30 July 2025

Future Metals NL

Quarterly Activities Report for period ending

30 June 2025

Future Metals NL ("Future Metals" or the "Company", ASX | AIM: FME) is pleased to announce its Quarterly Activities and Cashflow Report for the quarter ended 30 June 2025 (the "Quarter").

Highlights

· Execution of a Memorandum of Understanding with Zeta Resources to assess the potential of Zeta Resources' Savannah Plant to process Eileen Bore Cu-Ni-PGM & Panton PGM ores

· Completion of a A$4.2 million capital raise (before costs), consisting of:

o A placement raising A$1.58 million at 1.1 cents per share to Zeta Resources;

o A fully underwritten rights issue, raising ~A$2.64 million (1 for 3 basis) with existing shareholders on same terms as placement; and

o Zeta Resources acquired a 12.4% stake in FME through the capital raise process

· Initiation of a CEO hiring process to drive exploration activities at Eileen Bore as well as project development at Panton

· Successful award of a co-funding grant from the WA Government's EIS programme for ground electromagnetic programme at Eileen Bore

· Strong PGM price appreciation creating favourable conditions to progress continued development of Panton & Eileen Bore

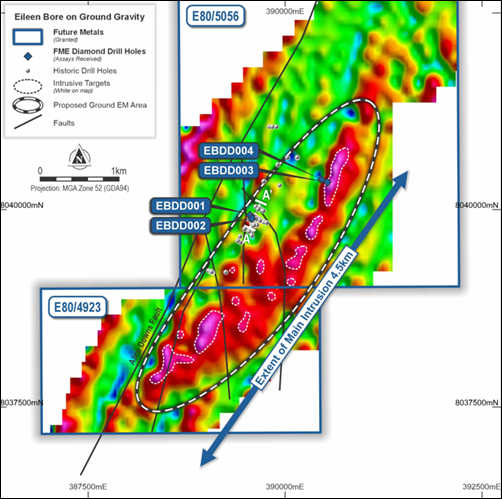

Figure 1 : Plan view of the planned geophysics programme over the Eileen Bore tenements forming part of the Western Australian Governments EIS co-funded exploration programme

Eileen Bore Prospect

EM Programme Co-Funded Award

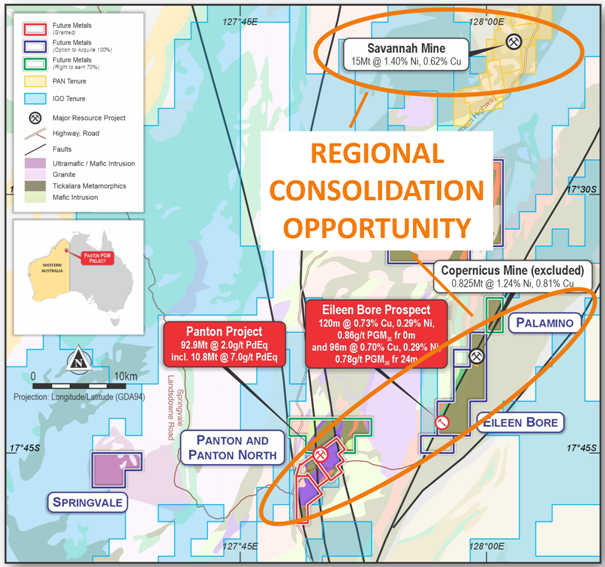

Eileen Bore, located within 20 km of Future Metals' 100%-owned Panton Project, forms part of the Alice Downs Corridor ("ADC") in the highly prospective East Kimberley region of Western Australia. Recent drilling results indicate the presence of broad zones of disseminated and net-textured copper and nickel sulphides across the Eileen Bore Prospect. These intrusions host sulphide assemblages including chalcopyrite, pyrrhotite, pentlandite, and pyrite.

In 2024, ground gravity surveys and drilling revealed that historical mineralisation at Eileen Bore has been structurally offset approximately 300m north from a significant 4.5 km-long northeast-southwest striking intrusion. This body is now interpreted as the likely source of mineralisation at Eileen Bore. Gravity data also identified numerous internal density variations and north-south trending faults (refer to Figure 1), with hole EBDD003 intersecting 127m of fertile ultramafic including:

· 7.4m @ 0.46% Cu, 0.51% Ni, and 0.3g/t PGM (3E)

This intercept, combined with the anomalous Ni-Cu-Pd-Pt-S over 127m, confirms the fertility of the intrusion which was previously unknown. Considering the historical mineralisation is interpreted to be offset from this intrusion, further zones similar to that intersected in EBDD002 which intersected 30m @1.06% Cu, 0.45% Ni & 1.14g/t PGM(3E) from 88.9m are key targets.

To refine targeting within the main intrusion, a ground electromagnetic (EM) survey is planned. Historical EM work focused on the now-offset Eileen Bore mineralisation, as the structural relationship to the southern intrusion was unknown. The upcoming EM programme aims to identify conductive sulphide zones within the 4.5 km intrusion to plan future drilling.

Future Metals has secured $63,375 in co-funding from the Western Australian Government's Exploration Incentive Scheme ("EIS") Venture 2 to support this geophysical programme.

Corporate

Capital Raising

During the Quarter, FME announced the execution of a strategic infrastructure-based non-binding Memorandum of Understanding ("MOU") with Zeta Resources Limited ("Zeta Resources") and completed a placement and fully underwritten rights issue raising A$4.2 million before costs ("Capital Raising").

Via the Capital Raising, Zeta Resources acquired a 12.4% interest in the ordinary share capital of the Company.

Funds raised from the Capital Raising will be used primarily to advance the development of the Eileen Bore Cu-Ni-PGM Prospect, targeting a bulk copper feed source for the Savannah Plant, as well as for working capital purposes and costs of the Fundraise.

Zeta Resources MOU

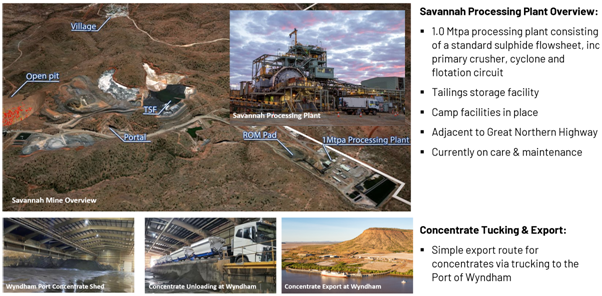

The non-binding MOU with Zeta Resources announced in the Quarter, is targeting the collaborative assessment of the feasibility of Future Metals supplying ore from its Eileen Bore Cu-Ni-PGM Prospect and/or Panton PGM Project to the Savannah Mine processing plant.

Zeta Resources is an investment company specialising in acquiring resource assets. Zeta Resources has a diversified portfolio, with interests in several mining operations. Zeta Resources is the sole shareholder of Panoramic Resources Limited, which owns the Savannah Mine processing plant, currently on care and maintenance. The Savannah Mine processing plant represents a significant opportunity for strategic partnerships to enhance shareholder value.

Future Metals and Zeta Resources have agreed to assess the technical, economic, and regulatory aspects of utilising alternate ore sources that may come from Future Metals projects and prospects to the Savannah Mine processing plant. This assessment will involve ongoing feasibility analysis, based on the availability of technical and economic information. Should the assessment yield positive results, the parties will negotiate in good faith for a suitable commercial structure for future operations involving a combination of Future Metals' ores and the Savannah Mine's processing plant.

Figure 2: Location of the Eileen Bore Cu-Ni-PGM Prospect and the Panton PGM Project in proximity to the Savannah Mine

Figure 3: Savannah Mine infrastructure overview and concentrate export facilities at the Port of Wyndham

Figure 4: Regional setting of the Panton PGM Project, Savannah Mine and the Port of Wyndham

Improving Metal Price Environment & CEO Recruitment Process

Given the backdrop of prolonged depressed PGM prices, over the last 12 months the Company has been focused on minimising corporate expenditure and undertaking targeted low-cost, high-value expenditure activities at both Eileen Bore and Panton.

Table 1: Performance of metal prices over 2025 to date (note: Copper price on LME), prices as of 25 July 2025

| Metal |

Current Price (USD) |

Price Performance (Year to Date) |

| Platinum |

$9,790/t |

56% |

| Palladium |

$1,255/oz |

38% |

| Copper |

$1,423/oz |

12% |

| Nickel |

$15,187/t |

-1% |

The combination of tailwinds of improving metal prices and Zeta Resources as a Strategic Partners via the Capital Raise, Future Metals is now targeting a ramp-up of its exploration and development activities at both Eileen Bore and Panton.

The Company has initiated a process with the appointment of a CEO to drive its projects forward and is expecting the results of this process to be announced in the September quarter.

The Company continues to focus on efficient capital use, including maintaining all directors at non-executive remuneration levels.

Financial Commentary

The Company held approximately A$3.92m in cash at the end of the Quarter.

Exploration and project development expenditure during the Quarter amounted to approximately A$56k. Payments for administration and corporate costs amounted to approximately A$289k. Also included in corporate costs were payments to related parties and their associates of A$33k, comprising Director fees and remuneration (including superannuation). The Quarterly Cashflow Report (Appendix 5B) for the period ended 30 June 2025 provides an overview of the Company's financial activities.

The Quarterly Cashflow Report (Appendix 5B) is available at the following link : http://www.rns-pdf.londonstockexchange.com/rns/0483T_1-2025-7-29.pdf and on the Company's website Quarterly Reports - Future Metals NL .

For additional information please refer to the ASX/AIM announcements covered in this announcement:

10 April 2025 FME Execute Strategic Infrastructure MOU with Zeta Resources

7 May 2025 Launch of $2.64M Entitlement Offer

15 May 2025 Commencement of Entitlement Offer

15 May 2025 Entitlement Offer Details for DI Holders

27 May 2025 Entitlement Offer - Extension of Closing Date

4 June 2025 Entitlement Off Fully Underwritten

20 June 2025 Results of Non-Renounceable Entitlement Offer

The above announcements are available to view on the Company's website at future-metals.com.au. The Company confirms that it is not aware of any new information or data that materially affects the information included in the relevant original market announcements. The Company confirms that the information and context in which any Competent Person's findings are presented have not been materially modified from the original market announcements.

This announcement is authorised for release by the Board of the Company.

For further information, please contact:

Appendix One | Exploration and Mining Permits

Exploration & Mining Permits changes during the Quarter

| Project |

Location |

Tenement |

Interest at beginning of Quarter |

Interest at end of Quarter |

| Nil |

||||

Farm-In / Farm Out Agreement changes during the Quarter

| Joint Venture |

Project |

Location |

Tenement |

Interest at beginning of Quarter |

Interest at end of Quarter |

| Octava Minerals Ltd |

Panton North |

Western Australia |

E80/5455 |

- |

- |

| Octava Minerals Ltd |

Palamino |

Western Australia |

E80/5459 |

- |

- |

Future Metals may earn up to 70% in the two tenements listed above. Details of the transaction can be found in the announcement 'Farm-In Agreement Over East Kimberley Ni-Cu-PGE Prospects' released on 17 January 2023.

Interests in Mining & Exploration Permits & Joint Ventures at 30 June 2025

| Project |

Location |

Tenement |

Area |

Interest at end of Quarter |

| Panton PGM-Ni Project |

Western Australia |

M80/103 M80/104 |

8.6km 2 5.7km 2 |

100% 100% |

| |

|

M80/105 |

8.3km 2 |

100% |

| Panton North (OCT JV) |

Western Australia |

E80/5455 |

8 BL |

- |

| Alice Downs Corridor (OCT JV) |

Western Australia |

E80/5459 |

2 BL |

- |

| Alice Downs Corridor |

Western Australia |

E80/4922 |

1BL |

100% |

| Alice Downs Corridor |

Western Australia |

E80/4923 |

2BL |

100% |

| Alice Downs Corridor |

Western Australia |

E80/5056 |

10BL |

100% |

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.