ASX/AIM RELEASE

15 September 2025

Further High-Grade Intercepts Determined

HIGHLIGHTS

· Drilling results from current drilling program highlight high-grade intercepts of 113.1 m @ 1.32% Cu and 0.41 g/t Au from 8.1 m, including 54.6 m @ 1.84% Cu and 0.74 g/t Au from 60.4 m.

· Conditional approval issued by the National Water Resources Board on water abstraction in preparation for MCB Project's operational requirements.

· Feasibility Update study and FEED Program on schedule.

_______________________________________________________________________________

Celsius Resources Limited ("Celsius" or the "Company") (ASX, AIM: CLA) and its Philippines affiliate company Makilala Mining Company, Inc. ("MMCI") is pleased to announce results from the drilling program which commenced in June this year[1]. The drilling program is focused on geo-technical and hydro-geological drilling and additional metallurgical test work. Results from the metallurgical testwork drilling has intercepted further high-grade mineralisation where predicted, including some further extensions to the previously interpreted high grade mineralisation.

The detailed assay results are shown in the tables below, and as stated by Peter Hume, our Country Technical Director, "This recent drill hole was completed to provide Ausenco and its mineral processing team with sufficient high-quality material from the MCB deposit so that further testwork can be completed to reaffirm the process plant design. With these new higher-grade intercepts, we have further confidence that our mine plan, development and operating strategy will deliver the best value for the Project, our investors, shareholders and the community".

The Philippines National Water Resources Board has issued a Conditional Water Permit for the next twelve months, which covers the start of our construction of the Maalinao-Caigutan-Biyog Copper-Gold Project ("MCB Project").

The feasibility study update continues on schedule and the Company recently received the interim study report from Ausenco[2]. The report confirmed the work that has been progressed since June, which pointed to enhancements in the site layout, underground mine design, process plant design and materials handling, which are likely to result in improved operating costs and an overall improvement in project economics. When combined with updated commodity price forecasts, the feasibility study financial model is expected to show an overall improvement in the project's valuation. When the studies have been completed, an updated JORC Mineral Resource Estimate, Mining Reserve statement and Feasibility Study can be published. In parallel, the Front-End Engineering Design ("FEED") study is advancing detailed engineering, ESG initiatives, sustainability, environmental stewardship, and social responsibility to support lasting value and meet to stakeholder expectations. The current scope of work is expected to be completed in December.

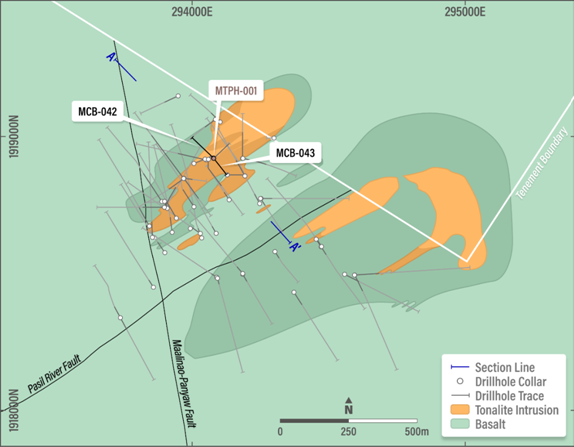

Figure 1. Location of drill hole MTPH-001 relative to recent and historical diamond drilling at MCB.

Drilling Results

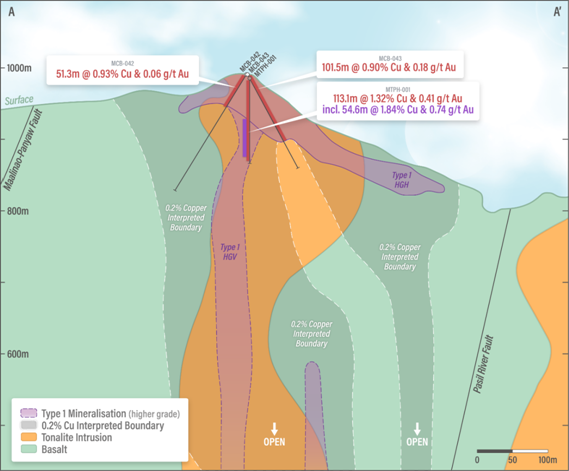

The recently completed metallurgical test hole returned results that were higher than anticipated when compared to the resource model, confirming the presence of consistent high-grade copper mineralisation. The hole intersected a continuous interval of 113.1 metres from 8.1 metres downhole, grading 1.32% Cu and 0.41 g/t Au, including a higher-grade zone of 54.6 metres from 60.4 metres grading 1.84% Cu and 0.74 g/t Au. These results provide strong support for the robustness of mineralisation within the targeted zone and will be incorporated into future metallurgical test work and resource evaluation.

Table 1. Significant intersection from drill hole MTPH-001.

| Hole ID |

East |

North |

RL |

Dip |

Azi |

EOH (m) |

From (m) |

To(m) |

Length (m) |

Cu (%) |

Au (g/t) |

| MTPH-001 |

294085 |

1918920 |

994.93 |

90 |

0 |

121.2 |

8.1 |

121.2 |

113.1 |

1.32 |

0.41 |

| Including |

60.4 |

115 |

54.6 |

1.84 |

0.74 |

||||||

Figure 2. Cross section (see location at Figure 1) showing drill hole MTPH-001 in proximity to MCB-042 and MCB-043[3], highlighting significant assay results (looking northeast).

As noted in the Company's ASX/AIM announcement of 7 August 2025, Celsius and MMCI continue active discussions with a number of parties with regards to potential financing for the MCB Copper-Gold project.

Maharlika Investment Corporation ("MIC") have provided initial financing from the First OLSA bridging loan and continues to express investment interest in in the MCB project[4]. Discussions with all interested investment parties, including MIC and Kiri Industries Limited are continuing, although there is no guarantee that discussions will lead to any definitive agreement[5].

The Company is focused on completion of the updated Feasibility Study and FEED program whilst securing the best possible financing solution for MCB project and the best possible value for Celsius shareholders. We continue to deliver on our commitments to The Philippines Government and our highly supportive Balatoc community, with whom we are confidently advancing the MCB project.

Ancillary Permitting Update

The Philippine National Water Resources Board ("NWRB")[6] has issued a Conditional Water Permit authorising MMCI to commence water use activities in support of the MCB Project's development, subject to compliance with specific conditions. In accordance with the Water Code of the Philippines (PD 1067) and its Implementing Rules and Regulations, MMCI is required to install measuring devices and submit quarterly utilisation reports to the NWRB. These reports enable the NWRB to verify actual water withdrawals, assess the sustainability of the source, and ensure that project water use does not impair existing rights or deprive surrounding communities of their water needs. The issuance of a permanent water permit is contingent on satisfactory compliance with these monitoring and reporting requirements.

The Company remains committed to working diligently to meeting all regulatory requirements while safeguarding local water resources to secure full permit conversion.

MCB COPPER-GOLD PROJECT

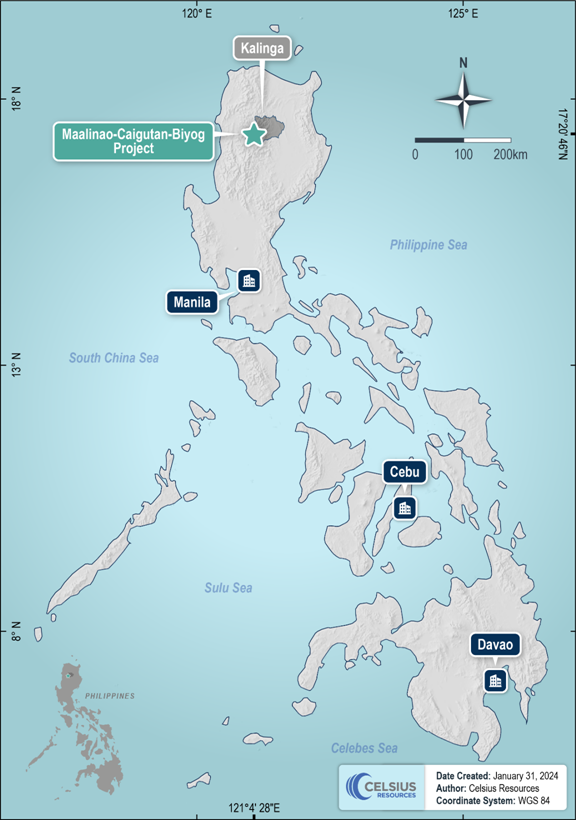

The MCB Copper-Gold Project (MCB) is located in the Cordillera Administrative Region in the Philippines, approximately 320km north of Manila (Figure 1). It is the flagship project within the Makilala portfolio which also contains other key prospects in the pipeline for permit renewal/extension.

An updated JORC compliant Mineral Resource Estimate was announced for the MCB Project on 12 December 2022, comprising 338 million tonnes @ 0.47% copper and 0.12 g/t gold, for a total of 1.6 million tonnes of contained copper and 1.3 million ounces of gold, of which 249 million tonnes @ 0.44% copper and 0.11 g/t gold is classified as Indicated, 42 million tonnes @ 0.52% copper and 0.11 g/t gold is classified as Inferred, and 47 million tonnes @ 0.59% copper and 0.19 g/t gold is classified as Measured.

A Study for the MCB Project was announced by CLA on 1 December 2021, which identified the potential for the development of a copper-gold operation with a 25-year mine life. The Study was based on an underground mining operation and processing facility to produce a saleable copper-gold concentrate.

Highlights from that Study include a Post tax NPV (8%) of US$464m and IRR of 31%, assuming a copper price of US$4.00/lb and gold price of US$1,695/oz. Initial capital expenditure is estimated to be US$253m with a payback period of approximately 2.7 years. The designed mine production is matched to a 2.28Mtpa processing plant which will treat ore with an estimated average grade of 1.14% copper and 0.54g/t gold for the first 10 years of planned production with a C1[7] cash costs at just US$0.73/lb copper, net of gold credits.

Please note that as at the date of this announcement there are studies ongoing to update the Feasibility Study for the Project and to complete the Front-end Engineering and Design. These studies are scheduled for completion before December 2025[8].

Figure 3. Location of the MCB Project in the province of Kalinga, Northern Luzon, Philippines.

This announcement has been authorised by the Board of Directors of Celsius Resources Limited.

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 as it forms part of UK Domestic Law by virtue of the European Union (Withdrawal) Act 2018.

Qualified / Competent Person Statement

Information in this report relating to Exploration Results is based on information compiled, reviewed and assessed by Mr. Steven Olsen, who is a Fellow of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Mr. Olsen is a consultant to Celsius Resources and has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined by the 2012 Edition of the Australasian Code for reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr. Olsen consents to the inclusion of the data in the form and context in which it appears.

Listing Rule Disclosures

Th e information in this announcement at footnote 3 relates to exploration results that have been previously released to ASX. The Company confirms that it is not aware of any new information or data that materially affects the information included in the original ASX announcement and that all material assumptions and technical parameters continue to apply.

The Mineral Resource Estimate for the MCB Project referred to in this announcement was first disclosed in accordance with the requirements of ASX Listing Rule 5.8 in the Company's ASX Announcement dated 12 December 2022 titled "Updated Mineral Resource for Celsius' MCB Copper-Gold Project". The Company confirms that it is not aware of any new information or data that materially affects the information included in the previous announcement and that all material assumptions and technical parameters underpinning the Mineral Resource Estimate continue to apply and have not materially changed.

Forward Looking Statements

Some of the statements appearing in this announcement may be in the nature of forward-looking statements. You should be aware that such statements are only predictions and are subject to inherent risks and uncertainties. Those risks and uncertainties include factors and risks specific to the industries in which the Company operates and proposes to operate as well as general economic conditions, prevailing exchange rates and interest rates and conditions in the financial markets, among other things. Actual events or results may differ materially from the events or results expressed or implied in any forward-looking statement.

No forward-looking statement is a guarantee or representation as to future performance or any other future matters, which will be influenced by a number of factors and subject to various uncertainties and contingencies, many of which will be outside the Company's control.

The Company does not undertake any obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after today's date or to reflect the occurrence of unanticipated events. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information, opinions or conclusions contained in this announcement. To the maximum extent permitted by law, none of the Company's Directors, employees, advisors, or agents, nor any other person, accepts any liability for any loss arising from the use of the information contained in this announcement. You are cautioned not to place undue reliance on any forward-looking statement. The forward-looking statements in this announcement reflect views held only as at the date of this announcement.

Celsius Resources Contact Information

Level 5, 191 St. Georges Terrace

Perth WA 6000

PO Box 7059

Cloisters Square PO

Perth WA 6850

P: +61 2 8072 1400

| Celsius Resources Limited |

|

| Neil Grimes |

P: +61 419 922 478

|

| Multiplier Media (Australia Media Contact) Jon Cuthbert |

M: +61 402 075 707

|

| Zeus Capital Limited (Nominated Adviser & Broker) Harry Ansell/James Joyce/ James Bavister

|

P: +44 (0) 20 3 829 5000 |

Zeus Capital Limited ("Zeus") is the Company's Nominated Adviser and is authorised and

regulated by FCA. Zeus's responsibilities as the Company's Nominated Adviser,

including a responsibility to advise and guide the Company on its responsibilities under

the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to

the London Stock Exchange. Zeus is not acting for and will not be responsible to any

persons for providing protections afforded to customers of Zeus nor for advising them in

relation to the proposed arrangements described in this announcement or any matter referred to in it.

Appendix 1: The following tables are provided to ensure compliance with the JORC Code (2012) requirements for the reporting of Exploration Results for the MCB Project.

SECTION 1:

Sampling Techniques and Data

(Criteria in this section apply to all succeeding sections.)

| Criteria |

JORC Code explanation |

Commentary |

| Sampling techniques |

· Nature and quality of sampling (e.g. cut channels, random chips, or specific specialised industry standard measurement tools appropriate to the minerals under investigation, such as down whole gamma sondes, or handheld XRF instruments, etc). These examples should not be taken as limiting the broad meaning of sampling. · Include reference to measures taken to ensure sample representivity and the appropriate calibration of any measurement tools or systems used. · Aspects of the determination of mineralisation that are Material to the Public Report. In cases where 'industry standard' work has been done this would be relatively simple (eg 'reverse circulation drilling was used to obtain 1 m samples from which 3 kg was pulverised to produce a 30 g charge for fire assay'). In other cases, more explanation may be required, such as where there is coarse gold that has inherent sampling problems. Unusual commodities or mineralisation types (e.g. submarine nodules) may warrant disclosure of detailed information. |

· Samples were collected from diamond core drilled from the surface. All drill core was generally sampled on 2-meter intervals. In cases where geological and mineralogical characteristics change, sample length was not less than 1 meter. · Core samples cut into half using diamond core saw following the cutting lines marked by the Geologist. Split cores returned to its respective core tray. · Samples were shipped by company vehicle to Intertek Testing Services which is an external laboratory located in Manila, Philippines. · Crushed samples were fire assayed for gold (Au) using a 30-gram charge, with a detection limit of 0.005 ppm. Gold values greater than 50 ppm were determined by gravimetric fire assay. · Copper (Cu) values were assayed using Four acid digestion. Elements determined by AAS finish with final reporting for a total of 36 elements. |

| Drilling techniques |

· Drill type (e.g. core, reverse circulation, open-hole hammer, rotary air blast, auger, Bangka, sonic, etc) and details (e.g. core diameter, triple or standard tube, depth of diamond tails, face-sampling bit or other type, whether core is oriented and if so, by what method, etc). |

· Diamond drilling was used to capture the rock samples for the new drill hole intercepts, with the following drill core size summarized as follows: · PQ sized drill core with a core diameter of 81.1 mm was used from surface to more competent lithology. Core samples of this size are estimated to comprise about 43%of the total length of the recently drilled holes. · HQ sized drill core, with a core diameter of 61.1mm, was then substituted at greater depths to accommodate variations of subsurface conditions. Core samples of this size is estimated to comprise about 57% of the total length of the recently drilled holes. |

| Drill sample recovery |

· Method of recording and assessing core and chip sample recoveries and results assessed. · Measures taken to maximise sample recovery and ensure representative nature of the samples. · Whether a relationship exists between sample recovery and grade and whether sample bias may have occurred due to preferential loss/gain of fine/coarse material. |

· Core recovery has been recorded for every interval as part of the routine geomechanical logging. · Recovered core lengths on average were measured to be over 98% for the total length of the drill hole, indicating a high recovery and minimal lost core. · All drilling activities were supervised by company Geologists. Trained Core house Technician were responsible for the core recovery determination. · Core was arranged to fit the breakages before the actual core length from the start to the end of the drill run was measured. Percent recovery was calculated from dividing the measured core length over the total drill run multiplied by 100.

|

| Logging |

· Whether core and chip samples have been geologically and geotechnically logged to a level of detail to support appropriate Mineral Resource estimation, mining studies and metallurgical studies. · Whether logging is qualitative or quantitative in nature. Core (or costean, channel, etc) photography. · The total length and percentage of the relevant intersections logged. |

· Geologists were tasked to oversee the daily quick log report down to sampling. Daily quick log form was completed to identify the geological details such as lithology, alteration and mineralisation with corresponding percentage estimate of Cu minerals and Cu grade, using an established geological code. · Detailed logging proceeds describing geological characteristics present in the core, i.e. lithology, alteration, mineralogy, structures, etc. · Core photography was undertaken after completing the geomechanical logging. |

| Sub-sampling techniques and sample preparation |

· If core, whether cut or sawn and whether quarter, half or all core taken. · If non-core, whether riffled, tube sampled, rotary split, etc and whether sampled wet or dry. · For all sample types, the nature, quality and appropriateness of the sample preparation technique. · Quality control procedures adopted for all sub-sampling stages to maximise representivity of samples. · Measures taken to ensure that the sampling is representative of the in-situ material collected, including for instance results for field duplicate/second-half sampling. · Whether sample sizes are appropriate to the grain size of the material being sampled.

|

· Samples were routinely taken over a 2m interval, and cut in half, with half of the drill core sent for analysis and half of the drill core retained for future reference. · Samples were cut on site using a hand core saw. Samples were then selected and bagged on site prior to delivery to the laboratory (Intertek) in Manila for sample preparation. · The sample size is considered appropriate for type of material being samples.

|

| Quality of assay data and laboratory tests |

· The nature, quality and appropriateness of the assaying and laboratory procedures used and whether the technique is considered partial or total. · For geophysical tools, spectrometers, handheld XRF instruments, etc, the parameters used in determining the analysis including instrument make and model, reading times, calibrations factors applied and their derivation, etc. · Nature of quality control procedures adopted (e.g. standards, blanks, duplicates, external laboratory checks) and whether acceptable levels of accuracy (i.e. lack of bias) and precision have been established. |

· Samples were fire assayed for gold (Au) using a 30-gram charge, with a detection limit of 0.005 ppm. Gold values greater than 50 ppm were determined by gravimetric fire assay. Copper (Cu) values were assayed using four acid digestion. Elements determined by AAS finish · The procedures for the submission of samples to the laboratory also include the regular insertion of QA/QC samples in every transmittal form or batch, which was typically delivered to the laboratory in batches of 50 numbered samples. For each batch of 50 samples a total of 43 came from core samples and an additional 7 samples were included for QA/QC checks, which were as follows: · Four referenced standards · One referenced Blank · One coarse (unrecognisable) blank · One field duplicate taken from the quartered core · After sample preparation, all samples were sent for final analysis to Intertek at their laboratory in Manila. Intertek is an internationally recognised and ISO/IEC 17025:2005 & ISO/IEC 17020:2004 certified independent laboratory. |

| Verification of sampling and assaying |

· The verification of significant intersections by either independent or alternative company personnel. · The use of twinned holes. · Documentation of primary data, data entry procedures, data verification, data storage (physical and electronic) protocols. · Discuss any adjustment to assay data. |

· Analytical procedures provided by an internationally certified laboratory is considered in line with industry standard for the type of deposit and mineralisation identified at the Property. · Apart from the verification of the procedures and results as described above, no further verification of the sampling and assaying have been undertaken. · None of the diamond drill holes in this report are twinned. |

| Location of data points |

· Accuracy and quality of surveys used to locate drill holes (collar and down-hole surveys), trenches, mine workings and other locations used in Mineral Resource estimation. · Specification of the grid system used. · Quality and adequacy of topographic control. |

· All data reference points and maps for the Makilala database, including drill hole collar co-ordinates are recorded in WGS 84/UTM Zone 51N. · Compass measurements taken by Geologists were used to establish the dip and azimuth of the collar hole as part of their initial collar surveys. Drill collar locations were positioned using a handheld Garmin GPS unit, set to UTM WGS 84 Zone 51N coordinate reference system, with an accuracy expected to be within 2 metres. Downhole surveys were also completed using a Keeper Gyro at 50m intervals. · Collar surveys were then logged into the master MS Excel spreadsheet as part of the database. |

| Data spacing and distribution |

· Data spacing for reporting of Exploration Results. · Whether the data spacing and distribution is sufficient to establish the degree of geological and grade continuity appropriate for the Mineral Resource and Ore Reserve estimation procedure(s) and classifications applied. · Whether sample compositing has been applied. |

· The broad drilling pattern is at 100m spacing for a series of diamond drill holes which are oriented in a north-west direction and dipping at predominantly at 60 degrees. These drill holes are augmented by some drill holes which have a west-north-west orientation or a north-east orientation or are vertical. (see figure 1 for Drill Hole Locations). · Drill holes at the MCB deposit are distributed broadly on eight grid lines, giving coverage of 1,000 metres from east to west. · The drill hole spacing where significant copper-gold mineralisation has been identified is sufficient to determine the geology and grade continuity of the area, as well as the ore body and mineralisation extents. |

| Orientation of data in relation to geological structure |

· Whether the orientation of sampling achieves unbiased sampling of possible structures and the extent to which this is known, considering the deposit type. · If the relationship between the drilling orientation and the orientation of key mineralised structures is considered to have introduced a sampling bias, this should be assessed and reported if material. |

· In the resource estimation, drill hole assays were composited to 2 metres downhole intervals. · The dominant trend of the tonalite intrusion, which is directly related to the broader lower grade copper-gold mineralisation has an overall strike of 50 degrees and a near to vertical dip. Drill hole MCB-042 to MCB-044 was drilled at a 45-degree angle to intersect the interpreted high-grade positions which appear to be horizontal to shallow east dipping in orientation. |

| Sample security |

· The measures taken to ensure sample security. |

· The following standard procedures were enforced for the drilling of new intercepts: · Sample bags are arranged in sequence according to its sample number. These are then weighed and jotted down to a sample dispatch note which details the sample numbers, sample type and laboratory processing required. Geologists ensures that the transmittal form is correct for encoding and submission. The bags of samples are sent directly to the Intertek Laboratory in Manila by company · vehicle. No unsupervised third parties were given access prior to the chain of custody procedure. · Samples were delivered to Intertek Testing Services along with two copies of the sample dispatch form. One copy for the laboratory to accept custody of the sample, and the signed/received copy return to database custodian at the Core House facility in Tabuk, Kalinga. |

| Audits or reviews |

· The results of any audits or reviews of sampling techniques and data. |

· No other specific audit or review was conducted other than the validation checks by the author documented earlier with regard to the sample preparation, analysis or security for the information in the new drillholes. |

SECTION 2:

Reporting of Exploration Results

(Criteria listed in the preceding section also apply to this section.)

| Criteria |

JORC Code explanation

|

Commentary

|

| Mineral tenement and land tenure status |

· Type, reference name/number, location and ownership including agreements or material issues with third parties such as joint ventures, partnerships, overriding royalties, native title interests, historical sites, wilderness or national park and environmental settings. · The security of the tenure held at the time of reporting along with any known impediments to obtaining a licence to operate in the area.

|

· The Maalinao-Caigutan-Biyog (MCB) Copper-Gold project is situated in Luzon Central Cordillera in the Barangay of Balatoc, Municipality of Pasil, Province of Kalinga. · The property comprises a single Exploration Tenement (EP-003-2006-CAR) which covers an area of approximately 2,500.82 hectares. The Exploration Tenement surrounds the previous Copper-Gold mining operations known as Batong Buhay Gold Mines, Inc. · The underlying title is in the name of the Philippines registered corporation Makilala Mining Company Inc. (MMCI) which is 100% owned by Makilala Holdings Ltd. · Celsius Resources Ltd has acquired 100% of Makilala Holdings upon the issuance of the extension to carry out exploration of the Tenement (EP-003-2006-CAR) from the Mines and Geosciences Bureau (MGB) of the Philippines and this requirement was met on 24th November 2020

|

| Exploration done by other parties |

· Acknowledgment and appraisal of exploration by other parties. |

· Exploration work and drilling was completed by Makilala Mining Company Inc. which was previously a subsidiary of Freeport-McMoran Exploration Corporation-Philippine Branch from year 2006 to 2013, the details of which have been documented in CLA announcement dated 16 September 2020. · The relative quality and detail associated with the drilling information is considered to be of a high standard. This has enabled the author to establish a high level of confidence associated with the historical drilling information. |

| Geology |

· Deposit type, geological setting and style of mineralisation. |

· The geological setting for the MCB copper-gold mineralisation is typical of a porphyry copper + gold + moly deposit as commonly defined in many academic papers (Hedenquist and Lowernstern, 1994; Sillitoe, R. H., 2010. Corbett and Leach, 1997). The mineralisation and associated alteration exist across the contact between the genetically related intrusive body (tonalite) and the surrounding host rock material. In most cases the surrounding host rock is a mafic volcanic, however, in some instances the older (not genetically related to copper-gold mineralisation) intrusive bodies also exist in contact with the younger intrusive resulting in broad sections of mineralisation and alteration within a series of intrusive bodies. · There is also evidence at MCB for epithermal vein deposit types which exist within close proximity to the large-scale porphyry copper-gold mineralisation. At this stage only the deposit type that is identified from the drilling information for MCB is a porphyry copper-gold style. · Basalt lava flows make up the majority of the host rocks in the tenement area, which is part of the oldest exposed unit, Basement Complex. This Cretaceous-Paleogene Metavolcanics has been intruded by quartz diorite complex, which in Kalinga, ranges in composition from gabbro to tonalite. · A later stage Tonalite intrusion exists throughout the project area and is interpreted to be genetically related to the copper-gold mineralisation at MCB deposit. · A dacite flow and dacitic pyroclastic blankets the older basalt host rock and tonalitic intrusive rocks. · There are four types of ore mineralisation that were emphasized in the project: o Type 1 - Early high-grade porphyry Cu-Au mineralisation, hosted both in tonalite and basalt. o Type 2 - Mix of high-grade porphyry Cu-Au (Type 1) and high-sulphidation mineralisation (Type 4). Hosted in basalt and tonalites, but with strong Type 1 mineralisation that was partially overprinted by ore Type 4. o Type 3 - Medium grade porphyry-copper o Type 4 - High-sulphidation epithermal mineralisation · (See figures 2 and 3 for a representative Cross Section of the Geology and its relationship to the copper-gold mineralisation at the MCB Deposit). |

| Drill hole Information |

· A summary of all information material to the understanding of the exploration results including a tabulation of the following information for all Material drill holes: · easting and northing of the drill hole collar · elevation or RL (Reduced Level - elevation above sea level in metres) of the drill hole collar · dip and azimuth of the hole · down hole length and interception depth · hole length. · If the exclusion of this information is justified on the basis that the information is not Material and this exclusion does not detract from the understanding of the report, the Competent Person should clearly explain why this is the case. |

· See Table 1 for all details pertaining to drill holes MCB-042, MCB-043, and MTPH-001 which is the subject of this release. · In summary, with the inclusion of the drill hole reported in this announcement, the drill hole database for the Property consists of 58 diamond core drilled holes with an accumulative meterage of 30,607.9 0 · See CLA announcement dated 16 September 2020 for details regarding the historical drill hole information completed at the MCB Property which relate to the interpretations associated with drill hole MCB-042 to MCB-044.

|

| Data aggregation methods |

· In reporting Exploration Results, weighting averaging techniques, maximum and/or minimum grade truncations (eg cutting of high grades) and cut-off grades are usually Material and should be stated. · Where aggregate intercepts incorporate short lengths of high-grade results and longer lengths of low-grade results, the procedure used for such aggregation should be stated and some typical examples of such aggregations should be shown in detail. · The assumptions used for any reporting of metal equivalent values should be clearly stated. |

· Significant intersections are reported in Table 1 and are aggregated relative to broad mineralised interval which correspond with a definable and continuous zone of copper-gold mineralisation, nominally above a grade of 0.2% copper. The intervals have been reported as weighted average totals. Internal to the broader mineralisation that has been reported, there are some internal higher-grade copper-gold assay results reported (nominally above 0.5% copper) which are interpreted to exist as a continuous domain of higher-grade copper-gold mineralisation. These sections have also been reported as weighted average totals. · The reporting of copper equivalent values (CuEq) is based on a copper price of US$4.0lb, gold price of US$1,695/oz and with copper and gold recoveries of 94.2% and 79% respectively as identified in the reported Scoping Study for the MCB Project (see CLA announcement on 1 December 2021). |

| Relationship between mineralisation widths and intercept lengths |

· These relationships are particularly important in the reporting of Exploration Results. · If the geometry of the mineralisation with respect to the drill hole angle is known, its nature should be reported. · If it is not known and only the down hole lengths are reported, there should be a clear statement to this effect (eg 'down hole length, true width not known'). |

· Drill hole MTPH-001 is a metallurgical test hole and was vertically drilled to obtain samples of the orebody. This hole intersected the interpreted shallow high-grade domain which appear to be horizontal in orientation in addition to some possible vertical structures which also host the high-grade copper mineralisation. Its results were higher than anticipated when compared to the resource model, confirming the presence of consistent high-grade copper mineralization. · Based on the geometry of the mineralisation relative to drill hole MCB-042 to MCB-044, the true width of the reported higher-grade intercepts is approximately 70 to 80% of the down hole interval reported for the drill hole. |

| Diagrams |

· Appropriate maps and sections (with scales) and tabulations of intercepts should be included for any significant discovery being reported These should include, but not be limited to a plan view of drill hole collar locations and appropriate sectional views. |

· See Figure 2 for representative Cross Section of the Geology and its relationship to the copper-gold mineralisation at MCB for drill hole MCB-042, MCB-043, and MTPH-001. |

| Balanced reporting |

· Where comprehensive reporting of all Exploration Results is not practicable, representative reporting of both low and high grades and/or widths should be practiced to avoid misleading reporting of Exploration Results. |

· All data for the project has been collected, validated and reported and is considered to be a fair representation of the Exploration Results from drill hole MTPH-001, which is the subject of this release.

|

| Other substantive exploration data |

· Other exploration data, if meaningful and material, should be reported including (but not limited to): geological observations; geophysical survey results; geochemical survey results; bulk samples - size and method of treatment; metallurgical test results; bulk density, groundwater, geotechnical and rock characteristics; potential deleterious or contaminating substances. |

· Historical exploration since the date of the original grant of EP-003-2006-CAR in 2006 was undertaken under the ownership and management of Makilala Mining Company Inc. Exploration work conducted by Makilala Mining Company Inc include surface mapping and sampling (2007), ground magnetic survey (2007), induced polarisation (IP) geophysical surveys (2010), and an extended period of diamond drilling from 2006 through to 2013 for a total of 46 diamond drill holes.

|

| Further work |

· The nature and scale of planned further work (eg tests for lateral extensions or depth extensions or large-scale step-out drilling).

· Diagrams clearly highlighting the areas of possible extensions, including the main geological interpretations and future drilling areas, provided this information is not commercially sensitive. |

· There are a few locations where the potential extension to the current Minerals Resource could be tested. These locations are initially defined at depth plunging steeply to the west underneath the high-grade copper-gold mineralisation, and also to the west of the Maalinao-Panyaw fault. The location for the possible high-grade copper-gold to the west include at depth, due to the interpretation that the fault has downthrown the geology on its western side, or toward the north-west, as a possible trend exists to the mineralisation in this direction which has not been tested. · Apart from the direct extensions to the currently defined copper-gold mineralisation, there is considerable scope for further discoveries of two defined deposit types at the MCB Tenement. · Porphyry copper-gold deposit types o There are extensive intrusions in the area that are directly related to the copper-gold mineralisation, and which could at multiple locations formed significant high-grade copper-gold deposits. · Epithermal vein hosted deposit types o It is considered likely that there could be a combination of narrow high grade, and/or more broad large scale and lower grade epithermal deposit types that are closely related to the porphyry copper-gold deposits at MCB. |

[1] ASX/AIM announcement 11 June 2025

[2] ASX/AIM announcements 19 May 2025 and 27 June 2025

[3] ASX/AIM announcement 28 February 2023

[4] ASX/AIM announcements 24 February 2025, 19 May 2025, and 17 June 2025

[5] ASX announcement 7 August 2025

[6] https://www.tlcpay.ph/NWRB/homepage

[7] C1 costs include all direct costs in mining, processing, general and administration, and selling (including freight).

[8] ASX announcement 7 August 2025

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.