Investment in the Company.

This follows Stage 1, comprising MIIF's subscription for 19,245,574 Atlantic Lithium shares for a value of US$5m, which completed in January 2024.

The Company is also in communication with MIIF regarding its entitlement to appoint a new nominee director to the Atlantic Lithium Board, following the resignation of Edward Nana Yaw Koranteng from the Board in January 2025. The Company will update shareholders as and when appropriate.

Stakeholder Engagement

The Company attended the following conferences and industry events during the period:

- Health, Environment, Safety and Security (HESS) Awards, Accra (20 June)

- West African Mining & Power Expo (WAMPEX), Accra (28-30 May)

- Canaccord Genuity Global Metals & Mining Conference, California (20-22 May)

- Shanghai Metals Market Lithium Battery Tour, China (21-25 April)

- CLNB New Energy Industry Chain Expo, Suzhou (16-18 April)

Sustainability

HESS Awards

In June, Atlantic Lithium was proud to have been honoured with two awards - Best Company in Health and Safety Campaign and Best Company in Risk Management and Reporting - at the 2025 Health, Environment, Safety and Security (HESS) Awards.

Hosted annually in Accra, the awards celebrate excellence across various industries, such as mining, oil and gas, healthcare, and finance, with a strong focus on leadership, accountability, and transparency in HESS practices.

The Company was shortlisted and subsequently crowned in respect of the two categories following a rigorous site audit and an evaluation of its health and safety management systems - including hazard identification and risk assessment, safety trainings, SOPs (Standard Operating Procedures), health and safety campaigns, initiatives, hazards and near-miss reporting.

Members of the Atlantic Lithium team, led by Health & Safety Manager, Emmanuel Kwame Attiah, took to the stage at the ceremony to receive the awards on behalf of the Company.

Share Capital Changes - Ordinary Shares, Options and Performance Rights

Between 1 April 2025 and the date of this report, a total of 2,000,000 options, that had been granted under the Company's Employee Share Option Plan, and 9,622,787 unlisted options granted to MIIF lapsed unexercised. In the same period, 702,549 performance rights over new ordinary shares of no-par value each were forfeited.

A summary of movement and balances of equity securities between 1 April 2025 and the date of this report is as follows:

|

|

Ordinary |

Unquoted |

Unquoted performance rights |

| On issue at start of quarter |

693,147,313 |

14,422,787 |

15,558,614 |

| Employee Share Options lapsed (16 May 2025) |

|

(2,000,000) |

|

| Performance Rights forfeited (23 May 2025) |

|

|

(702,549) |

| Unlisted options held by the Minerals Income Investment Fund lapsed (23 July 2025) |

|

(9,622,787) |

|

| Total securities on issue at date of this report |

693,147,313 |

2,800,000 |

14,856,065 |

Compliance

During the quarter, the Company spent A$2.7m on its exploration, feasibility, and development activities in Ghana. In accordance with the agreement announced on 1 July 2021, exploration and feasibility activities in Ghana are 50% funded by Piedmont, with Piedmont required to sole fund the first US$70m of Project development expenditure. All Development Costs and other Project expenditure are to be equally shared by both the Company and Piedmont thereafter. The Company spent A$0.2m on exploration in Côte d'Ivoire.

Payments to Related Parties of the Entity and their Associates

Appendix 5B includes amounts in items 6.1 and 6.2. The amounts represent salaries (including superannuation) and fees paid to directors.

Appendix 5B expenditure disclosure

As at 30 June 2025, the Company had cash resources of A$5.4m and no debt. Exploration, feasibility, and development activities cash expenditure during the quarter was A$2.9m. Piedmont Lithium Inc. funded A$1.5m in the quarter.

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

| Name of entity: ATLANTIC LITHIUM LIMITED |

||

| ABN: 17 127 215 132 |

|

Quarter ended ("current quarter"): 30 June 2025 |

| Consolidated statement of cash flows |

Current quarter |

Year to date (12 months) |

|

| 1. |

Cash flows from operating activities |

- |

- |

| 1.1 |

Receipts from customers |

||

| 1.2 |

Payments for |

- |

- |

| |

(a) exploration & evaluation |

||

| |

(b) development |

- |

- |

| |

(c) production |

- |

- |

| |

(d) staff costs |

(213) |

(1,076) |

| |

(e) administration and corporate costs |

(694) |

(3,763) |

| 1.3 |

Dividends received (see note 3) |

- |

- |

| 1.4 |

Interest received |

3 |

11 |

| 1.5 |

Interest and other costs of finance paid |

(77) |

(92) |

| 1.6 |

Income taxes paid |

- |

- |

| 1.7 |

Government grants and tax incentives |

- |

- |

| 1.8 |

Other Income |

- |

- |

| 1.9 |

Net cash from / (used in) operating activities |

(981) |

(4,920) |

| |

|||

| 2. |

Cash flows from investing activities |

- |

- |

| 2.1 |

Payments to acquire or for: |

||

| |

(a) entities |

||

| |

(b) tenements |

- |

- |

| |

(c) property, plant and equipment |

- |

(100) |

| |

(d) exploration, feasibility, and development |

(2,860) |

(19,435) |

| |

(e) investments |

- |

- |

| |

(f) other non-current assets |

- |

- |

| 2.2 |

Proceeds from the disposal of: |

- |

- |

| |

(a) entities |

||

| |

(b) tenements |

- |

- |

| |

(c) property, plant and equipment |

- |

- |

| |

(d) investments |

- |

- |

| |

(e) other non-current assets |

- |

1 |

| 2.3 |

Cash flows from loans to other entities |

- |

- |

| 2.4 |

Dividends received (see note 3) |

- |

|

| 2.5 |

Other - Piedmont Contributions from farm-in arrangement |

1,450 |

6,798 |

| 2.6 |

Other - Contribution from lessor for Lease Fit Out |

- |

165 |

| 2.7 |

Net cash from / (used in) investing activities |

(1,410) |

(12,571) |

| |

|||

| 3. |

Cash flows from financing activities |

- |

10,268 |

| 3.1 |

Proceeds from issues of equity securities (excluding convertible debt securities) |

||

| 3.2 |

Proceeds from issue of convertible debt securities |

- |

- |

| 3.3 |

Proceeds from exercise of options |

- |

- |

| 3.4 |

Transaction costs related to issues of equity securities or convertible debt securities |

- |

(253) |

| 3.5 |

Proceeds from borrowings |

- |

- |

| 3.6 |

Repayment of borrowings |

- |

- |

| 3.7 |

Transaction costs related to loans and borrowings |

- |

- |

| 3.8 |

Dividends paid |

- |

- |

| 3.9 |

Other (provide details if material) |

- |

- |

| 3.10 |

Net cash from / (used in) financing activities |

- |

10,015 |

| |

|||

| 4. |

Net increase / (decrease) in cash and cash equivalents for the period |

|

|

| 4.1 |

Cash and cash equivalents at beginning of period |

8,080 |

12,679 |

| 4.2 |

Net cash from / (used in) operating activities (item 1.9 above) |

(981) |

(4,920) |

| 4.3 |

Net cash from / (used in) investing activities (item 2.7 above) |

(1,410) |

(12,571) |

| 4.4 |

Net cash from / (used in) financing activities (item 3.10 above) |

- |

10,015 |

| 4.5 |

Effect of movement in exchange rates on cash held |

(302) |

184 |

| 4.6 |

Cash and cash equivalents at end of period |

5,387 |

5,387 |

| 5. |

Reconciliation of cash and cash equivalents |

Current quarter |

Previous quarter |

| 5.1 |

Bank balances |

5,374 |

8,054 |

| 5.2 |

Call deposits |

- |

- |

| 5.3 |

Bank overdrafts |

- |

- |

| 5.4 |

Other - Petty Cash |

13 |

26 |

| 5.5 |

Cash and cash equivalents at end of quarter (should equal item 4.6 above) |

5,387 |

8,080 |

| 6. |

Payments to related parties of the entity and their associates |

Current quarter |

| 6.1 |

Aggregate amount of payments to related parties and their associates included in item 1 |

87 |

| 6.2 |

Aggregate amount of payments to related parties and their associates included in item 2 |

184 |

| 7. |

Financing facilities Add notes as necessary for an understanding of the sources of finance available to the entity. |

Total facility amount at quarter end |

Amount drawn at quarter end |

| 7.1 |

Loan facilities |

- |

- |

| 7.2 |

Credit standby arrangements |

- |

- |

| 7.3 |

Other |

- |

- |

| 7.4 |

Total financing facilities |

- |

- |

| |

|

|

|

| 7.5 |

Unused financing facilities available at quarter end |

- |

|

| 7.6 |

Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. |

||

| |

|||

| 8. |

Estimated cash available for future operating activities |

$A'000 |

| 8.1 |

Net cash from / (used in) operating activities (item 1.9) |

(981) |

| 8.2 |

(Payments for exploration & evaluation classified as investing activities) (item 2.1(d)) |

(2,860) |

| 8.3 |

Total relevant outgoings (item 8.1 + item 8.2) |

(3,841) |

| 8.4 |

Cash and cash equivalents at quarter end (item 4.6) |

5,387 |

| 8.5 |

Unused finance facilities available at quarter end (item 7.5) |

- |

| 8.6 |

Total available funding (item 8.4 + item 8.5) |

5,387 |

| |

|

|

| 8.7 |

Estimated quarters of funding available (item 8.6 divided by item 8.3) |

1.4 |

| NOTE : if the entity has reported positive relevant outgoings (ie a net cash inflow) in item 8.3, answer item 8.7 as "N/A". Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7. |

||

| 8.8 |

If item 8.7 is less than 2 quarters, please provide answers to the following questions: |

|

| |

8.8.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? |

|

| |

Answer: Yes |

|

| |

8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? |

|

| |

Answer: · Atlantic Lithium Ltd is funded under a co-development agreement with Piedmont Lithium Inc. Piedmont continues to contribute on a monthly basis under the co-development agreement. · The Company implemented further cost-cutting measures during the June 2025 quarter. Additionally, the Company will continue to closely monitor its available cash and adjust operating expenditure as required. · Atlantic Lithium has agreed non-binding Heads of Terms with the Minerals Income Investment Fund ("MIIF") under which MIIF will invest US$27.9m to acquire a 6% contributing interest in the Company's Ghana subsidiaries. The Company continues to engage with MIIF representatives to finalise this investment. |

|

| |

8.8.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? |

|

| |

Answer: Yes. The Company has funding available (see 8.8.2). The Company has its remaining LR7.1 capacity if required. The Company has a strong track record of being able to raise funds if required. |

|

| |

NOTE : where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered. |

|

Compliance statement

1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 31 July 2025

Authorised by: Authorised by the Board of Atlantic Lithium Limited

Notes

1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity's activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market by your board of directors, you can insert here: "By the board". If it has been authorised for release to the market by a committee of your board of directors, you can insert here: "By the [name of board committee - eg Audit and Risk Committee]". If it has been authorised for release to the market by a disclosure committee, you can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council's Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.

For any further information, please contact:

Atlantic Lithium Limited

Keith Muller (Chief Executive Officer)

Amanda Harsas (Finance Director and Company Secretary)

| |

www.atlanticlithium.com.au |

|||

| |

IR@atlanticlithium.com.au |

|||

| |

Tel: +61 2 8072 0640

|

|||

| SP Angel Corporate Finance LLP Nominated Adviser Jeff Keating Charlie Bouverat Tel: +44 (0)20 3470 0470 |

Yellow Jersey PR Limited Charles Goodwin Bessie Elliot Tel: +44 (0)20 3004 9512

|

Canaccord Genuity Limited Financial Adviser: Raj Khatri (UK) / Duncan St John, Christian Calabrese (Australia)

Corporate Broking: James Asensio Tel: +44 (0) 20 7523 4500 |

|

|

Notes to Editors:

About Atlantic Lithium

Atlantic Lithium is an AIM, ASX, GSE and OTCQX-listed lithium company advancing its flagship project, the Ewoyaa Lithium Project, a lithium spodumene pegmatite discovery in Ghana, through to production to become the country's first lithium-producing mine.

The Company published a Definitive Feasibility Study in respect of the Project in July 2023, indicating Ewoyaa's strong commercial viability.1 The Project was awarded a Mining Lease in October 2023, an Environmental Protection Authority ("EPA") Permit in September 2024, and a Mine Operating Permit in October 2024 and is being developed under an earn-in agreement with Piedmont Lithium Inc.

The Ewoyaa Mineral Resource Estimate (JORC) totals 36.8Mt at 1.24% Li2O and includes 3.7Mt at 1.37% Li₂O in the Measured category, 26.1Mt at 1.24% Li₂O in the Indicated category and 7.0Mt at 1.15% Li₂O in the Inferred category.1 Ore Reserves (Probable) of 25.6Mt at 1.22% Li2O have been reported for the Project.1

Atlantic Lithium holds a portfolio of lithium projects within 509km2 and 771km2 of granted and under-application tenure across Ghana and Côte d'Ivoire respectively, which, in addition to the Project, comprises significantly under-explored, highly prospective licences.

End Note

1 Ore Reserves, Mineral Resources and Production Targets

The information in this report that relates to Exploration Results, Ore Reserves, Mineral Resources and Production Targets complies with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code). The information in this report relating to exploration results is extracted from the Company's announcement entitled, "Spodumene Pegmatite Discovered at Agboville and Rubino Licences, Côte d'Ivoire" , dated 22 May 2025. The information in this report relating to the Mineral Resource Estimate ("MRE") of 36.8Mt at 1.24% Li ₂ O for the Ewoyaa Lithium Project ("Ewoyaa" or the "Project") is extracted from the Company's announcement entitled " New Dog-Leg Target Delivers Increase to Ewoyaa MRE ", dated 30 July 2024. The MRE includes a total of 3.7Mt at 1.37% Li ₂ O in the Measured category, 26.1Mt at 1.24% Li ₂ O in the Indicated category and 7.0Mt at 1.15% Li ₂ O in the Inferred category. The information in this report relating to the Feldspar Mineral Resource Estimate ("Feldspar MRE") of 36.8Mt at 41.9% feldspar for the Project is extracted from the Company's announcement entitled " Updated Feldspar Resource Estimate ", dated 30 January 2025. The MRE includes a total of 3.7Mt at 40.2% feldspar in the Measured category, 26.1Mt at 42.1% feldspar in the Indicated category and 7.0Mt at 42.4% feldspar in the Inferred category. The information in this report relating to Ore Reserves (Probable) of 25.6Mt at 1.22% Li2O and the Production Target of 3.6Mt of spodumene concentrate over a 12-year mine life is extracted from the Company's announcement entitled " Ewoyaa Lithium Project Definitive Feasibility Study ", dated 29 June 2023. The Company confirms, in the case of Mineral Resources, Ore Reserves and Production Targets, that all material assumptions and technical parameters underpinning the estimates continue to apply. Material assumptions for the Project have been revised on grant of the Mining Lease for the Project, announced by the Company on 20 October 2023 in the announcement entitled, " Mining Lease Granted for Ewoyaa Lithium Project ". The Company is not aware of any new information or data that materially affects the information included in this report or the announcements dated 22 May 2025, 30 January 2025, 30 July 2024, 20 October 2023 and 29 June 2023, which are available at www.atlanticlithium.com.au .

Competent Persons

Information in this report relating to exploration results is based on data reviewed by Mr I. Iwan Williams (BSc. Hons Geology), General Manager - Exploration of the Company, and reported in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (The Joint Ore Reserves Committee Code - JORC 2012 Edition). Mr Williams is a Member of the Australian Institute of Geoscientists (#9088) who has in excess of 30 years' experience in mineral exploration and is a Qualified Person under the AIM Rules and as a Competent Person as defined in the JORC Code. Mr Williams consents to the inclusion of the information in the form and context in which it appears.

Information in this report relating to Mineral Resources was compiled by Shaun Searle, a Member of the Australian Institute of Geoscientists. Mr Searle has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' and is a Qualified Person under the AIM Rules. Mr Searle is a director of Ashmore. Ashmore and the Competent Person are independent of the Company and other than being paid fees for services in compiling this report, neither has any financial interest (direct or contingent) in the Company. Mr Searle consents to the inclusion in this report of the matters based upon the information in the form and context in which it appears.

Information in this report relating to Ore Reserves was compiled by Mr Harry Warries. All stated Ore Reserves are completely included within the quoted Mineral Resources and are quoted in dry tonnes. Mr Warries is a Fellow of the Australasian Institute of Mining and Metallurgy and an employee of Mining Focus Consultants Pty Ltd. He has sufficient experience, relevant to the style of mineralisation and type of deposit under consideration and to the activity he is undertaking, to qualify as a Competent Person as defined in the 'Australasian Code for Reporting of Mineral Resources and Ore Reserves' of December 2012 ("JORC Code") as prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, the Australian Institute of Geoscientists and the Minerals Council of Australia. Mr Warries gives Atlantic Lithium Limited consent to use this reserve estimate in reports.

The Company confirms that the form and context in which the Competent Persons' findings are presented have not been materially modified from the original market announcement.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.