8 September 2025

URU Metals Limited

("URU" or the "Company")

High-power AEM Interpretation Highlights and Fundraise

URU Metals Limited ("URU" or the "Company") is pleased to report positive results from the independent interpretation of its high-power SpectremPlus™ airborne electromagnetic ("AEM") survey over the Zeb Nickel Project, Limpopo, South Africa. The AEM dataset has been integrated with the project's gravity and magnetic models to refine the geological framework and rank conductive anomalies along the ultramafic intrusive trend.

Highlights

· Coherent conductive responses identified: The interpretation delineates multiple discrete, laterally persistent conductors after screening for cultural and stratigraphic effects, with several features coincident with magnetic trends and intrusive margins which is consistent with the Company's chonolith/feeder-style nickel sulphide model.

· 3-D integration strengthens the geological case: Combining AEM, gravity and magnetics supports a focused corridor where sulphide accumulation is considered most plausible within or adjacent to the ultramafic package.

· De-risking pathway defined: The Company is advancing a follow-up programme that will include ground-based electromagnetic methods, downhole EM and complementary techniques to refine geometry, depth and conductance prior to selecting locations for initial drill-testing.

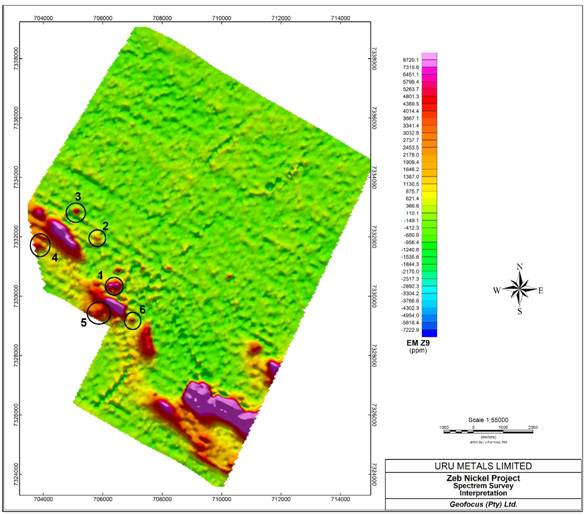

The interpretation of the recently completed Spectrem survey by Geofocus (Pty) Ltd outlines several clear, late-time conductive zones that cluster along the edges of the ultramafic body, interpreted to be a chonolith, and in close proximity to the magnetic and gravity shells. This spatial pattern is exactly what our chonolith/feeder model anticipates: nickel-copper-PGE sulphides commonly accumulate in 'trap' sites along basal contacts and feeder embayments, often slightly offset from the densest and most magnetic core of the intrusion. By integrating the EM with magnetics and gravity in 3-D, we've narrowed targeting to a well-defined corridor where intrusion-related sulphide mineralisation is geologically plausible, while filtering out many responses more likely to reflect stratigraphy or surface effects. These results do not confirm mineralisation, but the alignment of independent datasets materially strengthens the technical case and provides a strong foundation for focused follow-up geophysics to refine geometry and prioritise drill-ready targets. The main conductor picks are presented in Figure 1 below.

Figure 1: Late-time AEM response with conductor picks

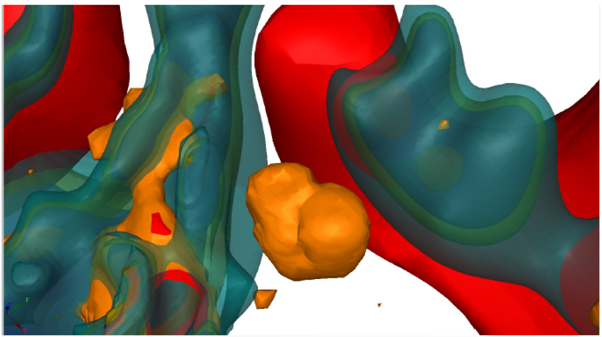

Figure 2: 3D view (looking north from above) The orange "cloud" shows a conductive zone detected by the EM survey. The red and blue outlines are earlier models of denser and more magnetic rock. The anomaly sits beside the Uitloop intrusion and close to those outlines, which fits how massive sulphides often occur: they tend to "pool" along the base or edges of an intrusion or in feeder embayments, slightly offset from the hardest, most magnetic core. This geometry is consistent with that setting, although it does not confirm mineralisation.

Geological context

Zeb is centred on an ultramafic intrusive trend interpreted as a chonolith/feeder system, analogous in style to the Uitkomst Intrusion, which hosted a massive sulphide body of 2.3 million tonnes grading 2.69% nickel, 1.4% copper, and 6.39 g/t 3PGE+Au. Under this model, semi- to massive Ni-Cu-PGE sulphides are expected to concentrate at, or near, intrusive contacts and feeder zones. The integrated geophysical interpretation supports this conceptual framework and provides a robust basis for the planned fieldwork.

Next Steps

To increase precision ahead of any drill selection, the Company will conduct a ground-based geophysical survey over selected targets. The work may include a combination of moving-loop and/or fixed-loop EM and limited complementary methods where appropriate.

Ground-based surveys provide orientation-controlled, higher signal-to-noise measurements that enable constrained plate modelling of conductive bodies. This improves confidence in position, dip and strike, and helps discriminate compact, highly conducting sulphide targets from look-alikes such as banded iron formation, graphitic horizons, conductive weathering fronts or cultural coupling. In practical terms, follow-up geophysics reduces false positives, sharpens drill vectors and lowers the probability of unnecessary metres, thereby improving capital efficiency and technical outcomes.

The completion of the AEM survey combined with the ground based geophysical work is a key step for the Company in identifying the semi massive-massive sulphide discovery. The Company are working closely with the Mining department in country regarding the awarding of the Mining Rights and hope to be in a position to update shareholders soon. Upon successful awarding of the Mining Rights, the Company intends on embarking on an extensive drill programme to further prove up the deposit.

The Company is finalising the scope and sequencing of the follow-up programme and the Company will provide a further update once the programme selection, scheduling and access arrangements are complete.

Fundraise

The Company is pleased to announce that it has raised £500,000 before expenses through a placing of 17,857,143 new ordinary shares of no nominal value each in the capital of the Company (the "Placing Shares") at a price of 2.8p per share (the "Placing"). The Placing was arranged by the Company's broker Axis Capital Markets Limited.

The funds raised will be used to fund the ground based geophysical survey as outlined above. It is anticipated that the Mining Rights will be received in the near term, part of the funding will be used to cover the administrative expenses associated with this process. The successful acquisition of the AEM survey data marked a critical milestone-strengthening every technical aspect of the project and significantly enhancing its execution.

Admission and Dealings of the Shares

The Placing Shares will be issued as fully paid and will rank pari passu in all respects with the existing ordinary shares of the Company, including the right to receive dividends and other distributions declared on or after the date on which they are issued.

Application will be made to the London Stock Exchange for the Placing Shares to be admitted to trading on AIM at 8.00 a.m. on or around 11 September 2025.

Total Voting Rights

Following admission of the Placing Shares, the Company's issued share capital will be 81,024,418 ordinary shares. This figure of 81,024,418 may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, the Company.

Richard Montjoie, VP Exploration , commented:

"We're encouraged that the Spectrem results further support our intrusion-hosted chonolith/feeder model at Zeb. The conductive zones cluster along intrusive margins and align with magnetic and gravity shells, which is consistent with where our model anticipates potential sulphide traps. Our next step is to apply targeted ground geophysics to refine geometry and conductance, reduce false positives, and position any initial drill holes with greater confidence."

About the Company

URU Metals is a mineral exploration and development company focused on advancing its high-potential critical metals projects in South Africa. The Company is committed to creating sustainable value through responsible mining practices, regulatory compliance, and engagement with stakeholders. For more information, visit.

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company's obligations under Article 17 of MAR.

For further information, please contact:

URU Metals Limited

John Zorbas

(Chief Executive Officer)

+1 416 504 3978

SP Angel Corporate Finance LLP

(Nominated Adviser and Broker)

Ewan Leggat / Jen Clarke + 44 (0) 203 470 0470

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.