The information contained within this announcement is deemed to constitute inside information as stipulated under the retained EU law version of the Market Abuse Regulation (EU) No. 596/2014 (the "UK MAR") which is part of UK law by virtue of the European Union (Withdrawal) Act 2018. The information is disclosed in accordance with the Company's obligations under Article 17 of the UK MAR. Upon the publication of this announcement, this inside information is now considered to be in the public domain.

FIRST CLASS METALS PLC

23 December 2025

Progress Update on Drilling at the North Hemlo Property

First Class Metals PLC ("First Class Metals", "FCM" or the "Company") the UK listed company focused on the discovery of economic metal deposits across its exploration properties in Ontario, Canada, is pleased to announce the successful completion of the maiden drilling programme on the North Hemlo property.

Highlights

· Maiden drilling programme successfully completed on the North Hemlo Property, confirming the Company's ability to operate efficiently across a large, structurally complex gold trend.

· Ten diamond drill holes completed over ~3km of strike along the Dead Otter trend, testing multiple priority targets.

· Five target areas each defined by previously reported high-grade grab samples, stripping results and/or soil geochemical anomalies.

· Over three hundred core samples dispatched for assay to date, including approximately one hundred additional samples currently in transit, providing a substantial dataset from this initial scout programme.

· Drilling exceeded the planned contractual minimum of seven hundred metres, reflecting both operational efficiency and the geological encouragement encountered during the programme.

· Core logging and sampling ongoing and is anticipated to be completed prior to the Christmas break.

· Multiple visually prospective zones identified and sampled in every drill hole, with repeated intersections displaying deformation, veining and sulphide mineralisation consistent with the Company's primary exploration model.

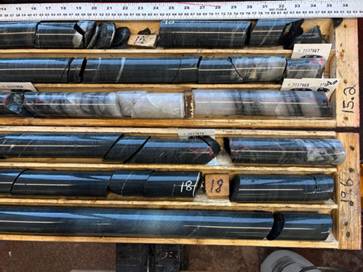

· Several logged intersections exhibit visually encouraging geological features, consistent with the Company's exploration model and supporting the decision to advance drilling. Representative examples of cut core sections displaying multiple deformed structures, contacts, clasts, veining and sulphide mineralisation are shown in Figures 1-5 below.

Marc J. Sale CEO First Class Metals commented:

"The successful completion of our maiden drill programme on the Dead Otter trend represents an important milestone for First Class Metals at North Hemlo. Ten drill holes were completed over approximately three kilometres of the trend, testing multiple priority targets within a structurally complex system.

Geological logging has identified multiple visually prospective zones in every hole, including deformation, veining, and sulphide mineralisation consistent with our exploration model, which supports the decision to advance to drilling across this trend. As expected for an initial scout programme, the objective was to confirm the presence and continuity of a mineralised system rather than to define a resource, and in that regard the programme at this stage visually has delivered a strong geological foundation.

While assay results will ultimately determine the significance of these intersections, the scale of the programme, the volume of samples generated and the geological observations to date reinforce our confidence in the exploration potential of the Dead Otter trend. I would also like to thank the drill contractor and the Emerald Geological Services team for their professionalism and commitment in delivering the programme efficiently and to a high standard."

Location & Strategic Context

The North Hemlo Project is situated within the world-class Hemlo Greenstone Belt, a district that contains the Hemlo gold mine which has produced more than twenty-three million ounces of gold since discovery.

In early December 2025, Barrick Gold Corporation completed the sale of its Hemlo Mine to Hemlo Mining Corporation ("HMC") in a transaction valued at up to US$1.09 billion. That transaction signalled a renewed and focused investment into the Hemlo district and reflects continued interest in evaluating the region's exploration potential. First Class Metals' Dead Otter trend lies contiguous with HMC's regional exploration holdings.

Ten drill holes were completed in this maiden drill programme. The metres drilled exceeded the contractual minimum of 700m. Details of the holes are reproduced below.

Table showing drill hole statistics

|

|

NH 2025 DDH Collars |

||||

| Hole_ID |

Easting |

Northing |

Elevation |

Az_deg |

Dip_deg |

| NH-25-01 |

591566 |

5410975 |

366 |

10 |

-45 |

| NH-25-02 |

591566 |

5410975 |

366 |

10 |

-70 |

| NH-25-03 |

591542 |

5410973 |

367 |

10 |

-45 |

| NH-25-04 |

591542 |

5410973 |

367 |

10 |

-70 |

| NH-25-05 |

589167 |

5412220 |

416 |

25 |

-45 |

| NH-25-06 |

589161 |

5412198 |

420 |

25 |

-45 |

| NH-25-07 |

589113 |

5412227 |

393 |

25 |

-45 |

| NH-25-08 |

588650 |

5412383 |

407 |

25 |

-45 |

| NH-25-09 |

588353 |

5412519 |

404 |

25 |

-45 |

| NH-25-10 |

588478 |

5412620 |

387 |

25 |

-45 |

In total seven distinct geochemically anomalous zones were targeted; these areas represent key focal points of gold anomalism and structural complexity along the trend.

The drillholes primarily targeted the previously reported 19.6 g/t high grade Au grab sample and zones of pronounced structural deformation ("messed up rocks"). This style of mineralisation - shear hosted orogenic style gold mineralisation is prevalent in the Hemlo greenstone belt and the model applied to the mineralisation at the Hemlo gold mine.

Figure 1/2 showing sheared mafic volcanics with quartz veining and variable but significant sulphides.

There have also been a potentially significant number of hanging wall structures, predominantly manifesting as quartz veining. The geochemical relevance is uncertain at this stage.

Additional prospective zones targeted included the 'Dead Otter showing', the zone of the 2.3 gramme grab / stripping, as well as two further areas of anomalous grab samples and soil geochemistry.

Figure 3/4 showing altered porphyritic rocks with quartz veining as well as possible intercalations of mafic volcanics and fragmentals.

Figure 5 showing silicified, fractured granodiorite with shearing and quartz veins (with chlorite/ mylonite?) occupying the shear planes

Other target areas included a site immediately north of the 2.3 g/t Au sample and the interpreted granite contact, which has now been tested with two drillholes.

First Class Metals remains open-minded with respect to mineralisation styles at the Dead Otter trend. While the primary exploration model is shear-hosted orogenic gold mineralisation within the greenstone sequence, the proximity of the trend to the Dotted Lake Pluton (granodiorite) introduces additional geological complexity and opportunity.

Accordingly, the technical team (FCM and Emerald Geological Services) considered it both prudent and technically justified to test the greenstone-granitoid contact, an area supported by anomalous gold values in historical grab samples and soil geochemistry. Such contact zones are recognised as favourable sites for structurally controlled gold mineralisation within the Superior Province whether mineralisation is hosted within granitic batholiths (e.g. Renabie) or within / adjacent to stocks and plugs (Hemlo, McIntyre-Hollinger, Macassa).

Emerald Geological Services ('EGS') continue to oversee and manage all drill-site ESG - environmental matters and geological operations, including core logging, sampling, and photography at their Manitouwadge facility. All holes have now been logged and sampling is nearing completion. It is anticipated that the remain (approximately 100) samples will be dispatched prior to Christmas.

Given the seasonal volume of samples being processed across the region, combined with the Christmas-New Year period, assay turnaround times are difficult to estimate accurately at this stage.

ENDS

Qualified Person

The technical disclosures contained in this announcement have been drafted in line with the Canadian Institute of Mining, Metallurgy and Petroleum standards and guidelines and approved by Marc J. Sale, who has more than 30 years in the gold exploration industry and is considered a Qualified person owing to his status as a Fellow of the Australian Institute of Mining and Metallurgy.

For Further Information:

Engage with us by asking questions, watching video summaries, and seeing what other shareholders have to say. Navigate to our Interactive Investor hub here: https://firstclassmetalsplc.com/announcements

For further information, please contact:

James Knowles, Executive Chair

Email: [email protected]

Tel: 07488 362641

Marc J Sale, CEO and Executive Director

Email: [email protected]

Tel: 07711 093532

AlbR Capital Limited (Financial Adviser)

David Coffman/Dan Harris

Website: www.albrcapital.com

Tel: (0)20 7469 0930

Axis Capital Markets (Broker)

Lewis Jones

Website: Axcap247.com

Tel: (0)203 026 0449

First Class Metals PLC - Background

First Class Metals listed on the LSE in July 2022 and is focused on metals exploration in Ontario, Canada which has a robust and thriving junior mineral exploration sector. In particular, the Hemlo 'camp' near Marathon, Ontario is a proven world class address for gold exploration, featuring the Hemlo gold deposit operated by Hemlo Mining Company (>23M oz gold produced), with the past producing Geco and Winston Lake base metal deposits also situated in the region.

FCM currently holds 100% ownership of seven claim blocks covering over 250km² in north west Ontario. A further three blocks are under option and cover an additional 30km2.FCM is focussed on exploring for gold, but has base metals and critical metals mineralisation. FCM is maintaining a joint venture with GT Resources on the West Pickle Lake Property, a drill-proven ultra-high-grade Ni-Cu project.

The flagship properties, North Hemlo and Sunbeam, are gold focussed. North Hemlo has a significant discovery in the Dead Otter trend which is a discontinuous 3.5km gold anomalous trend with a 19.6g/t Au peak grab sample. This sampling being the highest known assay from a grab sample ever recorded on the North Limb of Hemlo.

In October 2022 FCM completed the option to purchase the historical high-grade past-producing Sunbeam gold mine near Atikokan, Ontario, ~15 km southeast of Agnico Eagle's Hammond Reef gold deposit (3.3 Moz of open pit probable gold reserves).

FCM acquired the Zigzag Project near Armstrong, Ontario in March 2023. The property features Li-Ta-bearing pegmatites in the same belt as Green Technology Metals' Seymour Lake Project, which contains a Mineral Resource estimate of 9.9 Mt @ 1.04% Li2O. Zigzag was successfully drilled prior to Christmas 2023.

The Kerrs Gold property, acquired under option by First Class Metals in April 2024, is located in northeastern Ontario within the Abitibi Greenstone Belt, one of the world's most prolific gold-producing regions. The project holds a historical inferred resource of approximately 386,000 ounces of gold, underscoring its potential as a meaningful addition to FCM's expanding gold portfolio. Kerrs Gold complements the Company's exploration strategy and provides exposure to a well-established mining district. FCM is currently reviewing plans to advance the project and further unlock its value.

The significant potential of the properties for precious, base and battery metals relates to 'nearology', since all properties lie in the same districts as known deposits (Hemlo, Hammond Reef, Seymour Lake), and either contain known showings, geochemical or geophysical anomalies, or favourable structures along strike from known showings (e.g. the Esa project, with an inferred Hemlo-style shear along strike from known gold occurrences).

For further information see the Company's presentation on the web site:

www.firstclassmetalsplc.com

Forward Looking Statements

Certain statements in this announcement may contain forward-looking statements which are based on the Company's expectations, intentions and projections regarding its future performance, anticipated events or trends and other matters that are not historical facts. Such forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements sometimes use words such as 'aim', 'anticipate', 'target', 'expect', 'estimate', 'intend', 'plan', 'goal', 'believe', or other words of similar meaning. These statements are not guarantees of statements. Given these risks future performance and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking and uncertainties, prospective investors are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date of such statements and, except as required by applicable law, the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.