15 AUG 2025

SolGold plc

("SolGold" or the "Company")

Reports Exceptional Near-Surface Copper-Gold

Intercepts at Tandayama América

· Hole TAD-58 delivers the strongest near-surface intervals to date at Tandayama and the Cascabel Project, intersecting 140 m @ 0.92 % CuEq from 8 m, including 106 m @ 1.10 % CuEq from 22 m

· Results continue to confirm the strong potential for a low-capex, near-surface open-pit starter operation to accelerate early cash flow at Cascabel

· Mineralisation remains open at depth , with further drilling planned to expand the resource

· Geological interpretations and geochemistry point to further extensions and targets

· Integration with Alpala underground development remains central to SolGold's staged production plan

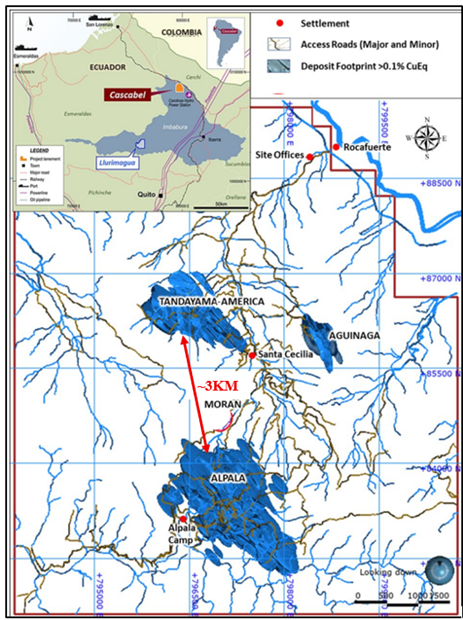

SolGold (LSE: SOLG) is pleased to report assay results from three additional drill holes, TAD-25-055 ("Hole 55"), TAD-25-056 ("Hole 56"), and TAD-25-058 ("Hole 58"), at the Tandayama-Ameríca ("Tandayama") deposit. These results follow the high-grade intervals reported on 28 July 2025 (News Release: SolGold plc Reports Multiple High-Grade Intervals at Tandayama-América as Part of Cascabel Execution Plan) 1 and further reinforce the Company's strategy to bring forward low capex, low opex, open-pit ore from Tandayama in the early years of Cascabel's mine life. The Tandayama deposit is part of the 100% owned Tier-One copper-gold Cascabel Project Complex ("Cascabel" or the "Project") in northern Ecuador.

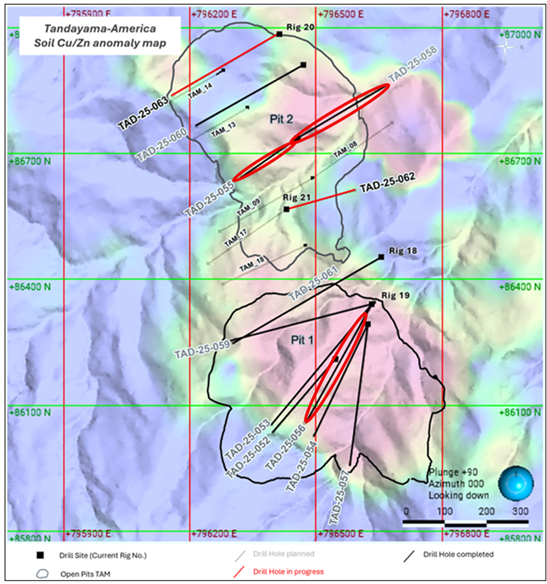

These holes build on the existing resource at Tandayama, and the recently released high-grade drill core assays from holes TAD-25-052, TAD-25-053, and TAD-25-054 from the current drilling program. The program is designed to confirm the Company's strategy to develop an open-pit and underground operation at Cascabel. The SolGold team continues to investigate near-surface copper-gold mineralisation within a potential open-pit design envelope, with additional drilling and assays pending. Additional mineralisation is likely to extend resources, notional pit boundaries, and grades.

DRILLING HIGHLIGHTS

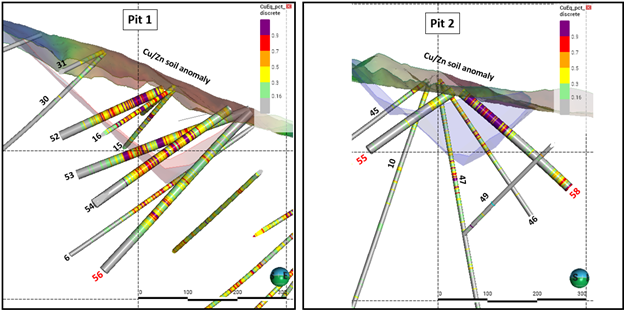

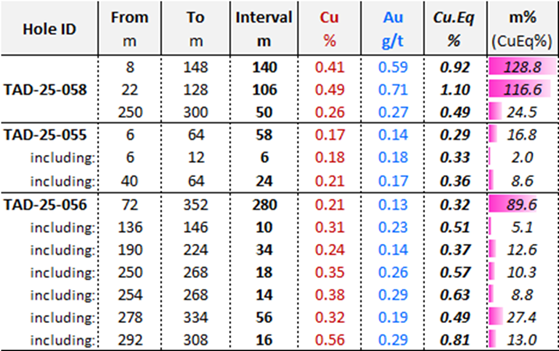

· TAD-25-058 (Pit 2):

• 140 m @ 0.92 % CuEq (0.41 % Cu, 0.59 g/t Au) from 8 m, including

• 106 m @ 1.10 % CuEq from 22 m

• Additional 50 m @ 0.49 % CuEq from 250 m; mineralisation open at depth

The intersections in hole 58 in pit 2 area open considerable prospectivity for further substantial resource definition at Tandayama.

· TAD-25-055 (Pit 2):

· 58 m @ 0.29 % CuEq (0.17 % Cu, 0.14 g/t Au) from 6 m, including

· 6 m @ 0.33 % CuEq (0.18 % Cu, 0.18 g/t Au) from 6m,

· 24 m @0.36 % CuEq (0.21 % Cu, 0.17 g/t Au) from 40

The mineralization found in hole 55 represents the extension towards the SE of hole 58, as these two holes started from the same collar (see figure 4).

· TAD-25-056 (Pit 1):

· 280 m @ 0.32 % CuEq (0.21 % Cu, 0.13 g/t Au)

This hole tested the border of the preliminary Pit 1 design, providing a clear indication that the mineralized body inside contains grades economically minable (see figure 3).

· Holes TAD-57, TAD-59, TAD-60 and TAD-61 have been completed, and all the core samples have already been sent to the laboratory for analysis. When the assay results from the entire hole (s) are received, they will be published.

CEO Dan Vujcic commented:

"TAD-58 is one of the most robust results we've seen from Cascabel to date - with high grades from near surface over substantial widths in a location that aligns with our open-pit to underground strategy. These results continue to show the potential to deliver early, high-margin tonnes from Tandayama-the kind of material that can provide valuable flexibility in the development of Cascabel.

As I've noted on previous occasions, SolGold, relative to global peers and precedents, is considerably undervalued; continuing to deliver results like this and increasing market awareness of the quality of our endowment in Northern Ecuador is how we close the value gap. Early results suggest an increase in the size of the resource being open at depth, and the grades exceed what we have internally modelled previously for the deposit . We will continue to update the market as we finalise and potentially expand the current drill program, while continuing to progress early works and preparation at Alpala."

STRATEGIC SIGNIFICANCE

The ongoing 2025 drill program at Tandayama is focused on upgrading near-surface resources to Measured and Indicated categories for inclusion in detailed mine planning. An open pit at Tandayama could supply higher-grade feed to Cascabel's processing plant ahead of full underground production from the Alpala deposit, located approximately 3 km to the south.

Integrating early ore from Tandayama into Cascabel's development sequence is a key pillar of SolGold's staged execution plan and a central driver of SolGold's low capex, early revenue strategy.

Figure 1: Project Location and Cascabel Tenement

Figure 2: Tandayama-América Drill Hole Location Plan

Figure 3 and 4: Pit 1 and 2 Drill Hole Sections, Tandayama -América

TABLE 1: ASSAY SUMMARY

MINERALISATION OVERVIEW

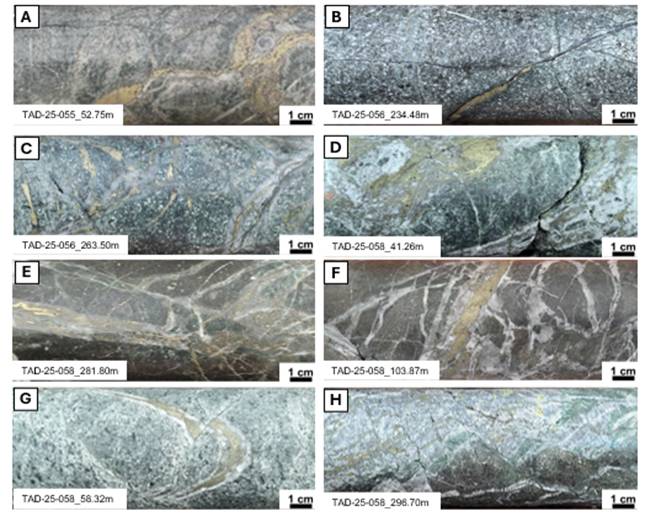

The current drilling at the Tandayama América deposit is confirming the presence of economic copper-gold mineralization close to surface. Mineralized magmatic intrusive breccia, early and intermineral dikes showing potassic alteration are the most common lithologies, chalcopyrite and pyrite are the more common sulfides identified, which are related with the presence of quartz (B-veins), magnetite and chalcopyrite veins, also disseminated sulfides along the core are a typical feature. Pictures below are examples of the typical mineralization from holes 55, 56, and 58.

Figure 5: A) Magmatic Intrusive Breccia, hosting chalcopyrite veins (C veins; 0.27%Cu, 0.23 g/t Au). B) Quartz diorite (QD15), hosting C veins (0.13%Cu, 0.09 g/t Au). C) Quartz diorite (QD15), hosting stockwork B veins with Chalcopyrite (0.57%Cu, 0.4 g/t Au). D) Quartz diorite (QD10), hosting B veins with chalcopyrite and magnetite (0.72% Cu, 0.73 g/t Au). E) Diorite (D10), hosting stockwork B veins with disseminated chalcopyrite (0.44% Cu, 0.48 g/t Au). F) Diorite (D10), hosting stockwork B veins and chalcopyrite veins (1.02% Cu, 1.05 g/t Au). G) Quartz diorite (QD15), hosting chalcopyrite bearing B-vein (0.57% Cu, 0.80 g/t Au). H) Diorite (D10), hosting chalcopyrite bearing B-vein (1.20% Cu, 1.30 g/t Au).

DRILLING PROGRAM AND PROJECT INTEGRATION

The 2025 Tandayama drilling program is focused on upgrading resources within the conceptual open-pit shell to Measured and Indicated classifications, while providing critical input to the broader Cascabel development plan, including:

· Open pit slope geotechnical domains

· Processing plant feed sequencing

· Infrastructure layout and pit-access planning

To date:

· 10 holes completed (3,398.16 m drilled)

· 8 holes remaining (1,868.84 m planned)

· 4 drill rigs active at site

· Samples from 4 more holes have been shipped out for assaying

NEXT STEPS

· Integration of new results into ongoing mine planning

· Receive and report assays from Hole 57 and other pending holes in August

· Incorporate new data into the Feasibility Study led by G Mining Services

CONTACTS

| Dan Vujcic Chief Executive Officer

|

Tel: +61 461 304 393 |

ENDNOTES:

1. Refer to News Release Dated 28 July 2025: SolGold plc Releases Reports Multiple High-Grade Intervals at Tandayama-América as Part of Cascabel Execution Plan: See Link

COPPER EQUIVALENT CALCULATION

Copper equivalent (CuEq) values have been calculated using the following formula:

CuEq (%) = Cu (%) + [Au (g/t) × 0.858]

Copper equivalent (CuEq) values are calculated using a gold price of US$2,500/oz and a copper price of US$4.25/lb, and do not account for metallurgical recoveries. Recoveries will be updated as metallurgical test work advances.

ABOUT SOLGOLD

SolGold is a leading resources company focused on the discovery, definition, and development of world-class copper and gold deposits, and continues to strive to deliver objectives efficiently in the interests of its shareholders.

SolGold completed and released a staged development plan, including a Pre-Feasibility Study, on 16 February 2024. The study, completed at US$1,750/oz gold, US$3.85/lb copper, and US$22.50/oz for silver, delivered an NPV (based on a discount rate of 8%) of US$3.22bn on a capex of US$1.55bn for an initial 12 Mtpa underground block caving operation. The evaluation also showed an after-tax IRR of 24% and a first 10-year free cash flow generation of US$7.1bn. The PFS assessed Mineral Resources 539.7 Mt tonnes, which represents only 18% of the total resource over an initial 28-year project life.

On 15 July 2024, SolGold announced a gold stream agreement with Franco-Nevada (Barbados) Corporation and OR Royalties International Ltd. (formerly Osisko Bermuda Limited) (the "Streamers"), pursuant to which the Streamers would pay US$100 million as pre-development funding in three tranches, conditional upon achieving various technical and permitting milestones. The first US$33.3 million was received upon signing, with a further US$33.3 million approved by the Streamers on 9 July 2025. A further US$650m contribution to development expenditure will be provided on completion of the feasibility study, permitting and financing, subject to CPs, acceptable financing packages for the balance funding required. SolGold has agreed, in consideration for this funding, a life-of-mine stream priced at 20% of the spot gold price at the time, for 20% of gold production for the first 10 years and 12% thereafter. The stream represents approximately 5% of total revenue for the project and provides some 42% of currently estimated capital development costs. SolGold retains change of control buyback options on the stream to the extent of 50% within 3 years and 33 1/3 % for a further two years.

SolGold continues to advance de-risking programs, permitting and financing discussions, and to reevaluate the Project at recent consensus prices for copper and gold.

On 28 October 2024, SolGold appointed G Mining Services to be the Project Manager for the Feasibility Study.

The Company operates with transparency and in accordance with international best practices. SolGold is committed to delivering value to its shareholders while simultaneously providing economic and social benefits to impacted communities, fostering a healthy and safe workplace, and minimizing environmental impact.

SolGold is listed on the London Stock Exchange (LSE: SOLG).

See www.solgold.com.au for more information. Follow us on X @SolGold_plc.

QUALIFIED PERSON

The scientific and technical disclosure included in this news release has been reviewed and approved by Mr. Santiago Vaca (M.Sc. P.Geo.), a Qualified Person as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

CAUTIONARY NOTICE

News releases, presentations and public commentary made by SolGold plc (the "Company") and its Officers may contain certain statements and expressions of belief, expectation or opinion which are forward looking statements, and which relate, inter alia, to interpretations of exploration results to date and the Company's proposed strategy, plans and objectives or to the expectations or intentions of the Company's Directors, including the plan for developing the Project currently being studied as well as the expectations of the Company as to the forward price of copper. Such forward-looking and interpretative statements involve known and unknown risks, uncertainties, and other important factors beyond the control of the Company that could cause the actual performance or achievements of the Company to be materially different from such interpretations and forward-looking statements.

Accordingly, the reader should not rely on any interpretations or forward-looking statements, and save as required by the exchange rules of the TSX and LSE or by applicable laws, the Company does not accept any obligation to disseminate any updates or revisions to such interpretations or forward-looking statements. The Company may reinterpret results to date as the status of its assets and projects changes with time, expenditure, metals prices, and other affecting circumstances.

This release may contain "forward-looking information". Forward-looking information includes, but is not limited to, statements regarding the Company's plans for developing its properties. Generally, forward looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward looking information, including but not limited to: transaction risks; general business, economic, competitive, political and social uncertainties; future prices of mineral prices; accidents, labour disputes and shortages and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, risks relating to the ability of exploration activities (including assay results) to accurately predict mineralization; errors in management's geological modelling and/or mine development plan; capital and operating costs varying significantly from estimates; the preliminary nature of visual assessments; delays in obtaining or failures to obtain required governmental, environmental or other required approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; the global economic climate; fluctuations in commodity prices; the ability of the Company to complete further exploration activities, including drilling; delays in the development of projects; environmental risks; community and non-governmental actions; other risks involved in the mineral exploration and development industry; the ability of the Company to retain its key management employees and skilled and experienced personnel; and those risks set out in the Company's public documents filed on SEDAR+ at www.sedarplus.ca. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

The Company and its officers do not endorse, or reject or otherwise comment on the conclusions, interpretations or views expressed in press articles or third-party analysis.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.