11 November 2025

THIS ANNOUNCEMENT RELATES TO THE DISCLOSURE OF INFORMATION THAT QUALIFIED OR MAY HAVE QUALIFIED AS INSIDE INFORMATION WITHIN THE MEANING OF (A) ARTICLE 7(1) OF UK MAR IN SO FAR AS IT RELATES TO ORDINARY SHARES ISSUED BY GEORGINA ENERGY PLC

Georgina Energy plc

("Georgina", "Georgina Energy" or the "Company")

ACQUISITION OF ADDITIONAL RE-ENTRY TARGETS

Georgina Energy plc (LSE: GEX), is pleased to announce that it has executed a conditional share purchase agreement (SPA) with Central Petroleum Limited (CTP), an Australian Stock Exchange listed company, for the purchase of 100% of the issued capital of three of CTP's wholly owned subsidiaries, which hold interests in three main exploration targets within three Exploration Permits (EPs): (i) EP125 Mt Kitty-1 / Jacko Bore-1 well (Mt Kitty) (30% interest);(ii) EP112 Dukas 1 ST-1 well (Dukas) (45% interest); and (iii) EP82 Magee/Mahler-Magee 1 well (Mahler) (60% interest, excluding certain EP82 Sub-Blocks) (together the "Acquisition"). Other interests and assets held by these subsidiaries do not form part of the Acquisition and will be restructured to be remain under the ownership of the CTP group (the "Restructure").

Transaction highlights and rationale

· Transformative transaction

o Purchase of three companies which hold interests in three significant advanced exploration targets

o Highly complementary projects to Georgina's current portfolio

· Increased exposure to high value, strategically located re-entry targets

o Targets previously drilled and flowed to surface with high concentrations of helium, hydrogen and hydrocarbons

o At least one well has a recorded presence of Helium Isotope 3 ("3He")

§ The Amadeus Basin has recorded levels of 3He up to 1,100 ppt[1]

· Transaction details

o In consideration, upon completion, Central Petroleum will hold 25% of Georgina's issued share capital

o SPA is conditional on:

§ Ministerial consent from the Northern Territory Department of Mining and Energy;

§ Santos' consent under the relevant JOAs to the change of ownership;

§ Completion of CTP's Restructure;

§ Georgina shareholder vote at a General Meeting;

§ Fundraise of £7 million; and

§ Publication of Prospectus to be approved by the FCA.

Anthony Hamilton, Chief Executive Officer of Georgina Energy, commented:

"We are delighted to sign a transformational transaction with Central Petroleum, which, if completed, would bring enormous upside for shareholders and longevity to our business. A naturally fractured reservoir, Mt Kitty (EP125) already has drilled 2C Contingent Resources, which the Company plans to convert to Proven and Probable Reserves, adding valuable production barrels and cash flow to Georgina's portfolio. We're excited to explore Dukas, as a considered mega structure, as well as develop Hussar and Mt Winter, as planned.

"This transaction takes Georgina to the next level in achieving our strategy to become a leading producer of helium and hydrogen and we look forward to working with both Central Petroleum and Santos to take these assets forward."

Interest-holding subsidiaries that are the subject to the SPA are:

· Helium Australia Pty - Mt Kitty/Jacko Bore (EP125)

· Frontier Oil & Gas Pty Ltd - Dukas (EP112)

· Ordiv Petroleum Pty Ltd - Mahler/ Magee (EP82)

The EPs are subject to existing joint operating agreements (JOAs) with Santos QNT Pty Ltd (Santos).

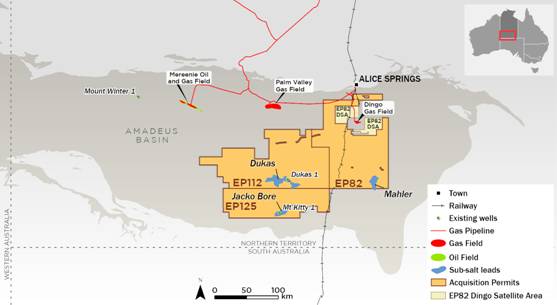

Location of Exploration Permits

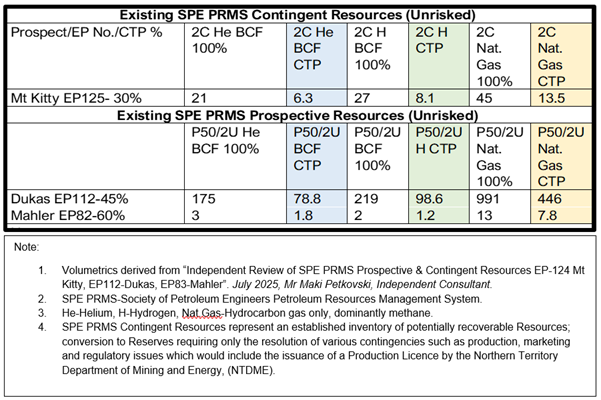

In March 2025, Georgina commissioned an Independent Competent Person's Report ("CPR") on the three EPs, identifying Prospective (Dukas and Mahler) and Contingent (Mt Kitty) Resources. A copy of the CPR is available on Georgina's website: https://www.georginaenergy.com/investors/results-reports-presentations/

All three prospects are of significant scale and represent advanced re-entry prospects, with Dukas considered a mega-structure and potentially the largest identified helium, hydrogen and hydrocarbon prospect to date in Australia. The Company intends to convert these Resources to Proven and Probable Reserve status.

The EPs are all within proximity to the Company's existing assets in the Amadeus and Officer Basins where Georgina has focused its attention to date.

The plugged and suspended Mt Kitty well was previously drilled in 2014 to a relatively shallow depth of 2,295m TD and produced a flow of 500,000 SCFGD gas to surface with exceptionally high concentrations of up to 9% Helium and 11% Hydrogen as well as a significant proportion of hydrocarbon gases at 40%. However, the well intersected only a short vertical section of naturally fractured basement and did not encounter the targeted Heavitree Sandstone reservoir. The Company believes that the Heavitree play remains a potential flanking target, which may be intersected in a planned re-entry well incorporating a 500m horizontal section, to enhance flow from the naturally fractured basement.

Transaction Details

In consideration for the Acquisition, the Company will issue such number of ordinary shares of £0.05 each in the capital of the Company (Ordinary Shares) as is equal to one-third of its issued share capital such that CTP holds 25% of the Company's Ordinary Shares following completion of the Acquisition (Consideration Shares).

As at the date of this announcement the Company has securities convertible or exercisable to Ordinary Shares (Convertible Securities) outstanding equal to 74,026,023 Ordinary Shares. Additionally, post completion, CTP will have a right to exercise such number of additional Ordinary Shares as is equal to one-third of any Convertible Securities existing at the date of completion via convertible loan notes (Convertible Notes), subject to their conversion by the individual holders and allotment by the Company. Accordingly, CTP's aggregate interest in the Company following completion of the Acquisition and after conversion or exercise of any Convertible Securities existing at the date of completion, will be equal to 25% of the Company's issued share capital on a fully diluted basis, calculated by reference to the date of completion. The Company shall be required to consult with the Takeover Panel regarding the issue of Consideration Shares.

The SPA is conditional on Ministerial consent from the Northern Territory Department of Mining and Energy, Santos' consent under the relevant JOAs to the change of ownership, completion of CTP's Restructure, and the passing of resolutions at a general meeting of the Company to approve the issuance of the Company's Ordinary Shares and the Convertible Notes to CTP. Additionally, the Company will need to undertake a fundraise of at least £7 million (net of costs and expenses) and to publish a Prospectus, subject to the approval of the FCA, to support the Fundraise, the admission of the Consideration Shares and issuance of the Company's Ordinary Shares on conversion of the Convertible Notes.

Upon completion, CTP will be entitled to nominate one non-executive director for appointment to the Company's board.

Further updates will be provided in due course.

END

About Central Petroleum

Central Petroleum is an established ASX-listed Australian oil and gas producer (ASX: CTP) with exploration and appraisal permits in the Northern Territory (NT). Central has grown to become the largest onshore gas Operator in the NT, supplying residential and industrial customers in the NT and wider Australian east coast market. Central is seeking to become a major domestic energy supplier, in addition to helium and naturally occurring hydrogen, with exploration, appraisal and development plans across 169,112 km² of tenements the NT, including some of Australia's largest known onshore conventional gas prospects in the Amadeus Basin.

About Santos

Santos is a global energy company with operations across Australia, Papua New Guinea (PNG), Timor-Leste and the United States of America (USA). Santos is an important Australian domestic gas supplier and liquefied natural gas (LNG) supplier in Asia and is committed to supplying critical fuels such as oil and gas, and abating emissions through carbon capture and storage (CCS), energy efficiency projects, use of renewables in its operations and high integrity emissions reduction units. The Santos portfolio is resilient across a range of decarbonisation scenarios. Santos has a Climate Transition Action Plan (CTAP) that will continue to evolve with time. Santos has a regional operating model. The Company's operating structure comprises three regional business units focused on executing corporate strategy and a Midstream Energy Solutions business unit.

Enquiries

Georgina Energy

| Tony Hamilton |

|

| Mark Wallace

|

|

| |

|

Tavira Financial Ltd - Financial Adviser and Joint Broker

| Jonathan Evans |

|

| Oliver Stansfield |

|

| |

|

Oak Securities - Joint Broker

| Jerry Keen |

|

| Henry Clarke |

|

| Dillon Anadkat |

|

Financial PR via [email protected]

| Violet Wilson |

+44 (0)203 757 4980 |

| Letaba Rimell |

|

Notes to Editors

Georgina Energy aims to become a leading player in the global energy market and is focused on establishing itself among the top producers of helium and hydrogen worldwide. With a strategic approach and leveraging the experienced management team's expertise, Georgina Energy aims to capitalize on opportunities in these critical energy sectors.

Georgina Energy has two principal onshore interests held through its wholly owned Australian subsidiary, Westmarket O&G. The first, the Hussar Prospect is located in the Officer Basin in Western Australia and Westmarket O&G holds a 100% working interest in the exploration permit. The second, the Mt Winter Prospect, is located in the Amadeus Basin in the Northern Territory.

In line with market demand trends, Georgina Energy is well-positioned to capitalize on the growing gap between supply and demand for hydrogen and helium with the resource potential of Mt Winter and Hussar projects for their potential accumulations.

For more information visit https://www.georginaenergy.com