13 January 2026

Lexington Gold Ltd

("Lexington Gold" or the "Company")

£1.19m Equity Fundraise, Conversion of Unsecured Loans and Directors' Dealings

Lexington Gold (AIM: LEX; OTCQB: LEXLF), the gold exploration and development company with a growing portfolio of high quality projects in South Africa and the United States, is pleased to announce that the Company has raised, in aggregate, gross proceeds of £1.19m from certain existing and new investors. In addition, the outstanding unsecured convertible loans of, in aggregate, £350,000 principal amount (the "Convertible Loans") announced on 5 November 2025 which were provided by longstanding substantial shareholder Pure Ice Ltd (as to £201,746), and three of the Company's directors, namely Edward Nealon (as to £50,000), Melissa Sturgess (via Hartford Corporate Limited a company under her joint control) (as to £20,000) and Mark Greenwood (as to £78,254) (together, the "Lenders") have, together with accrued interest, been settled in new equity on the same commercial terms as the fundraising (the "Loan Conversion Shares") in accordance with their conversion terms and in order to conserve the Company's working capital.

Fundraising: The Company has raised, in aggregate, gross proceeds of £1,190,000 (the "Fundraising") at a price of 4 pence (the "Fundraising Price") per new common share of US$0.003 each in the capital of the Company ("Common Shares") from the issue of, in aggregate, 29,750,000 new Common Shares (the "Fundraising Shares") conditional upon admission of such Fundraising Shares to trading on AIM ("Admission"). The Fundraising comprises a placing of 19,375,000 new Common Shares (the "Placing Shares") to raise £775,000 at the Fundraising Price (the "Placing"), via the Company's joint broker, Marex Financial, and direct subscriptions for, in aggregate, 10,375,000 shares at the Fundraising Price to raise £415,000 (the "Subscription").Existing major shareholder Orasa (a.k.a. Doris) Chiaratanasen, has invested £125,000 for 3,125,000 Fundraising Shares in the Subscription representing approximately 10.5 per cent. of the total Fundraising amount.

The net proceeds of the Fundraising will be utilised to:

1. progress the Jelani joint venture, including preparatory work and submissions in relation to advancing a potential Mining Licence application;

2. finalise the updated Jelani study being undertaken by Bara Consulting;

3. undertake selected drilling programmes in South Africa on the Company's priority targets;

4. progress the current work associated with assessing strategic options for the group's USA projects; and

5. provide additional working capital and funds for general corporate purposes.

Edward Nealon, Non-Executive Chairman of Lexington Gold, commented:

"We are pleased to have secured this equity financing, alongside the conversion of certain outstanding loans, which serves to strengthen Lexington Gold's balance sheet and provide funding to advance our asset portfolio. As well as augmenting the group's working capital position, the net proceeds will be directed towards progressing our Jelani joint venture, completing Bara Consulting's updated study, and undertaking selected drilling on priority targets in South Africa, whilst continuing to assess strategic options across our USA projects. We thank both existing and new investors for their continued support and would especially like to welcome those US institutional investors who have acted as cornerstone participants in this fundraising."

Additional Information

Further Details of the Fundraising: Pursuant to the Fundraising, in aggregate, 29,750,000 Fundraising Shares will be issued at the Fundraising Price to certain new investors and long-term major shareholder Orasa (a.k.a. Doris) Chiaratanasen upon Admission. The Fundraising Price represents a discount of approximately 9.1 per cent. to the closing middle market price of a Common Share of 4.40 pence on 12 January 2026, being the latest practicable business day prior to this announcement. The Company is also issuing warrants to the Fundraising participants to subscribe for up to a further 29,750,000 new Common Shares which are exercisable at a price of 6 pence per share (representing an approximate 50% premium to the Fundraising Price) for an exercise period of three years from Admission (the "Fundraising Warrants").

The Fundraising Shares represent, in aggregate, approximately 6.3 per cent. of the Company's enlarged issued share capital (as enlarged by the issue of the Fundraising Shares and the Loan Conversion Shares detailed below). The Fundraising Shares and Loan Conversion Shares will be fully paid and rank pari passu in all respects with the Company's existing Common Shares.

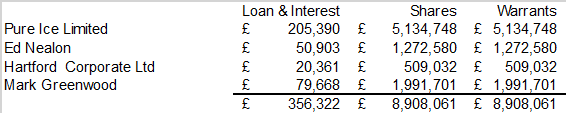

Loan Conversion Shares: The Company has agreed to settle, in aggregate, £356,322 of outstanding Convertible Loans including accrued interest thereon on the same terms as the Fundraising by way of the issue of 8,908,061 new Common Shares and 8,908,061 warrants with the same terms as the Fundraising Warrants (the "Loan Conversion") as per the table below:

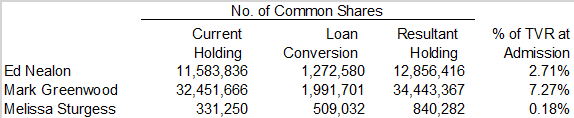

The table below shows the resultant shareholdings in the Company of Ed Nealon, Melissa Sturgess and Mark Greenwood and percentage of the total voting rights (TVR) at Admission:

Related Party Transaction - Substantial Shareholder Participation: The participation in the Fundraising by Orasa (a.k.a. Doris) Chiaratanasen constitutes a related party transaction pursuant to Rule 13 of the AIM Rules for Companies. Accordingly, the Board, having consulted with the Company's Nominated Adviser, Strand Hanson Limited, considers such participation to be fair and reasonable insofar as the Company's shareholders are concerned.

Application to trading on AIM: The Fundraising is conditional on Admission. Application will be made to the London Stock Exchange for the 29,750,000 Fundraising Shares and 8,908,061 Loan Conversion Shares (together, the "New Common Shares") to be admitted to trading on AIM. It is expected that Admission will become effective and that dealings in the New Common Shares will commence at 8.00 a.m. on or around 20 January 2026.

Total Voting Rights: On Admission, the number of Common Shares in issue outside treasury and the total voting rights in the Company will be 473,861,071. This figure may be used by shareholders in the Company as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, Lexington Gold under the notification provisions incorporated in the Company's Bye-laws.

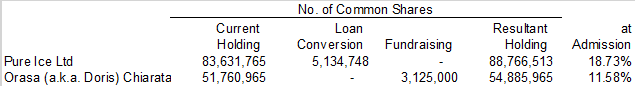

Additional Information: The table below shows the resultant shareholdings of the substantial shareholders who participated in the Fundraising and the Loan Conversion and their percentage of total voting rights at Admission

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulation (EU) No. 596/2014 ("UK MAR") as it forms part of UK domestic law by virtue of the Market Abuse (Amendment) (EU Exit) regulations 2019 (SI 2019/310).

For further information, please contact:

| Lexington Gold Ltd Bernard Olivier (Chief Executive Officer) Edward Nealon (Chairman) Mark Greenwood (Director) Mike Allardice (Group Company Secretary)

|

|

| Strand Hanson Limited (Nominated Adviser) Matthew Chandler / James Bellman / Abigail Wennington

|

T: +44 207 409 3494 |

| Optiva Securities Limited (Joint Broker) |

|

| Bartu Ciftci / Christian Dennis |

T: +44 203 981 4178 |

| |

|

| Marex Financial (Joint Broker) Angelo Sofocleous / Keith Swann / Matt Bailey (Broking)

|

email: [email protected] T: +44 207 655 6000 |

Note to Editors:

Lexington Gold (AIM: LEX; OTCQB: LEXLF) is a gold exploration and development company currently holding interests in four diverse gold projects, covering a combined area of approximately 1,675 acres in North and South Carolina, USA and in six gold projects covering approximately 114,638 hectares in South Africa.

Further information is available on the Company's website: www.lexingtongold.co.uk or follow us through our social media channel: X: @LexGoldLtd.

Neither the contents of the Company's website nor the contents of any website accessible from hyperlinks on the Company's website (or any other website) is incorporated into, or forms part of, this announcement.

|

PDMR Notification Forms: The notifications below are being made in accordance with the requirements of UK MAR.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1. |

Details of the person discharging managerial responsibilities / person closely associated |

|||||||

| a) |

Name |

Mark Greenwood |

||||||

| 2. |

Reason for the Notification |

|||||||

| a) |

Position/status |

Non-Executive Director |

||||||

| b) |

Initial notification/amendment |

Initial notification |

||||||

| 3. |

Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

|||||||

| a) |

Name |

Lexington Gold Ltd |

||||||

| b) |

LEI |

213800ZBDLZC9TO5W864 |

||||||

| 4. |

Details of the transaction(s):section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted |

|||||||

| a) |

Description of the Financial instrument, type of instrument |

Common shares of US$0.003 each in the Company ("Common Shares") |

||||||

| Identification code |

BMG5479L1072 |

|||||||

| b) |

Nature of the Transaction |

Settlement of a loan and accrued interest in Common Shares

|

||||||

| c) |

Price(s) and volume(s) |

|

||||||

| d) |

Aggregated information Aggregated volume Price |

N/A |

||||||

| e) |

Date of the transaction |

12 January 2026 |

||||||

| f) |

Place of the transaction |

Outside of an exchange |

||||||

| 1. |

Details of the person discharging managerial responsibilities / person closely associated |

|||||||

| a) |

Name |

Melissa Sturgess

|

||||||

| 2. |

Reason for the Notification |

|||||||

| a) |

Position/status |

Non-Executive Director |

||||||

| b) |

Initial notification/amendment |

Initial notification |

||||||

| 3. |

Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

|||||||

| a) |

Name |

Lexington Gold Ltd |

||||||

| b) |

LEI |

213800ZBDLZC9TO5W864 |

||||||

| 4. |

Details of the transaction(s):section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted |

|||||||

| a) |

Description of the Financial instrument, type of instrument |

Common shares of US$0.003 each in the Company ("Common Shares") |

||||||

| Identification code |

BMG5479L1072 |

|||||||

| b) |

Nature of the Transaction |

Settlement of a loan and accrued interest by Hartford Corporate Limited in Common Shares

|

||||||

| c) |

Price(s) and volume(s) |

|

||||||

| d) |

Aggregated information Aggregated volume Price |

N/A |

||||||

| e) |

Date of the transaction |

12 January 2026 |

||||||

| f) |

Place of the transaction |

Outside of an exchange |

||||||