17 October 2025

TOWN CENTRE SECURITIES PLC

('TCS' or the 'Company')

Final results for the year ended 30 June 2025

A year of continued resilience

Town Centre Securities PLC, the Leeds, Manchester, Scotland, and London property investment, development, hotel and car parking company, today announces its audited final results for the year ended 30 June 2025.

Commenting on the results, Chairman and Chief Executive Edward Ziff, said:

"This was a year of continued resilience for Town Centre Securities, despite international geopolitical and domestic issues causing uncertainty in the UK economy. We have focused on our core operations, maintaining a cautious approach rooted in financial prudence, and positioning TCS for long-term value creation."

"Our property rental business, car park and hotel operations continue to deliver resilient underlying revenues and earnings in a challenging macro-economic environment. These conditions have led to outward movements in the underlying yields and a further small valuation reduction of our property portfolio. In the last year we have seen inflation reducing but still above the Bank of England's target of 2 percent, and alongside this the base rate has reduced; however, with our continued low levels of variable interest rate bank debt, I am confident that we are in a strong position in these uncertain times."

"Our attention is focused on both our core operations and on investing in our development programme over the coming years. However, we remain mindful that taking advantage of potentially accretive opportunities needs to be balanced against retaining robust finances."

"Overall, the business has been reset, with a more diverse portfolio of assets and historically low levels of variable rate borrowing."

Financial performance

· Net assets - resilient performance:

o Like for like portfolio valuation down 2.4% from June 2024:

o Statutory net assets of £112.3m or 266p per share (FY24: £117.4m, 279p). EPRA net tangible assets ('NTA') * measure at £109.9m or 261p per share (FY24 equivalent: £114.5m, 272p)

· Statutory results - reduced loss before tax :

o Statutory loss before tax of £3.4m (FY24: loss of £7.8m) and statutory loss per share of 8.2p (FY24: earnings of 17.5p), reflects impact of portfolio valuation reduction

· EPRA results:

o EPRA earnings before tax* of £3.0m (FY24: £3.9m)

o EPRA earnings per share before tax* of 7.0p (FY24: 8.6p)

o EPRA earnings* after tax of £1.8m (FY24: £6.3m)

o EPRA earnings per share* of 4.2p (FY24: 14.0p)

· Loan-to-Value ** increased to 53.1% (50.8%) following valuation reduction and the reassessment of lease liabilities arising from index-linked rent reviews:

o Total net borrowings of £139.9m (FY24: £137.2m) including £82.4m debenture

· Weighted average cost of borrowings at period end of 5.2%, 87.5% at fixed rates

· Shareholder returns:

o Proposed final dividend of 2.5p, making the total dividend for the year 5.0p (FY24: 8.5p, which reflected TCS leaving the REIT regime in the prior year).

* Alternative performance measures are detailed, defined and reconciled within Note 6 and the financial review section of this announcement

** LTV Calculation includes finance lease assets and liabilities

Protecting shareholder value whilst safeguarding the business for the future

Progress delivered under the four key strategic initiatives is as follows:

Actively managing our assets

Our long-standing strategy of active management and redevelopment, to drive income and capital growth, has continued:

· We have a well diversified portfolio comprising: 30% invested in retail and leisure; 29% offices; 14% car parks; 14% residential; 9% developments; and 4% hotels

· The portfolio is also very well focused, with 89% located in Leeds and Manchester

· The void rate across our portfolio decreased to 7.4% at 30 June 2025 (8.1% at 30 June 2024)

· Strong rent collection for the period of 99.2% (FY24: 99.2%)

· Roll out of our own car park management system across our car park portfolio completed

Maximising available capital

A conservative capital structure, with a mix of short-term and long-term secure financing, has always underpinned our approach:

· The final element of deferred consideration arising from the sale of our investment in YourParkingSpace Limited was received in July 2024 (£3.1m)

· Comfortable loan to value headroom over our bank facilities of £24.6m based on 30 June 2025 borrowings and valuations

Investing in our development pipeline

TCS's development pipeline, with an estimated GDV of over £400m, is a valuable and strategic point of difference, which we continue to progress and enhance. Notably, in the past six months at two of our largest sites with greatest potential:

· Merrion Centre: In June 2025, we received planning approval for student accommodation as part of the Merrion Centre's evolution. This approval incorporates a 1,039 new bed purpose built student accommodation scheme based on the redevelopment of Wade House and the adjacent 100MC site

· Whitehall Riverside: Following the securing of planning consent at Whitehall Riverside, a mixed-use scheme, in May 2023 (the formal decision notice was then issued in March 2024), we continue to move forward with both build contractors/professional teams and potential tenants for all phases of the development

Outlook - strong financial position to pursue attractive opportunities

· Focus on our core operations and bringing forward our developments

· Continue to explore opportunities both within traditional real estate in Leeds, Manchester and London and in complementary areas that can add value and further diversify risk.

· Resilient trading performance has continued into the first half of FY26:

o Rent collections remain robust with over 99% of amounts invoiced in the last quarter of the year now collected

o Car parks' recovery momentum continues

o Significant headroom of £24.6m on existing revolving credit facilities

o Weighted average cost of borrowings at period end of 5.2%, with 87.5% at fixed rates

· The Company's share price continues to trade at a significant discount to its NTA per share

-Ends-

For further information, please contact:

| Town Centre Securities PLC |

www.tcs-plc.co.uk / @TCS_PLC |

| Edward Ziff, Chairman and Chief Executive

|

0113 222 1234 |

| MHP |

|

| Reg Hoare / Matthew Taylor

|

+44 7827 662831 |

| Panmure Liberum |

|

| Jamie Richards / Satbir Kler

|

020 3100 2123 |

Chairman & Chief Executive's Statement

Overview

This has been a year of continued resilience for Town Centre Securities, despite international geopolitical issues causing uncertainty in the wider economy. We have focused on our core operations, maintaining a cautious approach rooted in financial prudence, and positioning the business for long-term value creation. I would like to thank all our colleagues for their ongoing dedication and contributions to the business.

Our property, car park and hotel operations delivered solid performance, with strong levels of occupancy and rent collection, and the completion of the rollout of our parking management system has enhanced efficiency. We did not make any acquisitions or disposals during the reporting period, although we took the decision to serve notice on a lease for one of our car parks in Watford. While some of our occupiers ceased trading during the period, we made some promising new lettings. An example is Dishoom, whose decision to open their first Leeds restaurant at Vicar Lane is a strong endorsement of the location's appeal and long-term potential.

At the end of the financial year, we were delighted to secure planning consent for a landmark student accommodation scheme at the Merrion Centre. The approved plans will transform the vacant 13-storey Wade

House and add a 37-storey tower on the adjacent 100MC site to provide 1,039 student bedrooms with top-tier amenities. By adding residential use for the first time, the scheme will further diversify the estate and cement the Merrion Centre's position as a vibrant, mixed-use destination. Our other key development site is Whitehall

Riverside, for which we received planning approval in 2024. Enabling ground works were completed in the year, and we are in advanced discussions with prospective occupiers for Z, our next-generation office development that is set to redefine workplace standards in Leeds.

Financial performance

◆ Our statutory loss in the year of £3.4m (2024: £7.8m loss) includes valuation losses and impairments in our property portfolio of £5.7m, with a like-for-like portfolio valuation down 2.4% from June 2024.

◆ Taking into account the other comprehensive losses in the year totalling £0.6m and £1.1m in dividends paid, net asset value per share was 266p, compared with 279p at 30 June 2024.

◆ Net borrowings, excluding lease liabilities, stood at £111.2m at 30 June 2025 (£108.6m at 30 June 2024).

◆ EPRA earnings per share are 4.2p for the year (2024: 14.0p) with the initial recognition and subsequent movement on deferred tax assets and liabilities accounting for 5.4p of earnings in the prior year. In the current year, taxation has reduced EPRA earning per share by 2.8p.

◆ 99% of all rent and service charge income invoiced in the year was collected.

◆ During the year the Company received the final receipt of £3m relating to the sale of its investment in YourParkingSpace. Since the July 2022 sale the Company has received total consideration of over £21m, crystallising a profit of £18.5m in the two-year period.

People

I was deeply saddened to hear of the deaths of former Directors of the Company Clive Lewis, John Nettleton, David Whitehead, and John Leadbeater. We honour them in a dedicated section of the Annual Report and I also want to express my personal gratitude for their invaluable contributions to the success of the business, as well as their sound advice and friendship.

Sustainability

Our commitment to sustainability remains strong, and we are pleased that 43% of our portfolio has an EPC rating of B or above.

Dividend

Following completion of requirements associated with our exit from the REIT regime in 2023, we have resumed a regular dividend cycle. An uncovered dividend of 2.5p per share will be paid on 8 January 2026 to shareholders registered on 19 December 2025. Along with the interim dividend of 2.5p paid on 12 June 2025, this brings the total dividend for the reporting period to 5.0p, amounting to £2.1m or 119% of EPRA earnings.

Capital allocation decisions will continue to be evaluated by the Board with the aim of enhancing long-term shareholder value. This includes considering alternative methods of returning capital to shareholders, beyond the regular payment of Ordinary Dividends, where appropriate.

Outlook

Looking ahead, we will maintain our focus on creating long-term value from our existing property portfolio and car parking business, taking a disciplined financial approach to decision making. We are exploring additional investment opportunities, both within traditional real estate and in complementary areas that can add value and further diversify our risk. Our well-balanced portfolio, strong balance sheet, experienced team, and long-term

perspective position us well to navigate ongoing economic uncertainty and deliver sustainable growth.

Portfolio review

The like-for-like value of our portfolio decreased by 2.4% (£4.2m) after capital expenditure of £4.2m and a £2.1m disposal in the year.

The valuation of all of our properties (except two) was carried out by CBRE.

| |

Passing rent |

ERV |

|

Value |

% of portfolio |

Valuation incr/(decr) |

|

Initial yield |

Reversionary yield |

|

|

£m |

£m |

|

£m |

|

|

|

|

|

| Retail & Leisure |

0.4 |

1.5 |

|

15.9 |

6% |

14.5% |

|

2.3% |

9.2% |

| Merrion Centre (ex offices) |

4.0 |

4.7 |

|

48.1 |

19% |

-7.1% |

|

7.9% |

9.2% |

| Offices |

4.9 |

6.5 |

|

73.7 |

29% |

0.7% |

|

6.3% |

8.3% |

| Hotels |

0.9 |

0.9 |

|

10.2 |

4% |

3.0% |

|

8.5% |

8.5% |

| Out of town retail |

1.1 |

1.3 |

|

13.1 |

5% |

4.6% |

|

7.6% |

9.7% |

| Residential |

1.7 |

1.9 |

|

34.5 |

14% |

6.7% |

|

4.6% |

5.1% |

| |

|

|

|

|

|

|

|

|

|

| |

13.0 |

16.8 |

|

195.5 |

77% |

1.0% |

|

6.3% |

8.1% |

|

|

|

|

|

|

|

|

|

|

|

| Development property |

|

|

|

22.6 |

9% |

-14.9% |

|

|

|

| Car parks |

|

|

|

36.1 |

14% |

-10.9% |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Portfolio |

|

|

|

254.1 |

100% |

-2.4% |

|

|

|

Note: includes our share of Merrion House within Offices (£27.5m - see note 8 of these financial statements) and car park goodwill of £1.7m (see note 13 of these financial statements) arising on individual car park assets but specifically excluding goodwill arising from car park operation acquisitions. None of the above is included in the table set out in note 7 of these financial statements.

Note: excludes IFRS 16 adjustments that relate to right-of-use car park assets (£20.9m) as the Directors do not believe it is appropriate to include in this analysis assets which have fewer than 50 years remaining on their lease and the Group does not have full control over these assets. These assets are included in the table set out in note 7 of these financial statements.

The table below reconciles the table above to that set out in note 7 of these financial statements:

| |

FY25 |

FY24 |

| |

£m |

|

| Portfolio - as per note 7 |

245.8 |

248.9 |

| 50% Share in Merrion House |

27.5 |

27.5 |

| Goodwill - Car Parks |

1.7 |

2.5 |

| Less - Right-to-Use Car Parks |

(20.9) |

(22.9) |

| As per the table above |

254.1 |

256.0 |

Sales and purchases

During the financial year ended 30 June 2025 we did not sell or purchase any new properties, however we did serve notice to terminate the lease on one of our right of- use car parks, which has resulted in the recognition of a profit on disposal of a leasehold property.

Our continued commitment to asset recycling is clear when opportunities arise. The table below details the £168.4m of disposals made since FY17, of which 71% were retail and leisure assets.

| |

Sales |

|

|

Purchases |

|

| |

£m |

% retail and leisure |

|

£m |

% retail and leisure |

| FY17 |

22.3 |

88% |

|

4.0 |

46% |

| FY18 |

10.1 |

95% |

|

9.0 |

0% |

| FY19 |

14 |

100% |

|

16.0 |

25% |

| FY20 |

2.5 |

100% |

|

1.7 |

100% |

| FY21 |

48 |

93% |

|

0.0 |

0% |

| FY22 |

37.9 |

59% |

|

7.0 |

100% |

| FY23 |

33.4 |

21% |

|

18.8 |

0% |

| FY24 |

0.2 |

0% |

|

1.5 |

0% |

| FY25 |

0 |

0% |

|

0.0 |

0% |

| |

|

|

|

|

|

| |

168.4 |

71% |

|

58.0 |

25% |

Retail and leisure

The retail and leisure market has recovered this year. We have seen this with valuation improvements on our retail and leisure assets outside of the Merrion Centre.

Renewed interest in our Vicar Lane property following the announcement around Dishoom coming to Leeds is a particular highlight. The wider Merrion Estate is proving resilient, however the internal retail mall is suffering both from existing and potential tenant demand.

As the online retail market grows, high street units are having to diversify their offering to become more than just shops; some are now incorporating experiences, entertainment and restaurants. This is a trend that we are looking to replicate throughout our portfolio.

Regional offices

The valuation of our office portfolio has now stabilised following a number of years of decline and in the year has grown by 0.7%. Whilst the office market continues to face significant macroeconomic pressures there have been signs of positivity throughout the year, with rental growth being achieved at each building within our office portfolio.

This is particularly true at Town Centre House where we have committed significant investment into our suites and communal areas, allowing us to achieve EPC A and assist us in our sustainability targets.

Office space in prime locations continues to be well sought after, and we are seeing more demand for flexible work-space to be offered as part of a wider building amenity, with those taking large space on traditional leases looking for flexible space within the building to scale up and down as necessary.

Residential

The residential market has continued to grow with our residential portfolio increasing by 6.7% in value during the year. Whilst the Manchester rental market has started to see softening demand there has still been annual growth of 2.4%, with our Manchester portfolio outperforming this due to its positioning within the market, allowing us to remain an attractive option to various parties. The removal of multiple dwellings relief on stamp duty had an effect on our portfolio last year however the market now appears to be rebalancing itself, with demand growing again.

Car parks

During the year, the Company's freehold and long leasehold car park assets fell in value by £4.4m, a drop of 10.9%.

Occupancy levels across the portfolio remain consistent, however increased operating costs and rental charges

negatively impacted the underlying values.

Developments

The value of the Company's development sites reduced by £3.7m or 14.9% in the year.

Property

Overview

Our long-term perspective has remained a mainstay of our approach as international geopolitical factors have caused economic uncertainty, and, as such, the reporting period was not one of significant change to the portfolio. We remain in a strong financial position and continue to take a long-term approach to our portfolio.

In the main, our assets remain well let, with the exception of some voids and spaces held for redevelopment in Leeds. We did not make any acquisitions or disposals during the year, although we will continue to evaluate opportunities on a case-by-case basis to ensure alignment with our investment criteria and priorities. Excluding

the impact of business failure, where three of our tenants went into administration in the year, rent collection has remained robust.

We have continued to progress our development sites, while monitoring economic conditions and market sentiment to inform decisions.

Performance by segment

Our office locations have seen high occupancy. In line with our asset management strategy to invest in high quality space, the refurbishment of Town Centre House has gone well, with offices on the ground and fourth floors let, and a tenant on another floor looking to expand.

Across the wider sector, we have continued to see larger corporate occupiers seeking quality spaces with strong sustainability credentials as they encourage a return to office working. Demand for office space continues to be affected by people working from home, however, despite an increase in employers mandating office-based work. There is a great deal of secondary office stock to be absorbed before significant new build office development is likely, particularly in a challenging funding environment with interest rates remaining high, despite the recent reductions in the Bank of England base rate.

There have been winners and losers in the leisure sector, with several of our units affected during the year by restaurant closures. Our team has been busy working on what could replace them, and it is encouraging to see strong interest from prospective occupiers. We have made some high-quality lettings during the period. An example is Dishoom, who have chosen to locate their first Leeds restaurant on Vicar Lane and will occupy 8,000 square feet over two floors of the Coronation Buildings. A high-profile operator like Dishoom coming to Leeds is generating interest from other restaurant operators looking for a presence in the city. We are continuing to explore options for reinventing the vacant nightclub space at the Merrion Centre.

Our residential assets have continued to perform well across our locations. In Glasgow, we completed the refurbishment of Bath Street during the period and have let the apartments at strong rents. Our properties in Manchester and Leeds have also seen high occupancy and increasing rents.

Our Ibis Styles hotel has also enjoyed high occupancy throughout the year, with the UKREiiF (Real Estate Investment and Infrastructure Forum) in May an example of the types of events and conferences attracting high numbers of delegates to Leeds.

Development pipeline

At the end of the reporting period, we were pleased to receive planning approval from Leeds City Council for a flagship student accommodation scheme at the Merrion Centre. The plans will deliver 1,039 high quality student bedrooms with premium amenities by repurposing the vacant 13-storey Wade House and introducing a striking 37-storey building on the adjacent 100MC site. Adding residential use for the first time marks a significant milestone in the Merrion Centre's 61-year history and supports our vision to diversify the estate.

Having received planning permission for our prime Whitehall Riverside site in 2024, we completed groundwork during the year. We recently unveiled details of Z, which will create best-in-class, smart, energy-efficient office spaces as a core element of the wider masterplan that also includes a multistorey car park and are in discussions with potential occupiers.

Outlook

As we work to optimise returns from our portfolio and advance our development pipeline, diverse external factors will continue to present opportunities as well as challenges. Our expertise in multiple sectors, financial strength and long-term perspective make us well placed to capitalise on opportunities as they arise, as well as ride out periods of uncertainty in specific parts of the market, and we look forward with confidence.

CitiPark

Overview

The past year has been a period of consolidation for CitiPark, with a focus on organic growth of our existing portfolio, while we have maintained a cautious approach to exploring opportunities for growth. Revenues for the year were £14.0m (2024: £13.4m).

Performance

Utilisation of our branches has continued to be influenced by structural factors including fewer working days in the office, as well as local policies to encourage changes in travel patterns, such as traffic management schemes to alter traffic flows.

We have maintained our efforts to offset the effects of such challenges by offering different propositions and promotions to local businesses as we work to develop and strengthen relationships.

After taking on management of three branches in the previous reporting period, we have not entered additional car park management agreements this year. We have focused on operating existing locations and generating learnings to support the evaluation of future branches.

As part of our ongoing efforts to optimize our operations, we took the decision to serve notice on a lease for one of our car parks in Watford and will exit this site in December 2025.

Technology and innovation

Our parking management system has now been deployed across all our branches - owned and managed - and has been very well received. Our software and the associated hardware have greatly improved the customer experience, supported revenue generation and also created synergies with our enforcement business. We continue to drive improvements and to benefit from cost efficiencies from operating our own platform.

Our investment in EV charging infrastructure has focused on renewals and upgrades. Decisions on expansion of charging points are informed by our data and insights on utilisation as well as customer feedback. Although the number of charging points on our own branches has remained stable, we have increased the number of chargers

under our management, adding 29 chargers at the Plateworks in Leeds after we were approached to manage this new location.

Outlook

With a solid, well-invested business across our branches, parking management system and ancillary services, we retain a positive view of CitiPark's prospects. We will continue to apply our rigorous approach to evaluating

opportunities for growth and innovation, applying our deep sector expertise as well as data from our operations to guide decision making.

Financial Review

The financial performance of the Company during the year ended 30 June 2025 shows underlying EPRA earnings after tax of £1.8m (before taxation £3.0m - compared to before tax in FY24 of £3.9m).

The statutory profit of the year is again affected by both reductions in investment property values and

impairments to the Group car parking portfolio, as real estate investor and market sentiment across these segments remain subdued.

The statutory loss for the year was £3.4m, compared to a loss of £7.8m in the previous year.

EPRA Earnings* were a profit of £1.8m in the year, compared to a profit of £6.3m in the prior year. The EPRA profit for the prior year included a net taxation credit of £2.4m, whereas the current year includes a £1.2m expense; excluding the effect of taxation the EPRA profit of the Company would have been £3.0m, representing a 23% reduction in the underlying performance of the Company.

The Board is recommending the payment of a final dividend for the year of 2.5p, giving a full-year dividend of 5.0p, which is 41% lower than the previous year. The previous year's full-year dividend of 8.5p included an interim

dividend paid out as a property income distribution following the Company's exit from the REIT regime in July 2023.

During the year the Company received the final element of deferred consideration from the sale of its investment in YourParkingSpace Ltd ('YPS'), generating further proceeds of £3.1m. These amounts were retained by the Company to fund its working capital requirements.

Net borrowings have increased from £108.6m to £111.2m in the year. Net borrowings represent total financial

borrowings of £134.8m plus overdrafts of £1.1m, less lease liabilities of £24.7m.

Restatement of prior figures

Prior year comparatives have been restated to reflect the impact of index-linked rent reviews on the application of IFRS 16 to right-of-use assets and lease liabilities, full details of which are set out in note 14 of the financial statements.

| £000s |

|

FY25 |

|

FY24 |

|

YOY |

|

|

|

|

|

|

|

|

| Gross Revenue |

|

32,692 |

|

31,968 |

|

2.3% |

| Impairment of debtors provision movement |

|

0 |

|

0 |

|

- |

| Property Expenses |

|

(17,826) |

|

(15,604) |

|

14.2% |

|

|

|

|

|

|

|

|

| Net Revenue |

|

14,866 |

|

16,364 |

|

(9.2%) |

|

|

|

|

|

|

|

|

| Other Income / JV Profit |

|

2,994 |

|

1,990 |

|

50.5% |

| Other Expenses |

|

0 |

|

0 |

|

- |

| Administrative Expenses |

|

(7,512) |

|

(7,293) |

|

3.0% |

|

|

|

|

|

|

|

|

| Operating Profit |

|

10,348 |

|

11,061 |

|

(6.4%) |

|

|

|

|

|

|

|

|

| Net Finance Costs |

|

(7,405) |

|

(7,182) |

|

3.1% |

| Taxation |

|

(1,165) |

|

2,416 |

|

- |

|

|

|

|

|

|

|

|

| EPRA Earnings |

|

1,778 |

|

6,295 |

|

(71.8%) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Segmental |

|

FY25 |

|

FY24 |

|

YOY |

|

|

|

|

|

|

|

|

| Property |

|

|

|

|

|

|

| Net Revenue |

|

8,777 |

|

9,886 |

|

(11.2%) |

| Operating Profit |

|

5,987 |

|

6,264 |

|

(4.4%) |

|

|

|

|

|

|

|

|

| CitiPark |

|

|

|

|

|

|

| Net Revenue |

|

5,534 |

|

5,840 |

|

(5.2%) |

| Operating Profit |

|

3,763 |

|

4,118 |

|

(8.6%) |

|

|

|

|

|

|

|

|

| ibis Styles Hotel |

|

|

|

|

|

|

| Gross Revenue |

|

555 |

|

638 |

|

(13.0%) |

| Operating Profit |

|

555 |

|

638 |

|

(13.0%) |

|

|

|

|

|

|

|

|

| Investments |

|

|

|

|

|

|

| Other income and operating profit |

|

43 |

|

41 |

|

4.9% |

STATUTORY PROFIT

On a statutory basis the reported loss for the year was £3.4m.

The statutory profit reflects the EPRA Earnings* of £1.8m less £5.7m of non-cash valuation and impairment movements, plus the profit on disposal recognised of £1.7m on one car park right-of-use asset properties and investments sold in the year, less £1.2m of deferred taxation on valuation movements in the year.

Gross revenue

Gross revenue was up £0.7m or 2.3% year-on- year, with key drivers being:

• Gross property revenue during the year was £0.1m ahead of the previous period with no investment property sales or acquisitions in the year.

• CitiPark revenues have continued to grow in the year, with gross revenue across the portfolio increasing by 4.6% from £13.4m to £14.0m.

• Income for the Ibis Styles hotel has been consistent with last year at £3.3m.

Property expenses

Property expenses have increased by 14.2% year-on-year with increases to both direct investment property costs (irrecoverable service charge, vacant unit and significant repair costs all contributing to an increase of £1.1m) and car park operating expenses (£0.8m of rates rebates were received in the prior year which have resulted in a year-on-year increase).

Other/JV income

Total Other/JV income was up 50.5% or £1.0m year-on-year, with increased dilapidation and surrender premia received during the year.

Administrative expenses

Administrative costs were £0.2m or 3.0% higher year-on-year, reflecting inflationary increases to most cost headings.

Finance costs

Finance costs were 3.1% or £0.2m higher year-on-year as a result of the increase in the Company's bank borrowings which were primarily used to fund the Company's buyback of shares in November 2023.

| £m |

FY25 |

|

FY24 |

|

vs FY24 |

|

|

|

|

|

|

|

| Freehold and Right to Use Investment Properties |

160.5 |

|

156.5 |

|

2.6% |

| Development Properties |

22.6 |

|

24.5 |

|

(7.8%) |

| Car Park related Assets, Goodwill and Investments |

54.9 |

|

64.1 |

|

(14.4%) |

| Hotel Operations |

10.2 |

|

9.9 |

|

3.0% |

|

|

248.2 |

|

255.0 |

|

(2.7%) |

|

|

|

|

|

|

|

| Joint Ventures |

5.6 |

|

4.8 |

|

16.7% |

| Listed Investments |

2.6 |

|

3.3 |

|

(21.2%) |

| Other Non-Current Assets |

2.2 |

|

2.0 |

|

10.0% |

|

|

|

|

|

|

|

| Total Non-Current Assets |

258.6 |

|

265.1 |

|

(2.5%) |

|

|

|

|

|

|

|

| Net Borrowings |

(139.9) |

|

(141.4) |

|

(1.1%) |

| Deferred tax |

1.0 |

|

3.1 |

|

- |

| Other Assets/(Liabilities) |

(7.4) |

|

(9.4) |

|

(21.3%) |

|

|

|

|

|

|

|

| Statutory NAV |

112.3 |

|

117.4 |

|

(4.3%) |

|

|

|

|

|

|

|

| Statutory NAV per Share |

266p |

|

279p |

|

(4.4%) |

|

|

|

|

|

|

|

| EPRA Net Tangible Assets (NTA) |

109.9 |

|

114.5 |

|

(4.0%) |

|

|

|

|

|

|

|

| EPRA NTA per Share |

261p |

|

272p |

|

(4.0%) |

Non-current assets

Our total non-current assets (including investments in JVs) of £258.6m (2024:

£265.1m) have reduced by £6.5m during the year. This movement is made up of the following:

• Disposals, including YPS receipts of £(5.3m)

• Depreciation charge of £(2.3m)

• Capital expenditure of £5.4m

• Revaluation uplift/reversal of impairments totalling £(6.5m)

• IFRS 16 lease reassessments of £1.4m

• Operating profits generated and retained in JV entities and other movements of £0.8m

Borrowings

During the year our net borrowings have reduced by £1.5m, from £141.4m as at 30 June 2024 to £139.9m at the year-end. This reduction was primarily due to serving notice on a right-of-use car park asset, which has reduced lease liabilities by £2.1m in the year.

We have recently extended our existing Lloyds revolving credit facility by one year; it is now due to expire in June 2027. There remains the option to extend again by a further year, which we can opt for in October 2026. It is our intention to apply for this at that time; clearly it is subject to bank consent.

We have extended our NatWest revolving credit facility by a further 15 months during the year; it is now due to expire in December 2026. Our Handlesbanken credit facility expires in June 2026. We will be looking to renew both of these facilities in the coming months; clearly both will be subject to bank consent.

Loan-to-value has been increased to 53.1%, up from 50.8% a year ago, primarily due to the decrease in property values during the year. Note the calculation of loan-to-value includes both the finance lease assets and liabilities.

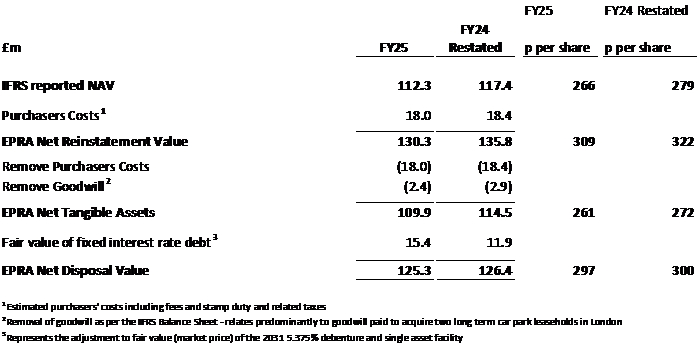

EPRA net asset reporting

We focus primarily on the measure of Net Tangible Assets ('NTA'). The below table reconciles IFRS net assets to NTA, and the other EPRA measures.

There are three EPRA Net Asset Valuation metrics, namely EPRA Net Reinstatement Value ('NRV'), EPRA Net Tangible Assets ('NTA') and EPRA Net Disposal Value ('NDV'). The EPRA NRV scenario aims to represent the value required to rebuild the entity and assumes that no selling of assets takes place. The EPRA NTA is focused

on reflecting a company's tangible assets. EPRA NDV aims to represent the Shareholders' value under an orderly sale of business, where, for example, financial instruments are calculated to the full extent of their liability. All three NAV metrics share the same starting point, namely IFRS Equity attributable to shareholders.

Future financial considerations

Future P&L pressure

The wider economy and underlying property values are still struggling, with uncertainty around office-based working and shopping habits continuing.

In terms of our own specific business, once you exclude the impact of valuation movements and one-off items (for example significant current year roof repairs and rates rebates in the prior period) we have seen recoveries in all segments. However, factoring in the above one-off items, underlying earnings of the business have reduced in the year. During the year we have resumed a more normal dividend cycle of an interim dividend of 2.5p per share and a proposed final dividend of 2.5p.

Future balance sheet

As identified in the Risk Report, we have highlighted the continued pressure on retail and office investments to be a significant risk to the business. As part of the going concern and viability statement review process, the Company has prepared consolidated forecasts and identified a number of mitigating factors to ensure that

the ongoing viability of the business is not threatened.

Going concern and headroom

One of the most critical judgements for the Board is the headroom in the Group's debt facilities. This is calculated as the maximum amount that could be borrowed, taking into account the properties secured to the

funders and the facilities in place.

The total headroom at 30 June 2025 was £24.6m (2024: £20.4m), which was considered to be sufficient to support our going concern conclusion. The properties secured under the Group's debt facilities would need to fall 25.8% in value before this headroom number was breached.

In assessing both the viability and going concern status of the Company, the Board reviewed detailed projections including various different scenarios. A summary of the approach and the findings is set out in the Risk Report, forming part of the Strategic Report of the Annual Report

Total shareholder return and total property return

Total shareholder return of 3.3% (2024:minus 14.7%) was calculated as the total of dividends paid during the financial year of2.5p (2024: 8.5p) and the movement in the share price between 30 June 2024 (133.5p)and 30 June 2025 (135.5p), assuming reinvestment of dividends. This compares with the FTSE All Share REIT Index at 1.3% (2024: 18.2%) for the same period. The Company's share price continues to trade at a significant discount to its NAV, impacting total shareholder return.

Total Shareholder returns % (CAGR)

| Total Shareholder returns |

1 Year |

10 Years |

20 Years |

| Town Centre Securities |

3.3% |

(3.6%) |

(0.5%) |

| FTSE All Share REIT Index |

1.3% |

0.2% |

2.7% |

Total property return is calculated as the net operating profit and gains/losses from property sales and valuations as a percentage of the opening investment properties. Total property return for the business for the reported 12 months was 6.2% (2024: 1.5%).

Consolidated income statement

for the year ended 30 June 2025

| |

|

2025 |

2024 Restated |

| |

Notes |

£000 |

£000 |

| Gross revenue (excluding service charge income) |

1 |

29,757 |

28,983 |

| Service charge income |

1 |

2,935 |

2,985 |

| Gross revenue |

1 |

32,692 |

31,968 |

| Service charge expenses |

1 |

(4,310) |

(3,982) |

| Property expenses |

1 |

(13,516) |

(11,622) |

| Net revenue |

|

14,866 |

16,364 |

| Administrative expenses |

2 |

(7,512) |

(7,293) |

| Other income |

3 |

1,937 |

965 |

| Valuation movement on investment properties |

7 |

(2,214) |

(7,625) |

| Impairment of car parking assets |

7 |

(2,697) |

(3,878) |

| Impairment of goodwill |

|

(772) |

(577) |

| Loss on disposal of investments |

|

(87) |

(191) |

| Valuation movement on investments |

|

- |

408 |

| Profit on disposal of investment properties |

|

- |

27 |

| Profit on disposal of freehold and leasehold properties |

7(B) |

1,762 |

- |

| Share of post-tax profits/(losses) from joint ventures |

8 |

1,057 |

(2,175) |

| Operating profit/(loss) |

|

6,340 |

(3,975) |

| Finance costs |

|

(7,423) |

(7,348) |

| Finance income |

|

18 |

166 |

| Loss before taxation |

|

(1,065) |

(11,157) |

| Taxation |

4 |

(2,381) |

3,319 |

| Loss for the year attributable to owners of the Parent |

|

(3,446) |

(7,838) |

| Earnings per share |

|

|

|

| Basic and diluted |

6 |

(8.2p) |

(17.5p) |

| EPRA (non-GAAP measure) |

6 |

4.2p |

14.0p |

| Dividends per share |

|

|

|

| Paid during the year |

5 |

2.5p |

11.0p |

| Proposed |

5 |

2.5p |

- |

Consolidated statement of comprehensive income

for the year ended 30 June 2025

| |

|

2025 |

2024 Restated |

| |

|

£000 |

£000 |

| Loss for the year |

|

(3,446) |

(7,838) |

| Items that will not be subsequently reclassified to profit or loss |

|

|

|

| Revaluation (losses)/gains on car parking assets |

7 |

(656) |

994 |

| Revaluation gains on hotel assets |

7 |

542 |

642 |

| Revaluation losses on other investments |

|

(706) |

(763) |

| Deferred tax on freehold car park valuation losses/(gains) |

|

178 |

(236) |

| Total other comprehensive (loss)/income |

|

(642) |

637 |

| Total comprehensive loss for the year |

|

(4,088) |

(7,201) |

|

|

|||

Consolidated balance sheet

as at 30 June 2025

| |

|

2025 |

2024 Restated |

2023 Restated |

|

| |

Notes |

£000 |

£000 |

£000 |

|

| Non-current assets |

|

|

|

|

|

| Property rental |

|

|

|

|

|

| Investment properties |

7 |

183,092 |

180,977 |

183,801 |

|

| Investments in joint ventures |

8 |

5,636 |

4,752 |

7,123 |

|

|

|

|

188,728 |

185,729 |

190,924 |

|

| Car park activities |

|

|

|

|

|

| Freehold and leasehold properties |

7 |

52,470 |

58,003 |

61,834 |

|

| Goodwill and intangible assets |

|

2,430 |

2,892 |

3,674 |

|

|

|

|

54,900 |

60,895 |

65,508 |

|

| Hotel operations |

|

|

|

|

|

| Freehold properties |

7 |

10,200 |

9,900 |

9,500 |

|

| |

|

10,200 |

9,900 |

9,500 |

|

| Fixtures, equipment and motor vehicles |

7 |

1,613 |

1,446 |

1,269 |

|

| Investments |

9 |

3,259 |

3,965 |

7,503 |

|

| Deferred tax assets |

10 |

939 |

3,083 |

- |

|

| Total non-current assets |

|

259,639 |

265,018 |

274,704 |

|

| Current assets |

|

|

|

|

|

| Trade and other receivables |

|

3,802 |

3,996 |

3,264 |

|

| Cash and cash equivalents |

|

17,990 |

22,152 |

23,320 |

|

| Investments |

9 |

- |

3,177 |

6,436 |

|

| Total current assets |

|

21,792 |

29,325 |

33,020 |

|

| Total assets |

|

281,431 |

294,343 |

307,724 |

|

| Current liabilities |

|

|

|

|

|

| Trade and other payables |

|

(11,229) |

(13,425) |

(12,387) |

|

| Bank overdrafts |

|

(18,375) |

(20,760) |

(21,700) |

|

| Borrowings and lease liabilities |

|

(12,620) |

(1,768) |

(4,665) |

|

| Total current liabilities |

|

(42,224) |

(35,953) |

(38,752) |

|

| Non-current liabilities |

|

|

|

|

|

| Borrowings and lease liabilities |

|

(126,905) |

(140,946) |

(130,249) |

|

| Total non-current liabilities |

|

(126,905) |

(140,946) |

(130,249) |

|

| Total liabilities |

|

(169,129) |

(176,899) |

(169,001) |

|

| Net assets |

|

112,302 |

117,444 |

138,723 |

|

| Equity attributable to the owners of the Parent |

|

|

|

|

|

| Called up share capital |

11 |

10,540 |

10,540 |

12,113 |

|

| Share premium account |

|

200 |

200 |

200 |

|

| Capital redemption reserve |

|

3,309 |

3,309 |

1,736 |

|

| Revaluation reserve |

|

4,248 |

4,184 |

2,784 |

|

| Retained earnings |

|

94,005 |

99,211 |

121,890 |

|

| Total equity |

|

112,302 |

117,444 |

138,723 |

|

| Net asset value per share |

13 |

266p |

279p |

286p |

|

Consolidated statement of Changes in Equity

for the year ended 30 June 2025

| |

Called up share capital |

Share premium account |

Capital redemption reserve |

Revaluation reserve |

Retained earnings |

Total equity |

| |

£000 |

£000 |

£000 |

£000 |

£000 |

£000 |

| Balance at 30 June 2023 |

12,113 |

200 |

1,736 |

2,784 |

121,890 |

138,723 |

| Comprehensive income for the year |

|

|

|

|

|

|

| Loss for the year |

- |

- |

- |

- |

(7,838) |

(7,838) |

| Other comprehensive income |

- |

- |

- |

1,400 |

(763) |

637 |

| Total comprehensive loss for the year |

- |

- |

- |

1,400 |

(8,601) |

(7,201) |

| Contributions by and distributions to owners |

|

|

|

|

|

|

| Arising on purchase and cancellation of own shares |

(1,573) |

- |

1,573 |

- |

(9,440) |

(9,440) |

| Final dividend relating to the year ended 30 June 2023 |

- |

- |

- |

- |

(1,054) |

(1,054) |

| Interim dividend relating to the year ended 30 June 2024 |

- |

- |

- |

- |

(3,584) |

(3,584) |

| Balance at 30 June 2024 |

10,540 |

200 |

3,309 |

4,184 |

99,211 |

117,444 |

| Comprehensive income for the year |

|

|

|

|

|

|

| Loss for the year |

- |

- |

- |

- |

(3,446) |

(3,446) |

| Other comprehensive income |

- |

- |

- |

64 |

(706) |

(642) |

| Total comprehensive loss for the year |

- |

- |

- |

64 |

(4,152) |

(4,088) |

| Contributions by and distributions to owners |

|

|

|

|

|

|

| Interim dividend relating to the year ended 30 June 2025 |

- |

- |

- |

- |

(1,054) |

(1,054) |

| Balance at 30 June 2025 |

10,540 |

200 |

3,309 |

4,248 |

94,005 |

112,302 |

Consolidated cash flow statement

for the year ended 30 June 2025

| |

|

2025 |

|

2024

|

||

| |

Notes |

£000 |

£000 |

|

£000 |

£000 |

| Cash flows from operating activities |

|

|

|

|

|

|

| Cash generated from operations |

12 |

9,471 |

|

|

12,594 |

|

| Interest received |

|

18 |

|

|

8 |

|

| Interest paid |

|

(6,186) |

|

|

(6,001) |

|

| Corporation tax paid |

4 |

(59) |

|

|

- |

|

| Net cash generated from operating activities |

|

|

3,244 |

|

|

6,601 |

| Cash flows from investing activities |

|

|

|

|

|

|

| Purchase and construction of investment properties |

7 |

- |

|

|

(1,544) |

|

| Refurbishment of investment, freehold and leasehold properties |

7 |

(4,183) |

|

|

(2,481) |

|

| Purchases of fixtures, equipment and motor vehicles |

7(D) |

(645) |

|

|

(525) |

|

| Proceeds from sale of investment properties |

|

- |

|

|

187 |

|

| Proceeds from sale of investments |

9 |

3,095 |

|

|

6,658 |

|

| Proceeds from sale of fixtures, equipment and motor vehicles |

7(D) |

131 |

|

|

- |

|

| Distributions received from joint ventures |

8 |

173 |

|

|

196 |

|

| Purchase of investments |

|

- |

|

|

(250) |

|

| Purchase of subsidiary, net of cash acquired |

|

(496) |

|

|

- |

|

| Net cash (used in)/generated from investing activities |

|

|

(1,925) |

|

|

2,241 |

| Cash flows from financing activities |

|

|

|

|

|

|

| Proceeds from non-current borrowings |

|

- |

|

|

9,750 |

|

| Repayment of non-current borrowings |

|

(100) |

|

|

(3,087) |

|

| Arrangement fees paid |

|

(163) |

|

|

(419) |

|

| Principal element of lease payments |

|

(1,780) |

|

|

(1,665) |

|

| Dividends paid to Shareholders |

5 |

(1,054) |

|

|

(4,209) |

|

| Purchase of own shares |

|

- |

|

|

(9,440) |

|

| Net cash used in financing activities |

|

|

(3,097) |

|

|

(9,070) |

| Net (decrease)/increase in cash and cash equivalents |

|

|

(1,778) |

|

|

(228) |

| Cash and cash equivalents at beginning of the year |

|

|

1,392 |

|

|

1,620 |

| Cash and cash equivalents at end of the year |

|

|

(386) |

|

|

1,392 |

|

|

|

|

|

|

|

|

| Cash and cash equivalents at the year end are comprised of the following: |

|

|

|

|||

|

|

|

|

|

|

|

|

| Cash balances |

|

|

17,989 |

|

|

22,152 |

| Overdrawn balances |

|

|

(18,375) |

|

|

(20,760) |

| |

|

|

(386) |

|

|

1,392 |

| |

|

|

|

|||

The Consolidated Cash Flow Statement should be read in conjunction with Note 12.

Audited preliminary results announcements

The financial information for the year ended 30 June 2025 and the year ended 30 June 2024 does not constitute the company's statutory accounts for those years.

Statutory accounts for the year ended 30 June 2024 have been delivered to the Registrar of Companies.

The statutory accounts for the year ended 30 June 2025 will be delivered to the Registrar of Companies following the Company's Annual General Meeting.

The auditors' reports on the accounts for 30 June 2025 and 30 June 2024 were unqualified, did not draw attention to any matters by way of emphasis, and did not contain a statement under 498(2) or 498(3) of the Companies Act 2006.

1. Segmental information

The chief operating decision-maker has been identified as the Board. The Board reviews the Group's internal reporting in order to assess performance and allocate resources. Management has determined the Group's operating segments based on these reports.

| (A) Segmental assets

|

2025 |

2024 Restated |

| |

£000 |

£000 |

| Property rental |

211,688 |

215,062 |

| Car park activities |

56,284 |

62,239 |

| Hotel operations |

10,200 |

9,900 |

| Investments |

3,259 |

7,142 |

| |

281,431 |

294,343 |

(B) Segmental results

| |

|

2025 |

|

|

|

2024 - Restated |

|

|||||||

| |

Property |

Car park |

Hotel |

|

|

|

Property |

Car park |

Hotel |

|

|

|||

| |

rental |

activities |

operations |

Investments |

Total |

|

rental |

activities |

operations |

Investments |

Total |

|||

| |

£000 |

£000 |

£000 |

£000 |

£000 |

|

£000 |

£000 |

£000 |

£000 |

£000 |

|||

| Gross revenue (excl service charge income) |

12,442 |

13,978 |

3,337 |

- |

29,757 |

|

12,314 |

13,361 |

3,308 |

- |

28,983 |

|||

| Service charge income |

2,935 |

- |

- |

- |

2,935 |

|

2,985 |

- |

- |

- |

2,985 |

|||

| Gross revenue |

15,377 |

13,978 |

3,337 |

- |

32,692 |

|

15,299 |

13,361 |

3,308 |

- |

31,968 |

|||

| Service charge expenses |

(4,310) |

- |

- |

- |

(4,310) |

|

(3,982) |

- |

- |

- |

(3,982) |

|||

| Property expenses |

(2,290) |

(8,444) |

(2,782) |

- |

(13,516) |

|

(1,431) |

(7,521) |

(2,670) |

- |

(11,622) |

|||

| Net revenue |

8,777 |

5,534 |

555 |

- |

14,866 |

|

9,886 |

5,840 |

638 |

- |

16,364 |

|||

| Administrative expenses |

(5,711) |

(1,801) |

- |

- |

(7,512) |

|

(5,571) |

(1,722) |

- |

- |

(7,293) |

|||

| Other income |

1,864 |

30 |

|

43 |

1,937 |

|

924 |

- |

- |

41 |

965 |

|||

| Share of post-tax profits from joint ventures |

1,057 |

- |

- |

- |

1,057 |

|

1,025 |

- |

- |

- |

1,025 |

|||

| Operating profit before valuation movements |

5,987 |

3,763 |

555 |

43 |

10,348 |

|

6,264 |

4,118 |

638 |

41 |

11,061 |

|||

| Valuation movement on investment properties |

(2,214) |

- |

- |

- |

(2,214) |

|

(7,625) |

- |

- |

- |

(7,625) |

|||

| Impairment of car parking assets |

- |

(2,697) |

- |

- |

(2,697) |

|

- |

(3,878) |

- |

- |

(3,878) |

|||

| Impairment of goodwill |

- |

(772) |

- |

- |

(772) |

|

- |

(577) |

- |

- |

(577) |

|||

| Loss on disposal of investments |

- |

- |

- |

(87) |

(87) |

|

- |

- |

- |

(191) |

(191) |

|||

| Valuation movement on investments |

- |

- |

- |

- |

- |

|

- |

- |

- |

408 |

408 |

|||

| Profit on disposal of investment properties |

- |

- |

- |

- |

- |

|

27 |

- |

- |

- |

27 |

|||

| Profit on disposal of freehold and leasehold properties |

- |

1,762 |

- |

- |

1,762 |

|

|

|

|

|

|

|||

| Valuation movement on joint venture properties |

- |

- |

- |

- |

- |

|

(3,200) |

- |

- |

- |

(3,200) |

|||

| Operating (loss)/profit |

3,773 |

2,056 |

555 |

(44) |

6,340 |

|

(4,534) |

(337) |

638 |

258 |

(3,975) |

|||

| Finance costs |

|

|

|

|

(7,423) |

|

|

|

|

|

(7,348) |

|||

| Finance income |

|

|

|

|

18 |

|

|

|

|

|

166 |

|||

| Loss before taxation |

|

|

|

|

(1,065) |

|

|

|

|

|

(11,157) |

|||

| Taxation |

|

|

|

|

(2,381) |

|

|

|

|

|

3,319 |

|||

| Loss for the year |

|

|

|

|

(3,446) |

|

|

|

|

|

(7,838) |

|||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All results are derived from activities conducted in the United Kingdom.

The car park results include car park income from sites that are held for future development. The value of these sites has been determined based on their development value and therefore the total value of these assets has been included within the assets of the property rental business.

The net revenue at the development sites for the year ended 30 June 2025, arising from car park operations , was £1,349,000. After allowing for an allocation of administrative expenses, the operating profit at these sites was £838,000.

Revenue received within the car park activities' segment and hotel operations' segment as well as other income in the property rental segment is the only revenue recognised on a contract basis under IFRS 15. All other revenue within the property rental segment comes from rental lease agreements.

| 2. Administrative expenses |

|

|

| |

2025 |

2024 |

| |

£000 |

£000 |

| Employee benefits |

4,427 |

4,457 |

| Depreciation |

172 |

168 |

| Charitable donations |

86 |

77 |

| Other |

2,827 |

2,591 |

| |

7,512 |

7,293 |

|

|

|

|

Depreciation charged to the Consolidated Income Statement as an administrative expense relates to depreciation on central office equipment, including fixtures and fittings, computer equipment and motor vehicles. Depreciation on operational equipment and Right-of-use assets within both the car park and hotel businesses are charged as direct property expenses within the Consolidated Income Statement.

| 3. Other income |

|

|

| |

2025 |

2024 |

| Other income |

£000 |

£000 |

| Commission received |

196 |

169 |

| Dividends received |

43 |

41 |

| Service charge management fees |

280 |

258 |

| Development management fees |

227 |

158 |

| Dilapidations receipts and income relating to surrender premiums |

1,019 |

267 |

| Profit on sale of fixed assets |

55 |

- |

| Other |

117 |

72 |

| |

1,937 |

965 |

4. Taxation

| |

2025 |

2024 Restated |

| |

£000 |

£000 |

| Current |

|

|

| Current year |

- |

- |

| Adjustments in respect of prior years |

59 |

- |

| |

59 |

- |

| Deferred tax |

|

|

| Recognition of previously unrecognised trading losses |

- |

(2,888) |

| Utilisation of trading losses |

967 |

1,203 |

| Origination and reversal of timing differences |

1,355 |

(1,634) |

| Adjustments in respect of prior periods |

- |

- |

| |

2,322 |

(3,319) |

| |

2,381 |

(3,319) |

| Taxation for the year i s higher (2024: higher) than the standard rate of corporation tax in the United Kingdom of 25% (2024: 25%). The differences are explained below:

|

||

| |

2025 |

2024 Restated |

| |

£000 |

£000 |

| Loss before taxation |

(1,065) |

(11,157) |

| Loss on ordinary activities multiplied by rate of corporation tax in the United Kingdom of 25% (2024: 25%) |

(266) |

(2,789) |

| Effects of: |

|

|

| - Valuation movements on which deferred tax is not recognised |

2,344 |

2,110 |

| - Recognition of carried forward trading losses |

- |

(2,888) |

| - Expenses not deductible for tax purposes |

244 |

248 |

| - Adjustments in respect of prior years |

59 |

|

| Total taxation charge/(credit) |

2,381 |

(3,319) |

|

|

|

|

The Company left the REIT regime with effect from 1 July 2023. The results of the Company and the Group have subsequently been subject to corporation tax.

| 5. Dividends |

|

|

| |

2025 |

2024 |

| |

£000 |

£000 |

| 2023 final paid: 2.5p per share |

- |

1,054 |

| 2024 interim paid: 8.5p per share |

- |

3,584 |

| 2024 final paid: 2.5p per share |

1,054 |

- |

| |

1,054 |

4,638 |

An interim dividend in respect of the year ended 30 June 2025 of 2.5p per Ordinary Share was paid to Shareholders on 13 June 2025.

A final dividend in respect of the year ended 30 June 2025 of 2.5p per Ordinary Share is proposed. This dividend, based on the shares in issue at 15 October 2025, amounts to £1.054m which has not been reflected in these accounts and will be paid on 8 January 2026 to shareholders on the register on 19 December 2025.

6. Earnings per share

The calculation of basic earnings per share has been based on the loss for the year, divided by the weighted average number of Ordinary Shares in issue. The weighted average number of shares in issue during the year was 42,162,679 (2024: 44,862,101).

| |

2025 |

|

2024 Restated

|

||||

| |

|

|

Earnings |

|

|

|

Earnings |

| |

Earnings |

|

per share |

|

Earnings |

|

per share |

| |

£000 |

|

p |

|

£000 |

|

p |

| Loss for the year and earnings per share |

(3,446) |

|

(8.2) |

|

(7,838) |

|

(17.5) |

| Valuation movement on investment properties |

2,214 |

|

5.3 |

|

7,625 |

|

17.0 |

| Deferred tax on valuation movements |

1,216 |

|

2.9 |

|

(903) |

|

(2.0) |

| Impairment of car parking assets |

2,697 |

|

6.4 |

|

3,878 |

|

8.7 |

| Impairment of goodwill |

772 |

|

1.8 |

|

577 |

|

1.3 |

| Valuation movement on properties held in joint ventures |

- |

|

- |

|

3,200 |

|

7.1 |

| Profit on disposal of investment properties |

- |

|

- |

|

(27) |

|

(0.1) |

| Profit on disposal of freehold and leasehold properties |

(1,762) |

|

(4.2) |

|

- |

|

- |

| Loss on disposal of investments |

87 |

|

0.2 |

|

191 |

|

0.4 |

| Valuation movement on investments |

- |

|

- |

|

(408) |

|

(0.9) |

| EPRA earnings and EPRA earnings per share |

1,778 |

|

4.2 |

|

6,295 |

|

14.0 |

EPRA earnings for the year ended 30 June 2024 included a tax credit £2,888,000 relating to the initial recognition of a deferred tax asset for historical trading losses.

There is no difference between basic and diluted earnings per share.

There is no difference between basic and diluted EPRA earnings per share.

7. Non-current assets

(A) Investment properties

| |

Freehold |

Right-of-use asset |

Development |

Total |

| |

£000 |

£000 |

£000 |

£000 |

| Valuation at 30 June 2023 |

160,700 |

2,250 |

20,851 |

183,801 |

| Additions at cost |

- |

2,860 |

- |

2,860 |

| Other capital expenditure |

1,716 |

- |

765 |

2,481 |

| Disposals |

(160) |

- |

- |

(160) |

| Movement in tenant lease incentives |

(380) |

- |

- |

(380) |

| Valuation movement |

(10,466) |

6 |

2,835 |

(7,625) |

| Valuation at 30 June 2024 |

151,410 |

5,116 |

24,451 |

180,977 |

| Other capital expenditure |

2,405 |

17 |

1,760 |

4,182 |

| Movement in tenant lease incentives |

147 |

- |

- |

147 |

| Valuation movement |

1,528 |

(87) |

(3,655) |

(2,214) |

| Valuation at 30 June 2025 |

155,490 |

5,046 |

22,556 |

183,092 |

At 30 June 2025, investment property valued at £178,095,000 (2024: £175,810,000) was held as security against the Group's borrowings.

During the prior year the Group acquired an investment property for a cash consideration of £1,544,000 and recognised an additional IFRS16 right-of-use asset of £1,316,000.

Right-of-use investment property assets include leasehold property interests.

The Company occupies an office suite in part of the Merrion Centre and one floor of an investment property in London. The Directors do not consider these elements to be material.

(B) Freehold and leasehold properties - car park activities

| |

Freehold |

Right-of-use asset Restated |

Total Restated |

| |

£000 |

£000 |

£000 |

| Valuation at 30 June 2023 |

25,110 |

36,724 |

61,834 |

| IFRS 16 adjustment |

- |

(95) |

(95) |

| Depreciation |

(272) |

(1,397) |

(1,669) |

| Valuation movement recognised in Other Comprehensive Income |

994 |

- |

994 |

| Oher movements - lease reassessments |

- |

817 |

817 |

| Reversal of impairment/(impairment) |

768 |

(4,646) |

(3,878) |

| Valuation at 30 June 2024 |

26,600 |

31,403 |

58,003 |

| Disposals |

- |

(2,098) |

(2,098) |

| IFRS 16 adjustment |

- |

(95) |

(95) |

| Depreciation |

(287) |

(1,164) |

(1,451) |

| Valuation movement recognised in Other Comprehensive Income |

(656) |

- |

(656) |

| Oher movements - lease reassessments |

- |

1,464 |

1,464 |

| Impairment |

(1,107) |

(1,590) |

(2,697) |

| Valuation at 30 June 2025 |

24,550 |

27,920 |

52,470 |

The historical cost of freehold properties and Right-of-use assets relating to car park activities is £30,153,000 (2024: £30,153,000).

At 30 June 2025, freehold properties and Right-of-use assets relating to car park activities valued at £33,424,000 (2024: £35,450,000) were held as security against the Group's borrowings.

(C) Freehold properties - hotel operations

| |

Freehold |

| |

£000 |

| Valuation at 30 June 2024 |

9,900 |

| Depreciation |

(242) |

| Valuation movement |

542 |

| Valuation at 30 June 2024 |

10,200 |

At 30 June 2025, freehold property relating to hotel operations valued at £10,200,000 (2024: £9,900,000) was held as security against the Group's borrowings.

The fair value of the Group's portfolio of investment and development properties, freehold car park properties and freehold hotel properties have been determined principally by independent, appropriately qualified external valuers CBRE. The remainder of the portfolio has been valued by the Directors.

Valuations are performed bi-annually and are performed consistently across the Group's whole portfolio of properties. At each reporting date appropriately qualified employees verify all significant inputs and review computational outputs. The external valuers submit and present summary reports to the Property Director and the Board on the outcome of each valuation round.

Valuation methodology for all properties (excluding the development properties)

Valuations take into account tenure, lease terms and structural condition. The inputs underlying the valuations include market rents or business profitability, incentives offered to tenants, forecast growth rates, market yields and discount rates and selling costs including stamp duty.

Valuation method for the development properties

The development properties principally comprise land in Leeds and Manchester. These have also been valued by appropriately qualified external valuers CBRE, taking into account an assessment of their realisable value in their existing state and condition based on market evidence of comparable transactions and residual value calculations.

Property income, values and yields as at 30 June 2025 are set out by category in the table below.

| |

Passing rent |

ERV |

Value |

Initial yield |

Reversionary yield |

| |

£000 |

£000 |

£000 |

% |

% |

| Retail and Leisure |

393 |

1,544 |

15,890 |

2.3% |

9.2% |

| Merrion Centre (excluding offices) |

4,029 |

4,662 |

48,079 |

7.9% |

9.2% |

| Offices |

3,097 |

4,800 |

46,196 |

6.3% |

9.8% |

| Hotels |

913 |

913 |

10,200 |

8.5% |

8.5% |

| Out of town retail |

1,050 |

1,341 |

13,075 |

7.6% |

9.7% |

| Residential |

1,688 |

1,852 |

34,500 |

4.6% |

5.1% |

| |

11,170 |

15,113 |

167,940 |

6.3% |

8.5% |

| Development properties |

|

|

22,556 |

|

|

| Car parks |

|

|

34,377 |

|

|

| IFRS 16 - Right-of-use assets held within car park activities |

19,573 |

|

|

||

| IFRS 16 - Right-of-use assets held within investment property |

1,316 |

|

|

||

| |

|

|

245,762 |

|

|

Car parks above include £1.48m of a car park categorised as an investment property in the Consolidated Balance Sheet.

Property income, values and yields have been set out by category as at 30 June 2024 in the table below.

| |

Passing rent |

ERV |

Value |

Initial yield |

Reversionary yield |

| |

£000 |

£000 |

£000 |

% |

% |

| Retail and Leisure |

1,178 |

1,282 |

13,810 |

8.1% |

8.8% |

| Merrion Centre (excluding offices) |

4,514 |

4,815 |

50,254 |

8.5% |

9.1% |

| Offices |

2,688 |

4,845 |

45,376 |

5.6% |

10.1% |

| Hotels |

875 |

875 |

9,900 |

8.4% |

8.4% |

| Out of town retail |

1,041 |

1,070 |

12,500 |

7.9% |

8.1% |

| Residential |

1,319 |

2,108 |

31,720 |

3.9% |

6.3% |

| |

11,615 |

14,995 |

163,560 |

6.7% |

8.7% |

| Development property |

|

|

24,451 |

|

|

| Car parks |

|

|

38,017 |

|

|

| IFRS 16 - Right-of-use assets held within car park activities |

21,536 |

|

|

||

| IFRS 16 - Right-of-use assets held within investment property |

1,316 |

|

|

||

| |

|

|

248,880 |

|

|

Investment properties (freehold and Right-of-use), freehold properties (PPE) and hotel operations.

The effect on the total valuation (excluding development properties, car parks and right-of-use assets) of £167.9m of applying a different weighted average yield and a different weighted average ERV would be as follows:

Valuation in the Consolidated Balance Sheet at a net initial yield of 5.3% - £199.7m, Valuation at 7.3% - £144.9m.

Valuation in the Consolidated Balance Sheet at a reversionary yield of 7.5% - £190.3m, Valuation at 9.5% - £150.3m.

Investment properties (development properties)

The key unobservable inputs in the valuation of one of the Group's development properties of £16.9m is the assumed per acre or per unit land value. The effect on the valuation of this development property of applying a different assumed per acre or per unit land value would be as follows:

Valuation in the Consolidated Balance Sheet if there was a 5% increase in the per acre or per unit value - £17.7m, 5% decrease in the per acre or per unit value - £16.0m.

The other key development property in the Group is valued on a per acre development land value basis, the effect on the valuation of this development property of applying reasonable sensitivities would not be material.

Freehold car park activities

The effect on the total valuation of the Group's freehold car park properties of £24.6m in applying a different yield/discount rate (valuation based on a 6.6% net initial yield) and a different assumed rental value/net income (valuation based on £1.6m) would be as follows:

Valuation in the Consolidated Balance Sheet based on a 1% decrease in the yield/discount rate - £28.9m, 1% increase in the yield/discount rate - £21.3m

Valuation in the Consolidated Balance Sheet based on a 5% increase in the assumed rental value/net income - £25.8m, 5% decrease in the assumed rental value/net income - £23.4m

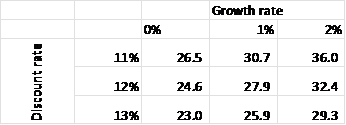

Right-of-use car park activities

The effect on the total valuation of the Group's Right-of-use car park properties of £27.9m in applying a different discount rate (valuation based on 12%) and a different growth rate (valuation based on 1%) would be as follows:

Property valuations can be reconciled to the carrying value of the properties in the Consolidated Balance Sheet as follows:

| |

Investment Properties |

Car park activities - freehold and leasehold properties |

Hotel operations- freehold properties |

Total |

| |

£000 |

£000 |

£000 |

£000 |

| Externally valued by CBRE |

179,475 |

24,550 |

10,200 |

214,225 |