21 February 2023

HSBC Bank plc

Annual Report and Accounts

In fulfilment of its obligations under sections 4.1.3 and 6.3.5(1) of the Disclosure Guidance and Transparency Rules, HSBC Bank plc (the "Company") hereby releases the unedited full text of its 2022 Annual Report and Accounts for the year ended 31 December 2022.

The document is now available on the Company's website:

http://www.hsbc.com/investor-relations/subsidiary-company-reporting

The document has also been submitted to the National Storage Mechanism (NSM) and will shortly be available for inspection at: https://data.fca.org.uk/#/nsm/nationalstoragemechanism

HSBC Bank plc

Annual Report and Accounts 2022

Registered number - 00014259

| Contents |

|

|

|

Page |

| Strategic Report |

|

| Highlights |

3 |

| Key themes of 2022 |

3 |

| Key financial metrics |

5 |

| About HSBC Group |

6 |

| Purpose and strategy |

6 |

| Our Global Businesses |

9 |

| ESG Overview |

10 |

| Key Performance Indicators |

14 |

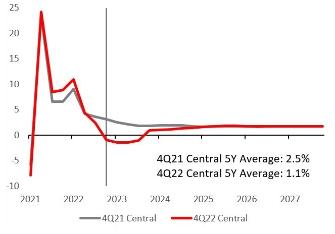

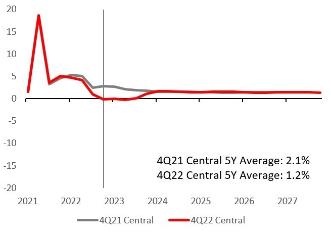

| Economic background and outlook |

15 |

| Financial summary |

15 |

| Risk overview |

24 |

| Report of the Directors |

|

| Risk |

26 |

| Corporate Governance Report |

101 |

| - Directors |

101 |

| - Company Secretary |

103 |

| - Board of Directors |

104 |

| - Directors' emoluments |

104 |

| - Board committees |

104 |

| - Dividends |

108 |

| - Internal control |

108 |

| - Employees |

111 |

| - Auditors |

112 |

| - Articles of association, conflicts of interest and indemnification of directors |

112 |

| - Statement on going concern |

114 |

| - Statement of directors' responsibilities in respect of the financial statements |

115 |

| Independent Auditors' Report |

116 |

| Financial Statements |

|

| Financial statements |

113 |

| Notes on the financial statements |

124 |

| |

|

| |

|

| Presentation of Information |

|

This document comprises the Annual Report and Accounts 2022 for HSBC Bank plc ('the bank' or 'the company') and its subsidiaries (together 'the group'). 'We', 'us' and 'our' refer to HSBC Bank plc together with its subsidiaries. It contains the Strategic Report, the Report of the Directors, the Statement of Directors' Responsibilities and Financial Statements, together with the Independent Auditors' Report, as required by the UK Companies Act 2006. References to 'HSBC', 'HSBC Group' or 'Group' within this document mean HSBC Holdings plc together with its subsidiaries.

HSBC Bank plc is exempt from publishing information required by The Capital Requirements Country-by-Country Reporting Regulations 2013, as this information is published by its parent, HSBC Holdings plc. This information is available on HSBC's website: www.hsbc.com.

Pillar 3 disclosures for the group are also available on www.hsbc.com, under Investors.

Contents of the linked websites are not incorporated into this document.

All narrative disclosures, tables and graphs within the Strategic Report and Report of the Directors are unaudited unless otherwise stated.

Our reporting currency is £ sterling.

Unless otherwise specified, all $ symbols represent US dollars.

Cautionary Statement Regarding Forward- Looking Statements |

This Annual Report and Accounts 2022 contains certain forward- looking statements with respect to the company's financial condition; results of operations and business, including the strategic priorities; financial, investment and capital targets; and the company's ability to contribute to the Group's Environmental, social and governance ('ESG') targets, commitments and ambitions described herein.

Statements that are not historical facts, including statements about the company's beliefs and expectations, are forward-looking statements. Words such as 'may', 'will', 'should', 'expects', 'targets', 'anticipates', 'intends', 'plans', 'believes', 'seeks', 'estimates', 'potential' and 'reasonably possible', or the negative thereof, other variations thereon or similar expressions are intended to identify forward-looking statements. These statements are based on current plans, information, data, estimates and projections, and therefore undue reliance should not be placed on them. Forward-looking statements speak only as of the date they are made. The company makes no commitment to revise or update any forward-looking statements to reflect events or circumstances occurring or existing after the date of any forward- looking statements. Written and/or oral forward-looking statements may also be made in the periodic reports to the US Securities and Exchange Commission, offering circulars and prospectuses, press releases and other written materials, and in oral statements made by the company's Directors, officers or employees to third parties, including financial analysts. Forward- looking statements involve inherent risks and uncertainties.

Readers are cautioned that a number of factors could cause actual results to differ, in some instances materially, from those anticipated or implied in any forward-looking statement. These include, but are not limited to:

• changes in general economic conditions in the markets in which the company operates, such as new, continuing or deepening recessions, prolonged inflationary pressures and fluctuations in employment and creditworthy customers beyond those factored into consensus forecasts (including, without limitation, as a result of the Russia-Ukraine war and, to a lesser extent, the Covid-19 pandemic); the Russia-Ukraine war and the Covid-19 pandemic and their impact on global economies and the markets where the company operates, which could have a material adverse effect on (among other things) the company's financial condition, results of operations, prospects, liquidity, capital position and credit ratings; deviations from the market and economic assumptions that form the basis for the company's ECL measurements (including, without limitation, as a result of the Russia-Ukraine war, inflationary pressures and the Covid-19 pandemic); changes in foreign exchange rates and interest rates; volatility in equity markets; lack of liquidity in wholesale funding or capital markets, which may affect the company's ability to meet its obligations under financing facilities or to fund new loans, investments and businesses; geopolitical tensions or diplomatic developments, both in Europe and in other regions such as Asia,

• producing social instability or legal uncertainty, such as the Russia-Ukraine war (including the continuation and escalation thereof) and the related imposition of sanctions and trade restrictions, the UK's relationship with the EU, supply chain restrictions and disruptions, sustained increases in energy prices and key commodities and diplomatic tensions between China and the US, extending to the UK and the EU, alongside other potential areas of tension, which may adversely affect the group by creating regulatory, reputational and market risks; the efficacy of government, customer, and the company's and the Group's actions in managing and mitigating ESG risks, in particular climate risk, nature-related risks and human rights risks, and in supporting the global transition to net zero carbon emissions, each of which can impact the company both directly and indirectly through its customers and which may result in potential financial and non-financial impacts; illiquidity and downward price pressure in national real estate markets; adverse changes in central banks' policies with respect to the provision of liquidity support to financial markets; heightened market concerns over sovereign creditworthiness in over-indebted countries; adverse changes in the funding status of public or private defined benefit pensions; societal shifts in customer financing and investment needs, including consumer perception as to the continuing availability of credit; exposure to counterparty risk, including third parties using us as a conduit for illegal activities without the company's knowledge; the discontinuation of certain key Ibors and the development of near risk-free benchmark rates, as well as the transition of legacy Ibor contracts to near risk-free benchmark rates, which exposes the company to material execution risks, including in relation to the effectiveness of the Group's Ibor remediation strategy, and increases some financial and non-financial risks; and price competition in the market segments that the company serves;

• changes in government policy and regulation, including the monetary, interest rate and other policies of central banks and other regulatory authorities in the principal markets in which the company operates and the consequences thereof (including, without limitation, actions taken as a result of the impact of the Russia-Ukraine war on inflation and as a result of the Covid-19 pandemic); initiatives to change the size, scope of activities and interconnectedness of financial institutions in connection with the implementation of stricter regulation of financial institutions in key markets worldwide; revised capital and liquidity benchmarks, which could serve to deleverage bank balance sheets and lower returns available from the current business model and portfolio mix; changes to tax laws and tax rates applicable to the company, including the imposition of levies or taxes designed to change business mix and risk appetite; the practices, pricing or responsibilities of financial institutions serving their consumer markets; expropriation, nationalisation, confiscation of assets and changes in legislation relating to foreign ownership; the UK's relationship with the EU, which continues to be characterised by uncertainty and political disagreement, particularly with respect to the regulation of financial services, despite the signing of the Trade and Cooperation Agreement ('TCA') between the UK and the EU; changes in UK macro-economic and fiscal policy as a result of the change in UK government leadership, which may result in fluctuations in the value of the pound sterling; general changes in government policy that may significantly influence investor decisions; the costs, effects and outcomes of regulatory reviews, actions or litigation, including any additional compliance requirements; and the effects of competition in the markets where we operate, including increased competition from non-bank financial services companies; and

• factors specific to the company and the Group, including the company's success in adequately identifying the risks it faces, such as the incidence of loan losses or delinquency, and managing those risks (through account management, hedging and other techniques); the company's ability to achieve its financial, investment, capital targets and the achievement of the Group's ESG targets, commitments and ambitions, which may result in the company's failure to achieve any of the expected benefits of its strategic priorities; model limitations or

failure, including, without limitation, the impact that high inflationary pressures, rising interest rates and the consequences of the Covid-19 pandemic have had on the performance and usage of financial models, which may require the company to hold additional capital, incur losses and/or use compensating controls, such as judgemental post-model adjustments, to address model limitations; changes to the judgements, estimates and assumptions the company bases its financial statements on; changes in the company's ability to meet the requirements of regulatory stress tests; a reduction in the credit ratings assigned to the company or any of its subsidiaries, which could increase the cost or decrease the availability of the company's funding and affect its liquidity position and net interest margin; changes to the reliability and security of the company's data management, data privacy, information and technology infrastructure, including threats from cyber-attacks, which may impact its ability to service clients and may result in financial loss, business disruption and/ or loss of customer services and data; the accuracy and effective use of data, including internal management information that may not have been independently verified; changes in insurance customer behaviour and insurance claim rates; the company's dependence on loan payments and dividends from subsidiaries to meet its obligations; changes in accounting standards, including the implementation of IFRS 17 'Insurance Contracts', which may have a material impact on the way the company prepares its financial statements and (with respect to IFRS 17) may negatively affect the profitability of HSBC's insurance business; changes in the company's ability to manage third-party, fraud and reputational risks inherent in its operations; employee misconduct, which may result in regulatory sanctions and/or reputational or financial harm; changes in skill requirements, ways of working and talent shortages, which may affect the company's ability to recruit and retain senior management and diverse and skilled personnel; and changes in the company's ability to develop sustainable finance and climate-related products consistent with the evolving expectations of its regulators, and the company's capacity to measure the climate impact from its financing activity (including as a result of data limitations and changes in methodologies), which may affect the Group's ability to achieve its climate ambition, targets and commitments, and increase the risk of greenwashing. Effective risk management depends on, among other things, the company's ability through stress testing and other techniques to prepare for events that cannot be captured by the statistical models it uses; the company's success in addressing operational, legal and regulatory, and litigation challenges; and other risks and uncertainties we identify in 'Top and emerging risks' on page 28 of the Annual Report and Accounts 2022.

s

| Highlights |

For the year ended 31 December 2022

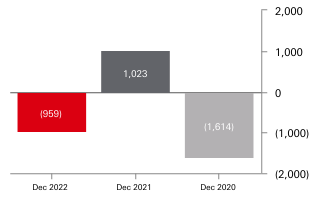

| Reported (loss)/profit before tax (£m) |

£(959)m

£(959)m

(2021: £1,023m); (2020: £(1,614)m)

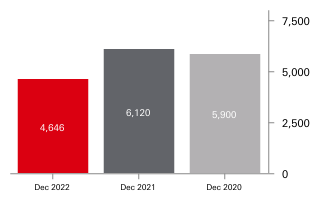

| Reported revenue (£m)

|

£4,646m

£4,646m

(2021: £6,120m); (2020: £5,900m)

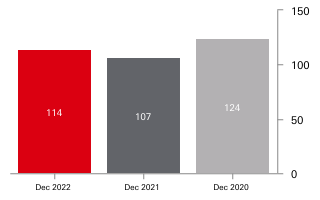

| Reported risk-weighted assets at period end (£bn) |

£114bn

£114bn

(2021: £107bn); (2020: £124bn)

.

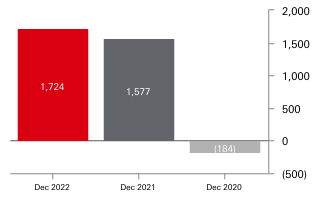

| Adjusted profit/(loss) before tax (£m) |

£1,724m

£1,724m

(2021: £1,577m); (2020: £(184)m)

| Total assets at period end (£bn) |

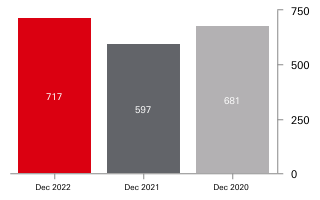

£717bn

£717bn

(2021: £597bn); (2020: £681bn)

| Common equity tier 1 ratio at period end (%) |

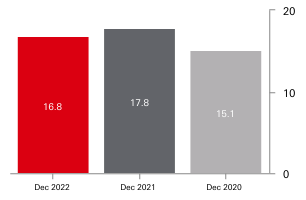

16.8%

16.8%

(2021: 17.8%); (2020: 15.1%)

| Key themes of 2022 |

HSBC Bank plc continued to support the Group through progress on our strategic aims, although challenges in the geopolitical and economic environment remain.

| Financial Performance |

Our financial performance in 2022 reflected losses associated with our restructuring initiatives, including impairments of businesses which have been classified as held-for-sale. These items resulted in a reported loss before tax. On an adjusted basis, profit before tax increased due to the benefit of higher interest rates and a strong performance in MSS. Costs decreased driven by the impact of our transformation and cost-saving initiatives. Expected credit losses returned to a charge for the year compared with a net release in 2021. Read more on pages 16 to 22.

| Strategic Transformation |

We have continued to progress in our areas of strength and simplify the group in order to streamline our operating model and seek to improve returns. During the course of 2022, we continued to prepare for the completion of the sale of our French retail operations, announced the sale of our Greece branch operations and entered into a sale agreement for our Russia business.

We remain focused on implementing our Intermediate Parent Undertaking ('IPU'), in line with European Union ('EU') Capital Requirements Directive ('CRD'): HSBC Continental Europe ('HBCE') acquired HSBC Trinkaus & Burkhardt GmbH ('HSBC Germany') and HSBC Bank Malta ('HBMT'), and expect to acquire HSBC Private Bank (Luxembourg) SA in the first half of 2023, subject to receipt of pending regulatory approvals. More information can be found on pages 6 and 7.

Climate Ambition |

The Group is committed to a net zero future and recognises that our planet urgently needs drastic and lasting action to protect our communities, businesses and the natural environment from the damaging effects of climate change.

The Group believe they can make the most significant impact by working with its customers to support their transition to a net zero global economy. Since 2020, HSBC Bank plc has supported our customers' transition to net zero and helped build a sustainable future by providing and facilitating $86.2bn of sustainable finance, $18.9bn of sustainable investment and $0.1bn of sustainable infrastructure, as defined in the Group's Sustainable Finance Data Dictionary 2022. This financing and investment contributes towards the Group's ambition to provide and facilitate $750bn to $1tn of sustainable financing and investment by 2030. The $86.2bn of sustainable finance includes lending facilities provided and capital markets facilitated transactions.

1 The detailed definitions of the contributing activities for sustainable finance are available in the Group's revised Sustainable Finance Data Dictionary 2022. For the Group's ESG Data Pack, Sustainable Finance Data Dictionary and third-party limited assurance report, see www.hsbc.com/who-we-are/esg-and-responsible-business/esg-reportingcentre

| Key financial metrics |

|

|

2022 |

2021 |

2020 |

| For the year (£m) |

|

|

|

| (Loss)/profit before tax (reported basis) |

(959) |

1,023 |

(1,614) |

| Profit/(loss) before tax (adjusted basis)1 |

1,724 |

1,577 |

(184) |

| Net operating income before change in expected credit losses and other credit impairment charges (reported basis)2 |

4,646 |

6,120 |

5,900 |

| (Loss)/profit attributable to the parent company |

(408) |

1,041 |

(1,488) |

| At 31 December (£m) |

|

|

|

| Total equity attributable to shareholders of the parent company |

23,875 |

23,584 |

23,666 |

| Total assets |

717,353 |

596,611 |

681,150 |

| Risk-weighted assets3,8 |

114,171 |

106,703 |

124,353 |

| Loans and advances to customers (net of impairment allowances) |

72,614 |

91,177 |

101,491 |

| Customer accounts |

215,948 |

205,241 |

195,184 |

| Capital ratios (%)3,8 |

|

|

|

| Common equity tier 1 |

16.8 |

17.8 |

15.1 |

| Tier 1 |

20.2 |

21.4 |

18.5 |

| Total capital |

31.7 |

31.9 |

27.5 |

| Leverage ratio (%)4,8 |

5.5 |

4.2 |

4.0 |

| Performance, efficiency and other ratios (annualised %) |

|

|

|

| Return on average ordinary shareholders' equity5 |

(3.1) |

4.3 |

(7.9) |

| Return on tangible equity (%)6 |

5.5 |

6.1 |

(2.7) |

| Cost efficiency ratio (reported basis)7 |

115.2 |

89.2 |

113.6 |

| Cost efficiency ratio (adjusted basis)7 |

70.9 |

80.9 |

89.6 |

| Ratio of customer advances to customer accounts |

33.6 |

44.4 |

52.0 |

1 Adjusted performance is computed by adjusting reported results for the effect of significant items as detailed on pages 18 to 20.

2 Net operating income before change in expected credit losses and other credit impairment charges is also referred to as revenue.

3 Unless otherwise stated, regulatory capital ratios and requirements are based on the transitional arrangements of the Capital Requirements Regulation in force at the time. These include the regulatory transitional arrangements for IFRS 9 'Financial Instruments', which are explained further on page 80. References to EU regulations and directives (including technical standards) should, as applicable, be read as references to the UK's version of such regulation and/or directive, as onshored into UK law under the European Union (Withdrawal) Act 2018, and as may be subsequently amended under UK law.

4 The leverage ratio is calculated using the end point definition of capital and the IFRS 9 regulatory transitional arrangements, in line with the UK leverage rules that were implemented on 1 January 2022, and excludes central bank claims and cash pooling netting. Comparatives for 2021 are reported based on the disclosure rules in force at that time, and include claims on central banks.

5 The return on average ordinary shareholders' equity is defined as profit attributable to shareholders of the parent company divided by the average total shareholders' equity.

6 The RoTE is calculated by adjusting reported profit attributable to ordinary shareholders by excluding movements in PVIF and significant items (net of tax), divided by average tangible shareholders' equity excluding fair value of own debt, debit valuation adjustment ('DVA') and other adjustments for the period. The calculation of this measure includes the UK bank levy incurred for the first time in 2021, which was previously paid by the Group. Comparative data have not been re-presented.

7 Reported cost efficiency ratio is defined as total operating expenses (reported) divided by net operating income before change in expected credit losses and other credit impairment charges (reported), while adjusted cost efficiency ratio is defined as total operating expenses (adjusted) divided by net operating income before change in expected credit losses and other credit impairment charges (adjusted).

8 From 30 September 2022, investments in non-financial institution subsidiaries or participations have been measured on an equity accounting basis in compliance with UK regulatory requirements. Comparatives for prior periods have been represented on a consistent basis with the current year.

| About HSBC Group |

With assets of $3.0tn and operations in 62 countries and territories at 31 December 2022, HSBC is one of the largest banking and financial services organisations in the world. Approximately 39 million customers bank with the Group and the Group employs around 219,000 full-time equivalent staff. The Group has around 182,000 shareholders in 128 countries and territories.

| Purpose and strategy |

| HSBC's purpose and ambition |

The Group's purpose is 'Opening up a world of opportunity' and the Group's ambition is to be the preferred international financial partner for the Group's clients.

HSBC values

HSBC values help define who we are as an organisation and are key to our long-term success.

We value difference

Seeking out different perspectives.

We succeed together

Collaborating across boundaries.

We take responsibility

Holding ourselves accountable and taking the long view.

We get it done

Moving at pace and making things happen.

HSBC Group strategy

The Group is implementing its strategy at pace across the four strategic pillars aligned to its purpose, values and ambition announced in February 2021.

The Group's strategy centres on four key pillars: focus on our areas of strength, digitise at scale to adapt our operating model for the future; energise our organisation for growth and support the transition to a net zero global economy.

Focus on our strengths: in each of our global businesses, the Group will focus on areas where we are strongest and have opportunities to grow.

Digitise at scale: the Group will focus investments in areas such as technology, to improve our customers' experience while ensuring security and resilience. These investments in technology will also help drive down costs, including through automating our middle and back offices and building solutions to free up office footprint.

Energise for growth: the Group is moving to a leaner and simpler organisation that is energised and fit for the future. The Group aims to inspire a dynamic culture and champion inclusion across the organisation, as well as help employees develop future skills.

Transition to net zero: the Group's ambition is to support the transition to a net zero global economy. The Group has set out an ambitious plan to aim to become a net zero bank, to support customers in their transition, and to unlock new climate solutions.

HSBC in Europe

Europe is an important part of the global economy, accounting for roughly 40% of global trade and one-quarter of global Gross Domestic Product (UNCTAD, IMF 2021). In addition, Europe is the world's top exporter of services and second largest exporter of manufactured goods (UNCTAD, IMF 2021). HSBC Bank plc facilitates trade within Europe and between Europe and other jurisdictions where the HSBC Group has a presence.

With assets of £717bn at 31 December 2022, HSBC Bank plc is one of Europe's largest banking and financial services organisations. We employ around 14,400 people across our locations. HSBC Bank plc is responsible for HSBC's European business, apart from UK retail and most UK commercial banking activity which, post ring-fencing, are managed by HSBC UK Bank plc.

HSBC Bank plc operates as one integrated business with two main hubs in London and Paris.

HSBC Bank plc is present in 20 markets1. We are organised around the principal operating units detailed below, which represent the region to customers, regulators, employees and other stakeholders.

The London hub consists of the UK non-ring fenced bank, which provides overall governance and management for the Europe region as a whole and is a global centre of excellence for wholesale banking for the Group.

HBCE comprises our Paris hub, its EU branches (Belgium, Czech Republic, Greece, Ireland, Italy, Luxembourg, Netherlands, Poland, Spain and Sweden), Germany and Malta. We are creating an integrated Continental European bank anchored on Paris to better serve our clients and simplify our organisation.

1 Full list of markets where HSBC Bank plc has a presence: Armenia, Belgium, Channel Islands and Isle of Man, Czech Republic, France, Germany, Greece, Ireland, Italy, Israel, Luxembourg, Malta, Netherlands, Poland, Russia, South Africa, Spain, Sweden, Switzerland and the UK.

| HSBC Bank plc's strategy and progress on our 2022 commitments |

Our ambition in Europe is to be the leading international wholesale bank connecting East and West, with a complementary Wealth business, an efficient operating model and a robust control framework (see our global businesses on page 9).

HSBC Bank plc exists to open up a world of opportunity for our customers by connecting them to international markets. Europe is the largest trading region in the world and Asia is Europe's biggest and fastest growing external trading partner (UNCTAD, IMF 2021). We are well positioned to capitalise on this opportunity and play a pivotal role for the Group.

We expect Europe to continue to deliver change in 2023 to drive our ambition, the majority of announced transformation has been completed (see 'Focus on our strengths' for more information). In parallel to completing our transformation work, we are repositioning for growth and are well placed to seek to deliver strong financial performance. Further detail can be found below.

In 2022, Europe faced significant inflationary pressure, resulting in rapid central bank interest rate rises. We expect to continue operating in a volatile environment. Further information as to how we have and will continue to support and engage with our stakeholders can be found on page 10.

Below we provide a progress update on our commitments and strategic initiatives for 2022.

Focus on our strengths

Through our transformation programme we are building a leaner, simpler bank with a sharper strategic focus. We have redesigned our franchise around the needs of our international clients and maintaining product and service capability where clients demand them. We intend to be a market leader in sustainable financing and assist the Group in meeting its climate ambition for net zero operations and supply chain by 2030.

New regulation in the EU provides an opportunity to simplify our structure. In response to the requirement for an IPU in line with EU CRD V, HBCE acquired HSBC Germany and HBMT in the second half of 2022, and expects to acquire HSBC Private Bank (Luxembourg) SA in the first half of 2023. This remains subject to regulatory approvals for which the process has now started.

During 2022, HBCE has continued to prepare for the completion of the sale, of our French retail business which is expected in the second half of 2023, subject to regulatory approval. Until completion

of the planned transaction, the business remains part of, and will be managed by HBCE. Please see Note 34: Assets held for sale and liabilities of disposal groups held for sale, for further financial information on the transaction on page 186.

Following a strategic review of our business in Greece, an agreement has been signed to sell HBCE's branch operations in Greece to Pancreta Bank SA. The transaction is subject to regulatory approval and is expected to complete in the first half of 2023.

Following a strategic review of HSBC Europe BV (a wholly-owned subsidiary of HSBC Bank plc), we have stopped taking on new business and clients in our Russian operations. The value of foreign currency customer deposits and RUB deposits is now minimal. HSBC Europe BV has entered into an agreement to sell its wholly-owned subsidiary HSBC Bank (RR) (Limited Liability Company), subject to regulatory and governmental approvals. Such sale is currently expected to occur in the first half of 2023.

HSBC Group has implemented a new operating model for its Private Banking activities, in which HSBC Private Bank (Luxembourg) SA will become a central hub for HBCE's Private Banking clients. These clients will be served via a Paris branch of HSBC Private Bank (Luxembourg) SA. This will enable us to provide an enhanced product range to clients leveraging our infrastructure in Luxembourg.

Digitise at scale

We continue to invest in the digitisation of our global businesses, which is central to our strategy. Within Europe, Wealth and Personal Banking ('WPB') is focused on enhancing our engagement between clients and relationship managers, and allowing clients to self-serve at a time that suits them. For example, we further enhanced our digital portfolio and risk analysis platform, which furthered Private Bank advisers' ability to make suitable investment recommendations to clients using a more holistic approach to risk management. For our Retail customers, we have placed efforts into reducing paper waste in connection with the bank statements, with 33,000 bank statements viewed or downloaded in the Channel Islands. Looking ahead, we will seek to deploy secure and private communications via social media channels between clients and relationship managers. We also plan to introduce new ESG-centred reporting.

We are committed to maintaining our core strength in Global Payments Solutions ('GPS'), formerly known as Global Liquidity and Cash Management ('GLCM'). In 2022, we successfully delivered Real Time Payment capability in Luxembourg. GPS have improved our offering for customers in HSBCnet by enabling new features such as allowing customers to track and create recurring SEPA payments. GPS also enhanced the Liquidity Management Dashboard functionality, improving customers' ability to create and manage cash flow forecasts. By December 2022, we had 288 customers using the dashboard.

Our strategy within Global Trade and Receivables Finance ('GTRF') Europe is to help make trade easier, faster and safer, whilst seeking to deliver sustainable and profitable growth. Throughout 2022, we enhanced our digital channel HSBCnet and strengthened collaborations with third-party platforms. Examples of third-party collaboration include Komgo, a bank-agnostic platform that provides solutions to our customers to manage trade finance needs, and Contour, a blockchain solution that fully digitises letters of credit.

As at year end, 85% of trade transactions across Europe were conducted digitally as we continue to see an increase in clients adopting digital solutions.

For digital currencies and assets, we have made significant progress in 2022 in building a strategic tokenisation platform ('HSBC Orion') in Global Banking and Markets. HSBC Orion launched the world's first GBP tokenised bond in January 2023.

The platform allows natively digital bonds to be registered and issued, fully supports both primary and secondary market trading and is part of our ambition to widen the adoption of digital assets.

In Foreign Exchange we continue to enhance our electronic trading infrastructure to provide improved risk management to our clients. Our focus is to support customers' FX and cross-border payment needs through improved pricing tools and e-trading.

Energise for growth

Empowering our organisation and energising our employees is critical to Europe's success and remains a key focus. We made good progress against our people strategy including our diversity and inclusion agenda and are committed to offering colleagues the opportunities to develop their skills whilst building our talent pipelines to support the achievement of our strategic priorities.

We are committed to increasing diverse representation in Europe, especially at senior levels and in 2023 we aim to significantly increase sponsorship and accountability for achieving our goals. Our Diversity and Inclusion Council defines and drives specific actions across our D&I strands, supported by our pan-European Employee Resource Group 'Inclusive Europe'.

To support the Group's climate ambitions to become net zero in its operations and supply chain by 2030, and align its financed emissions to the Paris Agreement goal of net zero by 2050, the Group launched the Sustainability Academy in 2022. The Academy is available to all colleagues across the Group and serves as a central point for colleagues to access learning plans and curated resources, and develop practical skills. The Group have partnered with some leading educational institutions such as Imperial College Business School and will continue to update the academy with new research and content related to ESG issues, including those related to social and governance issues.

We have strengthened the training we provide to leaders to help them support colleagues through the changing environment we are facing. We have continued the executive development programme for our most senior leaders, which focuses on the shifting expectations of our enterprise wide leadership cadre, embedding the clarity and alignment to achieve our goals and tackling strategic change.

For our Managing Director population, we have taken into consideration that leadership development will vary depending on individual career experiences and tenure in role. Our executive curriculum contains an array of programmes to meet varying leadership development personas and topics focus on a range of issues including critical skills areas such as influence, inclusion, and Agile methodologies. During 2022, we launched two Managing Director development programmes: 1) Shaping your Leadership; to help new Managing Directors sharpen their focus and define how they will 'show-up' as one of HSBC's most senior leaders, 2) Shaping HSBC, which focuses on the experimentation required to enhance the leadership skills that will drive adaptability, innovation and unleash the talent of our people to enable HSBC to thrive in a time of disruption and complexity.

We continue to focus on the development of people managers who are key to shaping the experience of, and development of, our colleagues. We have recently refreshed our core People Manager Excellence curriculum which covers 40 skills structured around four modules that are available in face-to-face and virtual formats. The modules focus on: 1) Your Role; connecting managers with HSBCs purpose and personal energetic leadership, 2) Your People; creating energy, commitment and high performance within your team, 3) Your work; managing productivity and delivering against outcomes, and 4) Your Team; building high performing collaborative teams.

Complimentary digital learning pathways will also be made available to support the development contained within the four modules.

Transition to net zero

Part of the Group's ambition to be a net zero bank is to achieve net zero carbon emissions in our operations and supply chain by 2030.

The Group has three elements to the strategy: reduce, replace and remove. The Group plan to first focus on reducing carbon emissions from consumption, and then replacing remaining emissions with low-carbon alternatives in line with the Paris Agreement. The Group plan to remove the remaining emissions that cannot be reduced or replaced by procuring, in accordance with prevailing regulatory requirements, high-quality offsets at a later stage.

In October 2020, the Group announced an ambition to reduce its energy consumption by 50% by 2030, against a 2019 baseline. In 2022, HSBC Bank plc implemented energy efficiency measures and a strategic reduction of our office footprint, across our office spaces and data centres.

These measures include:

• Embedding 100% renewable energy in our Germany offices;

• Further installation of LED lighting and optimisation of lighting timing controls in France, Switzerland, Spain and Germany; and

• Improvements to heating, ventilation and air conditioning systems throughout the HSBC Bank plc office portfolio to reduce energy consumption and increase efficiency.

As part of the Group's ambition to achieve 100% renewable power across our operations by 2030, HSBC Bank plc continue to look for opportunities to procure green energy in each of our markets.

HSBC Bank plc is managing the gradual resumption of employee travel in line with the Group's aim to halve travel emissions by 2030 compared with pre-pandemic levels.

For further information on the transition to net zero, please see the ESG review in the Group's Annual Reports and Accounts for the year ended 31 December 2022.

Supporting our Customers

The Group understands that financial institutions have a critical role to play in achieving the transition to a net zero global economy. The most significant contribution we can make is by mobilising finance to support our portfolio of customers in their transition to decarbonise.

Since 2020, HSBC Bank plc has supported our customers' transition to net zero and helped build a sustainable future by providing and facilitating $86.2bn of sustainable finance, $18.9bn of sustainable investment and $0.1bn of sustainable infrastructure, as defined in the Group's Sustainable Finance Data Dictionary 2022.

This financing and investment contributes towards the Group's ambition to provide and facilitate $750bn to $1tn of sustainable financing and investment by 2030. The $86.2bn of sustainable finance includes lending facilities provided and capital markets facilitated transactions.

Given the Group's global presence and relationships with our customers across industries, the Group recognise the role it can play in catalysing the global transition to net zero. The Group is well positioned to finance the transition in developing and emerging economies, mobilising capital to help enable sustainable business models and an inclusive, just and resilient transition.

For example, in 2022, HBCE acted as a sustainability coordinator, book runner and mandated lead arranger for a $150m sustainability-linked revolving credit facility for company: Nordic Semiconductor. The technology company which specialises in designing ultra-low power performance wireless systems, incorporated for the first time, sustainability-linked key performance indicators and an ESG roadmap within its business to help achieve their sustainability targets by 2030.

The breakdown of the Group's sustainable finance and investment progress is included in its ESG Data pack. The detailed definitions of the contributing activities for sustainable finance are available in the Group's Sustainable Finance Data Dictionary 2022. For the Group's ESG Data Pack, Sustainable Finance Data Dictionary and PwC Assurance Report, see www.hsbc.com/who-we-are/esg-and-responsible-business/esg-reporting-centre.

Unlocking New Climate Solutions

The Group understands the need to find new solutions to increase the pace of change if the world is to achieve the Paris Agreement's goal of net zero by 2050. Therefore, the Group is working closely with a range of partners to accelerate investment in natural resources, technology and sustainable infrastructure to reduce emissions and help address climate change.

HSBC Group partnered with the World Resources Institute and World Wildlife Fund ('WWF') in 2020 to launch its $100m philanthropic programme, Climate Solutions Partnership, with the aim to accelerate support for innovative solutions tackling climate change. This five-year philanthropic initiative aims to identify and remove barriers to scale for climate change solutions. As part of this, in France, two projects are being delivered in partnership with the French National Forestry Office and the Earthworm Foundation. These projects aim to better enable CO2 capture, preserve biodiversity and engage the community, helping to support a net zero and sustainable future.

| Our Global Businesses |

The Group manages its products and services through its three global businesses: Global Banking and Markets ('GBM'); Commercial Banking ('CMB'); Wealth and Personal Banking ('WPB'); and the Corporate Centre (comprising: certain legacy assets, central stewardship costs, and interests in our associates and joint ventures).

| Business segments |

Our operating model has the following material segments: a GBM business which is further split into three reportable segments: MSS, GB and GBM Other (as defined below), CMB, WPB and a Corporate Centre. These segments are supported by Digital Business Services and eleven global functions, including Risk, Finance, Compliance, Legal, Marketing and Human Resources.

| Markets & Securities Services ('MSS') |

Global Banking ('GB') |

GBM Other |

Commercial Banking ('CMB') |

Wealth and Personal Banking ('WPB') |

| Markets & Securities Services is a products group that services customers of all Global Businesses and institutional clients across the financial sector globally. We offer clients a range of services and capabilities including trading, financing and securities services across asset classes and geographies, supported by dedicated sales and research teams. Our European teams play a key role in providing access to FX, commodities, Equities and Fixed Income offerings, bridging emerging and developed markets, and collaborating with other global businesses to provide clients across the Group with commoditised and bespoke solutions that seek to support their growth ambitions. |

Global Banking delivers tailored financial solutions to corporate and institutional clients worldwide opening up opportunities through the strength of our global network and capabilities. We provide a comprehensive suite of services including capital markets, advisory, lending, trade services and global payments services. |

GBM Other primarily comprises Principal Investments and GBM's share of the Group's Markets Treasury function. |

We have a clear strategy to be the leading international corporate bank in Europe. We help connect our European customers to our international network of relationship managers and product specialists; supporting their growth ambitions and targets. Our products are designed to support clients in their international growth and range from term loans to region-wide treasury and trade solutions. We see the greatest opportunity to deliver and grow value for the Group by supporting European clients with international subsidiaries in Asia and other regions; our internal performance measures are aligned to this outcome. Commercial Banking is at the centre of creating revenue synergies within the Group: we collaborate closely with our Global Banking and Markets colleagues to provide expertise in capital finance and advisory solutions to support our Commercial Banking clients. Our trade teams within Commercial Banking also provide import and export finance solutions to Global Banking and Markets clients. We also support our clients to unlock efficiencies in their Treasury structures through our Global Payments Solutions team. As the European economy pivots to a net zero carbon economy, we are expanding our services and products to provide customers with innovative sustainable finance solutions and ensuring our relationship managers are positioned to support our clients' transition to net zero. |

In Europe, Wealth and Personal Banking serves customers with their financial needs through a number of business areas including Retail Banking, Private Banking, Wealth Management, Insurance and Asset Management. |

| Adjusted profit/(loss) before tax by business segment |

||||

| £472m |

£486m |

£(329)m |

£785m |

£577m |

| (2021: £(8)m); (2020: £20m) |

(2021: £589m); (2020: £55m) |

(2021: £99m); (2020: £(52)m) |

(2021: £490m); (2020: £152m) |

(2021: £323m); (2020: £(132)m) |

Our global businesses are presented on an adjusted basis, which is consistent with the way in which we assess the performance of our global businesses.

| ESG Overview |

We conduct our business to support the sustained success of our customers, employees and other stakeholders.

| Our approach |

We are guided by the Group's purpose to open up a world of opportunity for our colleagues, customers and communities. Our purpose is underpinned by the Group's values: we value difference; we succeed together; we take responsibility; and we get it done. The Group's purpose and values help us to deliver our strategy and unlock long-term value for our stakeholders.

As an international bank with significant breadth and scale, we understand that our climate, economies, societies, supply chains and people's lives are interconnected.The Group recognise they can play an important role in tackling ESG challenges. The Group focuses its efforts on three areas: the transition to net zero, building inclusion and resilience, and acting responsibly.

Fair outcomes

We are focused on running a strong and sustainable business that puts the customer first, values good governance, and gives our stakeholders confidence in how we do what we do. Our conduct approach helps to guide us to do the right thing and to focus on the impact we have for our customers and the financial markets in which we operate. For further information on conduct, see page 6. For further details on our purpose-led conduct approach framework, see www.hsbc.com/who-we-are. Our section 172 statement, detailing our Directors' responsibility to stakeholders, can be found on page 12.

Our colleagues

We aspire to open up a world of opportunity for our colleagues and build an inspiring, dynamic culture where the best talent want to work.

We value difference and we continue to build an inclusive workforce that is representative of the communities we serve. We set and report on progress made against the Group-wide gender and ethnic diversity goals.

Understanding the experience of colleagues is central to our efforts. Through our employee Snapshot survey, we capture our colleagues' views on topics such as hybrid working and well-being. In 2022, over 8,000 colleagues responded to the survey across Europe, a participation rate of 54%. Developing the skills of colleagues is critical to energising our organisation. We foster a culture of learning through a range of resources that provide colleagues with a breadth of educational materials and development opportunities.

Our Climate ambition

The Group has set a climate ambition to become net zero in its operations and its supply chain by 2030, and align its financed emissions to the Paris Agreement goal of net zero by 2050. In 2022, the Group expanded coverage of sectors for on-balance sheet financed emissions targets, recognising the challenge of evolving methodologies and data limitations.

Transition to net zero represents one of the Group's four strategic pillars. At the core of it is an ambition to support our customers on their transition to net zero, so that the greenhouse gas emissions from our portfolio of clients reaches net zero by 2050. The summary of the Group's Transition to net zero disclosure can be found on page 47 of the HSBC Holdings plc ESG review 2022.

Engaging with our stakeholders |

Engaging with our stakeholders is core to being a responsible business. To determine material topics that our stakeholders are interested in, we conduct a number of activities throughout the year, including engagements outlined in the table below.

| Our stakeholders |

How we engage |

Material topics highlighted by the engagement |

| Customers |

Our customers' voices are heard through our interactions with them, surveys and by listening to their complaints |

Customer advocacy |

| Employees |

Our colleagues' voices are heard through our employee Snapshot survey, Exchange meetings, and our 'speak-up' channels, including our global whistleblowing platform, HSBC Confidential |

Employee training |

| Investors |

Our ordinary shares are held by our parent HSBC Holdings plc, however external parties invest in our bond issuance. We engage with these investors via our investor relations programme which enables investor queries alongside a broader programme of management meetings and market engagement |

Strategic progress ESG policies Risk management

|

| Communities |

We welcome dialogue with external stakeholders, including non-governmental organisations ('NGOs') and other civil societies groups. We engage directly on specific issues and by taking part in external forums and working groups |

Financial Inclusion and Community Investment |

| Regulators and governments |

We proactively engage with regulators and governments to facilitate strong relationships via virtual and in-person meetings, responses to consultations individually and jointly via the industry bodies |

Anti-bribery and Corruption |

| Suppliers |

Our ethical and environmental code of conduct for suppliers of goods and services sets out how we intend to engage with our suppliers on ethical and environmental performance |

Supply Chain Management Human Rights |

Supporting our stakeholders facing a rising cost of living

We know that many of our customers are facing increasing cost of living pressures from higher inflation, and we are committed to helping them. Colleagues across our global businesses have been contacting our customers to provide them with access to support.

| Our ESG metrics and targets |

The Group has established targets that guide how we do business, including how we operate and how we serve our customers. These include targets designed to help us achieve our environmental and social sustainability goals.

They also help us to improve employee advocacy, the diversity of senior leadership and strengthen our market conduct.

The targets for these measures are linked to the pillars of our ESG strategy: transitioning to net zero, building inclusion and resilience, and acting responsibly.

To help us achieve our ESG ambitions, a number of measures are included in the annual incentive scorecards of the Europe Chief Executive and Executive Committee members.

Below we set out how we have made progress against the ESG-related ambitions and targets.

Environmental - Transition to net zero

One of the Group's strategic pillars is to support the transition to a net zero global economy. The Group's ambition is to align its financed emissions to the Paris Agreement goal to achieve net zero by 2050. The Paris Agreement aims to limit the rise in global temperatures to well below 2°C, preferably to 1.5°C, above pre-industrial levels.

The transition to net zero is one of the biggest challenges for our generation. Success will require governments, customers and finance providers to work together. The Group's global footprint means that many of its clients operate in high-emitting sectors and regions that face the greatest challenge in reducing emissions. This means that the Group's transition will be challenging but is an opportunity to make an impact.

The Group recognises that to achieve its climate ambition it needs to be transparent on the opportunities, challenges, related risks and progress it makes. To deliver on the ambition requires enhanced processes and controls, and new sources of data. The Group continues to invest in climate resources and skills, and develop its business management process to integrate climate impacts. Until systems, processes, controls and governance are enhanced, certain aspects of the Group's reporting will rely on manual sourcing and categorisation of data. In 2023, the Group will continue to expand its disclosures. Reporting will need to evolve to keep pace with market developments.

At the end of 2022, HSBC Bank plc achieved 63% cumulative reduction in absolute operational greenhouse gas emissions compared to a 2019 baseline in France, Germany, Switzerland and Malta. HSBC Bank plc continues to work to support the Group's ambition to achieve net zero in its own operations and supply chain by 2030.

Since 2020, HSBC Bank plc has supported our customers' transition to net zero and helped build a sustainable future by providing and facilitating $86.2bn of sustainable finance, $18.9bn of sustainable investment and $0.1bn of sustainable infrastructure, as defined in the Group's Sustainable Finance Data Dictionary 2022. This financing and investment contributes towards the Group's ambition to provide and facilitate $750bn to $1tn of sustainable financing and investment by 2030. The $86.2bn of sustainable finance includes lending facilities provided and capital markets facilitated transactions.

We continue to engage with our clients on their transition plans and to provide them with financing solutions to support their sustainability goals.

For further information regarding the Group's environmental footprint, please visit https://www.hsbc.com/who-we-are/our-climate-strategy/becoming-a-net-zero-bank.

Social - Build inclusion and resilience

• Our Snapshot employee engagement1 score was 47% as at the end of 2022, an increase of 1% compared to 2021;

• Our ethnic diversity goal2 for 2022 was to increase black heritage colleagues in senior leadership roles in the UK to 2.2%. We exceeded this target and reached 2.4%; and

• In 2022, we reached 24.6% senior leadership3 roles held by women up from 23.8% in 2021.

Governance - Acting responsibly

96%4 of HSBC Bank plc staff completed conduct training in 2022, which covers Conduct and Regulatory Compliance topics including: market abuse, conflicts of interest and treating customers fairly.

1 Employee engagement index is our headline measure of how employees feel about HSBC. HSBC Bank plc's score is low compared to the Group, key contributors are ongoing transformation and the challenging external environment in Europe. However, we are seeing year on year improvements and will continue to embed a positive and inclusive culture where our colleagues can thrive.

2 Our 2022 ethnicity goal of 2.2% includes UK RFB and NRFB.

3 Senior leadership is classified as those at band 3 and above in the Group's global career band structure. Our 2022 gender diversity target of 26.4% is cascaded by Group and inclusive of our operations in Bermuda; we reached 25.1% by end of 2022 at the regional level. We missed our 2022 target, our focus on improving gender balance in senior leadership across Europe remains a priority for HSBC Bank plc executive committee for 2023.

4 The completion rate shown relates to the 2021/22 'Taking Responsibility' Compliance training module which is categorised as 'required' learning for Global employees. Unlike with mandatory training, a formal target is not established for 'required' learning modules and non-completion is performance managed.

| Responsible Business Culture |

We have the responsibility to protect our customers, our communities and the integrity of the financial system. In this section, we outline our requirements under the Non-Financial Reporting Directive.

Environmental matters

More information about the Group's assessment of climate risk can be found in the HSBC Holdings plc Annual Report and Accounts 2022.

Employee matters

We are opening up a world of opportunity for our colleagues through building an inclusive organisation that values difference, takes responsibility and seeks different perspectives for the overall benefit of our customers.

We promote an environment where our colleagues can expect to be treated with dignity and respect. We are an organisation that acts where we find behaviours that fall short. Our index measuring colleagues' confidence in speaking up is at 67% in 2022.

At times our colleagues may need to speak up about behaviours in the workplace. We encourage colleagues to speak to their line manager in the first instance, and our annual employee Snapshot survey showed 82% feel comfortable doing so. We recognise that at times people may not feel comfortable speaking up through the usual channels. HSBC Confidential is our global whistleblowing channel, allowing our colleagues past and present to raise concerns confidentially and, if preferred, anonymously (subject to local laws).

We aspire to be an organisation that is representative of the communities which we serve. To achieve this, we set goals that will build sustainable lasting change. We are focused on increasing women and black heritage colleagues in senior leadership roles and whilst we have made good progress, we know there is more to be done.

To support our ambition, we encourage our colleagues to self-identify their ethnicity data where legally permissible. At a European level, we are limited in our collection of ethnicity data and can only report in: UK, Channel Islands and the Isle of Man ('CIIOM'), and South Africa. However, we are continuing to drive open dialogue and action to strengthen our employee networks and improved our diversity data where possible.

Communities

The Group has a long-standing commitment to help support the communities in which it operates. Through charitable partnerships and volunteering opportunities, our people share their skills and create a positive impact on society. The Group's global reach is its unique strength and bringing together diverse people, ideas and perspectives, helps us open up opportunities and build a more inclusive world.

In 2022, HSBC Bank plc continued to work with our charity partners across Europe to promote employability and financial capabilities in disadvantaged communities, and respond to local needs:

- HBCE partnered with charities Cresus and Adie to deliver programmes that enhance financial capability and entrepreneurship amongst disadvantaged individuals in their respective communities.

- HBMT supported local disadvantaged young people through its charitable partnership with the Prince's Trust Foundation and the 'Prince's Trust International Achieve programme' to develop employable skills.

In 2022, HSBC Bank plc collectively donated £1.8m to charitable programmes and was further supported by our employees' contribution of 1,540 volunteer hours in various community activities and projects during work time.

Human rights

Our commitment to respecting human rights, principally as they apply to our employees, our suppliers and through our financial services lending, is set out in our Statement on Human Rights. This statement, along with our statements under the UK's Modern Slavery Act, is available on www.hsbc.com/who-we-are/esg-and-responsible-business/esg-reporting-centre.

Anti-corruption and anti-bribery

We are committed to high standards of ethical behaviour and operate a zero-tolerance approach to bribery and corruption. We consider such activity to be unethical and contrary to good corporate governance.

HSBC requires compliance with all applicable anti-bribery and corruption ('AB&C') laws in all markets and jurisdictions in which we operate. These include the UK Bribery Act and France's 'Sapin II' law. We have a global AB&C policy, which gives practical effect to these laws and regulations, but also requires compliance with the spirit of laws and regulations to demonstrate our commitment to ethical behaviours and conduct as part of our environmental, social and corporate governance.

The global AB&C policy sets out the key principles and minimum control requirements that enable HSBC to mitigate bribery and corruption risk. Mandatory AB&C training is provided to all staff, with additional targeted training tailored to the roles of individuals. HSBC carries out regular risk assessments, monitoring and testing of its AB&C programme and maintains clear whistleblowing policies and processes to ensure that individuals can confidentially report concerns.

Non-Financial Information Statement

Disclosures required pursuant to the Companies, Partnerships and Groups (Accounts and Non-Financial Reporting) Regulations 2016 can be found on the following pages:

| Environmental matters (including the impact of the company's business on the environment) |

Page 11 |

| The company's employees |

Pages 10 to 13 and 101 to 102 |

| Social matters |

Page 11 |

| Respect for human rights |

Page 12 |

| Anti-corruption and anti-bribery matters |

Page 12 |

| Business model |

Page 9 |

| Principal risks |

Page 24 |

HSBC creates value by providing products and services to meet our customers' needs. We aim to do so in a way that fits seamlessly into their lives. This helps us to build long-lasting relationships with our customers. HSBC maintains trust by striving to protect our customers' data and information, and delivering fair outcomes for them and if things go wrong, we need to address complaints in a timely manner.

Operating with high standards of conduct is central to our long-term success and underpins our ability to serve our customers. Our Conduct Framework guides activities to strengthen our business and increases our understanding of how the decisions we make affect customers and other stakeholders. Details on our Conduct Framework are available at www.hsbc.com/Conduct.

| Section 172 statement |

This section, from pages 12 to 13 forms our section 172 statement and addresses the requirements of the Companies (Miscellaneous Reporting) Regulations 2018. It describes how the Directors have performed their duty to promote the success of the bank, including how they have considered and engaged with stakeholders and, in particular, how they have taken account of the matters set out in section 172(1)(a) to (f) of the Companies Act 2006 (the 'Act').

The Board considered a range of factors when making decisions and is supported in the discharge of its responsibilities by:

a. an induction programme and ongoing training for Directors to provide an understanding of our business and financial performance and prospects;

b. management processes which help ensure that proposals presented to Board and committee meetings for decision include information relevant to determine the action that would most likely promote the success of the bank and involve engagement with stakeholders where relevant, to support appropriate decision making; and

c. agenda planning for Board and committee meetings to provide sufficient time for the consideration and discussion of key matters.

Stakeholder Engagement

The Board understands the importance of effective engagement with its stakeholders and is committed to open and constructive dialogue. Engagement with stakeholders takes place at the holding company level and at the operational level. On certain issues, the Board may engage directly with stakeholders. The outcomes from such stakeholder engagement feeds into Board discussions and decision making. This approach allows the Board to better understand the impact of the bank's actions on its stakeholders and respond to the challenges facing the bank. The relevance of each stakeholder group varies depending on the specific decision being taken by the Board. Not every decision the Board makes will necessarily result in a positive outcome for all stakeholders.

As a result of both its direct stakeholder interactions and the reporting and information on stakeholder engagement it receives about its six key stakeholders, namely customers, employees, shareholders and investors, regulators and governments, suppliers, and communities, the Board seeks to understand, and have regard to, the interests and priorities of these stakeholders.

The two examples provided below of principal discussions and decisions taken by the Board in 2022 show how the Directors and Board respectively discharged their individual and collective responsibility for promoting the long-term success of the bank and took different stakeholder considerations into account in reaching a decision or forming a view.

For further details regarding the role of the Board and the way in which it makes decisions, including key activities during 2022, please see page 95 to 96.

Customers

As one of Europe's largest banking and financial services organisations our corporate and institutional customers are at the core of the bank's business model: without customers there would be no bank. We have a clear vision to be the leading international wholesale bank in Europe, complemented by a targeted wealth and personal banking business. The Board strives to ensure it has a broad understanding of customers, their needs and challenges, and to give full consideration to these when its approval is sought on matters such as material acquisitions, disposals, investments, large scale change or transformation programmes.

Throughout 2022, geopolitical and economic uncertainty has given our customers additional challenges and senior management have engaged directly with customers to better understand their issues and difficulties and how the bank can respond to them. During this period, the Board has been provided with customer feedback and key performance indicators, such as net promoter scores, customer complaints, customer on-boarding times and satisfaction survey results. The Board schedule also included Commercial Banking, Wealth and Personal Banking, Global Banking and Markets deep dive strategy sessions which incorporated discussions on customer interactions, customer surveys, complaints feedback and product developments to meet customers' needs.

Employee (Workforce Engagement)

Employees are critical to the success of the bank, its sustainability and long-term future. Understanding employee sentiment and how we are addressing feedback is a key area of Board focus. During the year, the Board received regular updates from senior management on the progression of our people priorities covering various employee-focused initiatives across culture, leadership, talent, skills, inclusion, wellbeing and colleague experience. Further information on people priorities can be found under Employee at page 101-112.

Feedback from employees is gathered via various mechanisms including surveys, exchange meetings and 'speak up' channels and reported to the Board. The Board is presented bi-annually with a culture dashboard which has been developed to track progress in embedding a positive and inclusive culture across the business. Board focus on employees was heightened due to the ongoing transformation programme and the need for continuing consideration of the impact on employees when making Board decisions.

The Board remained committed to building active communication and feedback channels with employees across the region in 2022. During the year, three cohorts were specifically targeted given their importance to the bank's strategy and their role in building a robust leadership pipeline. These included: i) Executive Committee member's direct reports, ii) Subsidiary Board members, and iii) Flagship Talent programme including participants from Accelerating Female Leaders, Explore, and Accelerating into Leadership programmes. Further details of the bank's engagement with employees can be found on pages 10 to 11 and 101 to 102.

Shareholders and Investors

The bank is a wholly owned subsidiary of HSBC Holdings plc and, as such, the Board took into account the implications of its decisions with regard to its shareholder, HSBC Holdings plc, and its debt security investors. Examples of how it fulfilled this include:

• the Board Chair and Committee Chairs engaged with Group counterparts and attended Group forums and Group committee meetings, together with Executive Directors, to engage on common issues and strategic priorities;

• Board review and approval of HSBC Bank plc specific components of Group programmes; and

• Board consideration of the strength of the balance sheet to ensure that the ability to pay principal or interest on its debt securities was not at risk.

Regulators and Governments

During the year, Directors met regularly with regulators both in the UK and Europe. It is central to the success of the bank that it has constructive relationships with regulators and governments and that there is a mutual understanding on expectations and challenges given their impact on customers, the business model and the bank's strategy.

The Board receives regular updates on how HSBC interacts with regulators globally and at the European level. Understanding regulators' views and priorities in this way shapes and influences Board discussions and decision making.

Suppliers

Suppliers are critical to supporting the infrastructure and operations of the business and we work with suppliers to ensure mutually beneficial relationships. Examples of Board engagement with suppliers during 2022 include:

• the Chief Operating Officer's regular reports on third-party supplier matters covering key suppliers' operational resilience and how we work with suppliers to mitigate impact to our customers; and

• oversight of progress of implementing contractual changes with third party suppliers to adopt new Standard Contractual Clauses to meet 'Schrems II decision' data requirements.

Communities

The bank has legal, regulatory and social responsibilities to the communities in which it operates and the environment and is conscious of the need to manage the societal and environmental impact of its business when making decisions. During the year the Board received regular updates on matters spanning human rights and environmental and climate issues.

Principal Decisions

Set out below are some of the principal decisions made by the Board during 2022. In each case, in taking such decisions, the Directors exercised their statutory duties under section 172(1) (a)-(f) of the Companies Act 2006.

Liability Management Exercise - Tender Offer

A key regulatory responsibility of the Board is to periodically assess the bank's capital and liquidity position and associated risks in a structured way, while also considering management proposals in support of the bank's financial strength and capital efficiency.

Mindful of the bank's continued focus on balance sheet optimisation, and broader regulatory expectations, management undertook an exercise to review potential liability management actions relating to its issued debt securities.

The review resulted in a formal proposal being brought to the Board, recommending the bank make an invitation to holders of certain legacy debt securities to tender any and all of such debt securities for purchase by the bank for cash, subject to certain conditions being satisfied.

Prior to approval, the Board constructively challenged and engaged with senior management to consider the capital and liquidity impact on the bank's balance sheet. As part of its considerations, the Board took in to account the impact of the project on the bank's key stakeholders, in particular its investors in such instruments and its obligations to, and relationship with, its regulators. In considering stakeholders, the Board also considered its minimum requirements for own funds and eligible liabilities and how the legacy securities were treated from a regulatory capital perspective.

In reaching its decision, the Board acknowledged the rationale for the proposal in the context of seeking to further enhance efficiencies in the bank's capital structure. The Board also acknowledged the Bank of England's ('BoE') resolvability assessment of major UK banks, which welcomed action being taken, where it is appropriate and proportionate to do so, to reduce the stock of legacy capital securities issued from non-resolution entities to holders outside the group. Having taken all of these and other factors into account, and subject to market and economic conditions, the Board approved the proposed tender offer in respect of the chosen legacy securities, which was subsequently announced on 14 November 2022.

European Transformation - Malta Transfer

For a number of years, management have considered the most appropriate organisational structure within Continental Europe to help execute the bank's Europe transformation strategy. In addition to this review, management acknowledged the need for banking entities to comply with the requirement under the CRD V to establish an EU IPU structure by the end of 2023. The review included a formal proposal being brought to the Board in October 2022, recommending the sale of HSBC Europe BV's entire shareholding in HBMT to the group's EU IPU, HBCE.

Prior to approval, the Board reviewed and assessed options presented by management to achieve compliance with the CRD V requirements. The Board constructively engaged with management to consider the financial and regulatory implications and the likely consequence of the proposal on the bank's key stakeholders, as appropriate. Mindful of longer-term consequences of decisions and the impact on operations, as well as HBMT's local listing, the Board also carefully considered the approach to valuation and purchaser protections for the transaction.

In reaching its decision, the Board acknowledged the rationale for the recommendation in the context of regulatory expectations and that HBCE had also provided its in-principle approval for the recommendation. Having taken these factors into consideration, including an assessment of the financial merits and risks, investor and regulatory engagement, the Board agreed to proceed with the proposal, as subsequently completed on 30 November 2022.

| Tax |

Our approach to tax

We are committed to applying both the letter and the spirit of the law in all territories where we operate, and have adopted the UK Code of Practice for the Taxation of Banks. As a consequence, we seek to pay our fair share of tax in the countries in which we operate. We continue to strengthen our processes to help ensure our banking services are not associated with any arrangements known or suspected to facilitate tax evasion.

HSBC continues to apply global initiatives to improve tax transparency such as:

• the US Foreign Account Tax Compliance Act ('FATCA');

• the Organisation for Economic Co-operation and Development ('OECD') Standard for Automatic Exchange of Financial Account Information (also known as the Common Reporting Standard);

• the CRD IV Country by Country Reporting;

• the OECD Base Erosion and Profit Shifting ('BEPS') initiative; and

• the UK legislation on the corporate criminal offence ('CCO') of failing to prevent the facilitation of tax evasion.

We do not expect the BEPS or similar initiatives adopted by national governments to adversely impact our results.

| Key Performance Indicators |

The Board of Directors tracks the group's progress in implementing its strategy with a range of financial and non-financial measures or key performance indicators ('KPIs'). Progress is assessed by comparison with the group strategic priorities, operating plan targets and historical performance. The group reviews its KPIs regularly in light of its strategic objectives and may adopt new or refined measures to better align the KPIs to HSBC's strategy and strategic priorities.

| Financial KPIs |

|||

|

|

2022 |

2021 |

2020 |

| (Loss)/profit before tax (reported) (£m) |

(959) |

1,023 |

(1,614) |

| Profit/(loss) before tax (adjusted) (£m) |

1,724 |

1,577 |

(184) |

| Cost efficiency ratio (reported) (%) |

115.2 |

89.2 |

113.6 |

| Cost efficiency ratio (adjusted) (%) |

70.9 |

80.9 |

89.6 |

| Return on tangible equity (%) |

5.5 |

6.1 |

(2.7) |

| Common equity tier 1 capital ratio (%) |

16.8 |

17.8 |

15.1 |

Profit/(loss) before tax (reported/adjusted): Reported profit/(loss) before tax is the profit/(loss) as reported under IFRS. Adjusted profit/(loss) before tax adjusts the reported profit/(loss) for the effect of significant items as detailed on pages 18 to 19.