THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

23 September 2025

Globalworth Real Estate Investments Limited

("Globalworth" or the "Company")

Interim Results for the six months ended 30 June 2025

Globalworth, a leading office investor in Central and Eastern Europe, announces the release of its Interim Report and Unaudited Consolidated Financial Results for the six-month period ended 30 June 2025 (the "Interim Report").

The Interim Report is also available on Globalworth's website at: https://www.globalworth.com/investor-relations/reports-presentations/

For further information visit www.globalworth.com or contact:

Enquiries

Rashid Mukhtar

Group CFO Tel: +40 732 800 000

Panmure Liberum (Nominated Adviser and Broker)

Atholl Tweedie Tel: +44 20 7886 2500

About Globalworth / Note to Editors:

Globalworth is a listed real estate company active in Central and Eastern Europe, quoted on the AIMsegment of the London Stock Exchange. It has become the pre-eminent office investor in the CEE real estate market through its market-leading positions both in Poland and Romania. Globalworth acquires, develops and directly manages high-quality office and industrial real estate assets in prime locations, generating rental income from high quality tenants from around the globe. Managed by over 250 professionals across Cyprus, Guernsey, Poland and Romania the combined value of its portfolio is €2.6 billion, as at 30 June 2025. Approximately 98.5% of the portfolio is in income-producing assets, predominately in the office sector, being leased to a diversified array of over 650 national and multinational corporates. In Poland Globalworth is present in Warsaw, Wroclaw, Lodz, Krakow, Gdansk and Katowice, while in Romania its assets span Bucharest, Constanta, Targu Mures and Craiova.

IMPORTANT NOTICE: This announcement has been prepared for the purposes of complying with the applicable laws and regulations of the United Kingdom and the information disclosed may not be the same as that which would have been disclosed if this announcement had been prepared in accordance with the laws and regulations of any jurisdiction outside of the United Kingdom. This announcement may include statements that are, or may be deemed to be, "forward-looking statements". These forwardlooking statements may be identified by the use of forward-looking terminology, including the terms "targets", "believes", "estimates", "plans", "projects", "anticipates", "expects", "intends", "may", "will" or "should" or, in each case, their negative or other variations or comparable terminology, or by discussions of strategy, plans, objectives, goals, future events or intentions. These forward-looking statements include all matters that are not historical facts and involve predictions. Forward-looking statements may and often do differ materially from actual results. Any forward-looking statements reflect the Company's current view with respect to future events and are subject to risks relating to future events and other risks, uncertainties and assumptions relating to the Company's business, results of operations, financial position, liquidity, prospects, growth or strategies and the industry in which it operates. Forward-looking statements speak only as of the date they are made and cannot be relied upon as a guide to future performance. Save as required by law or regulation, the Company disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this announcement that may occur due to any change in its expectations or to reflect events or circumstances after the date of this announcement.

GLOBALWORTH REAL ESTATE INVESTMENTS LIMITED

INTERIM REPORT AND UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

30 JUNE 2025

FINANCIAL HIGHLIGHTS: H1 2025

| Combined portfolio open market value €2.6bn |

|

Shareholders' equity

€1.5bn |

|

Dividends paid in H1-25

9 cents |

| 0.6 % on YE-24 |

|

0.5 % on YE-24 |

|

11 cents in H1-24 |

| |

|

|

|

|

| NOI

€67.0m |

|

NOI1 Like-for-like

€68.6m |

|

LTV

38.0% |

| -7.4 % in H1-24 |

|

2.9% in H1-24 |

|

38.1% at YE-24 |

| |

|

|

|

|

| Adjusted normalised EBITDA3 €57.3m |

|

EBITDA3 Like-for-like

€58.9m |

|

Cash and cash equivalents

€325.4m |

| -9.9 % in H1-24 |

|

1.5 % in H1-24 |

|

€333.6m on YE-24 |

| |

|

|

|

|

| IFRS Earnings per share

3 cents |

|

EPRA Earnings per share

6 cents |

|

EPRA NRV per share

€5.67 |

| -24 cents in H1-24 |

|

11 cents in H1-24 |

|

-3.7 % on YE-24 |

Net Operating Income ('NOI')

Loan to value ('LTV')

3 Earnings before interest, taxes, depreciation, and amortisation ('EBITDA')

Restated for scrip shares in October 2024 and April 2025

CHIEF EXECUTIVE'S REVIEW

Dear Stakeholders,

We have embarked 2025 with a sense of optimism and responsibility after a few years which proved to be more demanding and volatile than the average year. Globalworth has grown in terms of core business resilience and has adapted to multiple challenges, while balancing between a prudent financial policy and its mission of remaining the landlord of choice when it comes to providing best in class office spaces and services to its partners.

Our two markets, Poland and Romania, are increasingly linked to the greater EU economy, now, as geopolitical and trade tensions remain high, and an intensified sense of national pride lies in the background of most electoral outcomes of the latest year.

The European Commission's May'25 forecasts show the EU GDP growing by 1.1% in 2025 and 1.5% in 2026 with Poland and Romania expected to outperform EU average and have a growth of 3.3% and 1.4% in 2025 followed by 3.0% and 2.2% in 2026, respectively.

Globalworth's performance throughout the first half of the year was characterised once again by resilience and robustness, as we continued to implement our "local landlord" approach, with an increasing focus on sustainability and financial prudence.

We consider ourselves better prepared for future challenges and opportunities, now, that we have significantly strengthened our financial and debt profile, following last year's bond refinancing. The disposal of non-core assets not only contributed to this strengthening but has allowed us to focus on our core, office and mixed-use portfolio, carefully considering and applying select initiatives aimed at preserving and enhancing value for all our stakeholders.

Having in mind the above, my grateful thoughts go towards all our team members which proved that their dedication, commitment and positive attitude, does make a difference. I am, as well, extending my appreciation to all our stakeholders, partners and communities for their steadfast support and the trust that they put in us.

Our Portfolio

Our portfolio predominantly consists of Class "A" office spaces, which are complemented by additional investments in a few landmarks, mixed-use (office & retail) assets located in Poland, a residential investment with a retail component, one logistic property in Romania and several plots of land that ensure future development potential for our business.

During the first six months of 2025, the footprint of our standing portfolio remained constant at just above 1 million sqm, affected only by the sale of residential and retail units. At the end of June 2025, we were in the course of formalizing the acceptance of refurbishment works in Renoma, our mixed-use property in Wroclaw, Poland, which, after completion will further add 48.3k sqm of high-quality GLA to our standing portfolio.

Considering the rising popularity of hybrid work seen during the last years, we have started developing back in 2024 our "Ace of Space" concept, a flexible office solution, which has now reached 13.5k sqm of premium GLA being serviced by our dedicated teams, located in Warsaw and four other Polish regional centres.

The total combined portfolio value slightly increased by 0.6% during the first semester of the year sustained by an improving macroeconomic predictability and a slight upward trend of rental levels across our markets of interest. The impact of high interest and discount rates on commercial valuations has been mostly assimilated in the previous years, and a more stable outlook is expected, conditioned no future shocks occurring at macroeconomic and geopolitical levels.

Our Leasing and Occupancy

The leasing of our spaces remains a pivotal determinant of our business's success. During the initial half of 2025, we successfully managed the leasing of 52.3k sqm of commercial spaces, with a Weighted Average Lease Length (WALL) of 5.1 years.

As of June 30, 2025, the average occupancy rate across our combined commercial portfolio stood at 85.9%, decreasing in comparison to the year-end 2024, when it stood at 86.7%. Virtually all this decrease is attributable to spaces becoming available in two of our Bucharest office projects, while we still maintain above 95% occupancy in our Bucharest offices.

In both Romanian and Polish markets, the office supply remains at historical low levels affected by a combination of increased construction costs, tighter access to capital markets and the volatile demand of the previous years. As this demand picks up within a more predictable macroeconomic environment, we estimate the upward pressure on prime rents to continue, as the "flight-to-quality" of tenants will further enhance the desirability of A-grade, well-located assets with strong ESG performance such as the Globalworth assets, considering their increasing scarcity.

Our total annualised contracted rent slightly increased with 0.1%, reaching €187.7 million compared to the year-end 2024 figures (€187.5 million) as the positive effect of rent indexations was offset by negative net take up, mostly driven by the two of our Bucharest assets as mentioned above.

Our Financial Results

We recorded €74.9 million net rental income, €1.9 million higher on a like-for-like basis compared to the first half of last year as an effect of indexation and partially offset by the reduced rates at which existing leases were renewed for extended period or new leases were signed, accounting also for the new lease incentives amortisation during the period.

Our net service charge result is €6.3 million, €0.1 million higher for like-for-like properties. Total net operating income presented for the first half of 2025 is €67.9 million, after accounting the €1.6 million one off non recoverable property costs in Poland.

Our adjusted normalised EBITDA, for like-for-like properties, reached €58.9 million, after deducting recurring administrative and other expenditure categories.

Our net result for the initial half of 2025 shows a net profit of €8.0 million (€65.2 million loss in similar period 2024) with only €1.7 million loss recorded from fair valuation of investment properties.

Dividend

During March 2025, we announced the second interim dividend of €0.09 per share in respect of the twelve-month financial period ended 31 December 2024 with a scrip dividend alternative at a reference price of €2.08 per scrip aimed at preserving liquidity. Approximately 98.2% of the shareholders elected to receive scrip dividend shares thus resulting in only €0.5 million cash dividends outflows.

Also, in August 2025, we announced the payment of an interim dividend in respect of the six-month ended 30 June 2025 of €0.05 per ordinary share, payable on 26 September 2025. For this interim dividend, the Board has decided not to offer a scrip dividend alternative, as it is not necessary in order to meet the applicable bond restrictions. The Board may consider offering such an alternative for future interim dividends should the circumstances so require.

Balance Sheet

We hold €2,608 million investment properties, being strongly present in the two capital cities, Bucharest and Warsaw, with several commercial office buildings having occupancy above 85% and high ESG credentials, provides us with a unique strength in arranging additional secured facilities with local and regional banks in our markets.

Our cash and cash equivalent balance as of 30 June 2025 is still strong reaching €325 million, with further €115 million in undrawn debt facilities, out of which €50 million is available to draw until December 31, 2025 and €65 million were drawn in August. We successfully refinanced €100 million secured facility, which was expiring in May 2025, by extending it for another five years therefore we have no material debt maturing until 2027.

We secured our financing costs by reaching having 95.9% from total debt that carries a fixed/ hedged interest rate at the end of June 2025 (86.5% as of 31 December 2024), with 45% of total debt is unsecured financing from public debt markets. Our average debt maturity period is 4.7 years (4.9 years as of 31 December 2024) and our leverage ratio to 38.0% (38.1% as of 31 December 2024). This is consistent with the Group's strategy to manage its long-term target LTV of around or below 40%.

The EPRA Net Reinstatement Value (NRV) as of 30 June 2025 was €1.64 billion, or €5.67 per share, showing a 3.70% decrease from €5.89 per share on December 31, 2024, mostly impacted by the increase in number of shares following the scrips dividend shares issued in April 2025.

Fitch Ratings re-affirmed, in July 2025, Globalworth's investment grade rating, keeping the stable outlook, following the annual review of our ratings. S&P Global Ratings changed, during first semester, the rating to BB (from BB+) and the outlook to stable.

Environmental and social

We maintained our A-rating by MSCI and a low-risk rating by Sustainalytics. We issued our seventh Sustainable Development Report during the period.

We continued investing in our green portfolio and, during the first six months of 2025, we certified or recertified 6 properties in our Romanian portfolio with LEED Platinum, the highest certification of such type. We are proud to manage, at the end of June 2025, a portfolio of 52 green-certified properties valued at €2.5 billion, accounting for more than 98.2% of our total standing portfolio value.

We remain committed to our environmental target to reduce GHG emissions intensity by 46% by 2030 versus our baseline 2019 levels (for Scope 1 and 2), a target validated by the globally recognised Science Based Targets initiative (SBTi).

Outlook

With many of the headwinds affecting the office sector now dissipating and a more predictable macroeconomic environment, our business is ready to capitalise on the challenges and opportunities that may unfold. We have steered our strategy towards value preservation and enhancement through select spending initiatives that emphasise ESG performance and wellbeing, while adapting to relevant market trends like hybrid work, as we continue to uphold our mission of being the landlord of choice for corporates and multinationals operating in our markets.

The market fundamentals in our focus countries remain notably stronger than those of Western Europe, with estimated macroeconomic performance set to once again surpass the EU average performance. The office market we are operating in is now a blend of hybrid work and return to office schemes, which highlight the importance of well-being, collaboration, innovation and sustainability. We are continuously evaluating the performance of our portfolio, and we are closely assessing and implementing various portfolio optimisation initiatives aimed at keeping our best-in-class assets among the first choices of any company looking for spaces that define and add value to their business.

We consider that, due to our size and visibility of our assets, we are well-positioned to capitalise on current market trends and on opportunities of further enhancing our portfolio. As we maintain our dedication towards operational efficiency and solid financial policy, we are selectively pursuing investment initiatives that align with our strategic objectives.

Looking ahead, our path remains clear. We continue to capitalise on our scale, expertise, and integrated model to deliver stable cashflows. We keep our commitment to delivering long-term value for our stakeholders, responding swiftly to market dynamics, and pursuing opportunities that support our growth ambitions.

Dennis Selinas

Chief Executive Officer

23 September 2025

MANAGEMENT REVIEW

REAL ESTATE ACTIVITY

| During the first half of the year, Globalworth has focused its attention on its core asset base by continuing its renovation and proactive maintenance program aimed at preserving and enhancing the quality and desirability of our premium assets. "Ace of Space" brand, the group's flexible office solution, is now operating 13.5k sqm of GLA in seven locations in Warsaw and four other Polish cities, providing our tenants with best-in-class spaces and all the amenities needed to acquire and retain talents and helping them boost their corporate identity and brand. After delivering the newly renovated Supersam mixed-use property back in 2024, we are in course of finishing refurbishment works in Renoma, our mixed-use asset from Wroclaw, Poland, re-adding 48.3k sqm of GLA to our standing commercial portfolio. |

"Ace of Space" - our approach to flexible offices

After launching in 2024, our flexible office solution, " Ace of Space " is now fully operational in Warsaw and four other cities in Poland, offering premium spaces for our partners. These spaces are operated through a special group company, and the concept is addressing to tenants looking for smaller but high-quality spaces, usually for the short and medium term. This brings flexibility to our partners when planning for a new office while offering them access to our premium locations and state-of-the art spaces to help attract and retain talents and build their corporate identity.

As of June 30th, we had 13.5k sqm of GLA in our flex office portfolio across seven properties in Poland, with an average occupancy of 55.9%.

| Globalworth Flex Office Portfolio |

||||||||

|

|

Tryton Business House |

Quattro Business Park |

Retro Office House |

Silesia Star |

Supersam |

Skylight & Lumen |

Renoma |

TOTAL |

| Location |

Gdansk |

Krakow |

Wroclaw |

Katowice |

Katowice |

Warsaw |

Wroclaw |

|

| GLA (k sqm) |

0.5 |

1.5 |

1.2 |

1.2 |

3.6 |

3.0 |

2.5 |

13.5 |

| Occupancy (%) |

89.1% |

27.6% |

41.0% |

22.5% |

67.7% |

89.0% |

32.7% |

55.9% |

| 100% rent (€m) |

0.2 |

0.6 |

0.4 |

0.1 |

1.7 |

1.2 |

0.8 |

5.0 |

Review of Development Potential

During the first part of the year, we have focused on pro-active maintenance program and select capex initiatives aimed at preserving and enhancing the value of our core asset base.

In Poland, the reception of refurbishment works of our iconic Renoma mixed-use asset, after several delays, is expected to finally take place in the following months after agreement of final details with the construction company. The property is now offering a more attractive food court and an increase in office GLA compared to pre-refurbishment status.

| Properties Under Refurbishment / Repositioning |

|

|

|

Renoma |

| Location |

Wroclaw |

| Status |

Refurbishment / Repositioning |

| GLA - on Completion (k sqm) |

48.3 |

| GAV (€ m) |

115.6 |

| Occupancy (%) |

63.1% |

| Contracted Rent (€m) |

6.5 |

| ERV Rent at 100% (€ m) |

9.8 |

Future Developments

We own, directly or through JV partnerships, other land plots in prime locations in Bucharest and Constanta, Romania and in Krakow, Poland, covering a total land surface of 0.3 million sqm (comprising 1.5% of the Group's combined GAV), for future developments of office, industrial or mixed-use properties. When fully developed, these land plots have the potential to add a total of a further c. 224.5k sqm of high-quality GLA to our standing portfolio footprint.

These projects, which are classified as "Future Development", continue to be reviewed by the Group periodically. The pace at which they will be developed is subject to tenant demand and general market conditions.

| Future Developments |

|

|

|

|

|

|

|

Podium Park III |

Green Court D |

Globalworth West |

Constanta Business Park (Phased) |

Luterana |

| Location |

Krakow |

Bucharest |

Bucharest |

Constanta |

Bucharest |

| Status |

Postponed |

Postponed |

Postponed |

Planned |

Planned |

| GLA (k sqm) |

17.7 |

17.2 |

33.4 |

129.8 |

26.4 |

| CAPEX to 30 Jun 25 (€ m) |

8.5 |

3.3 |

5.2 |

3.3 |

7.4 |

| GAV (€ m) |

6.3 |

7.1 |

6.0 |

7.9 |

12.3 |

| Estimated CAPEX to Go (€ m)* |

29.7 |

38.0 |

38.5 |

60.2 |

39.7 |

| ERV (€ m) |

3.1 |

4.3 |

6.2 |

6.9 |

6.8 |

| Estimated Yield on Development Cost |

8.1% |

10.4% |

14.1% |

10.9% |

14.4% |

(*) Initial preliminary development budgets on future projects to be revised periodically or prior to the permitting.

ASSET MANAGEMENT REVIEW

| · 52.3k sqm of commercial space taken up or extended at an average WALL of 5.1 years, with Romania accounting for 53.1% of leases signed in the first six months of 2025 · New leases (including expansions) accounted for 45.9% of our leasing activity at a WALL of 5.6 years, with renewals signed at a WALL of 4.7 years · Total annualised contracted rent remained stable at €187.7 million, up just 0.1% compared to the year-end 2024, as the positive impact of indexations was offset by negative net take-up during the first half of the year · Like-for-like annualised contracted rent from our standing commercial assets owned throughout the first 6 months of the year was also stable at €181.0m (€181.2 as of Dec'24) · Total combined portfolio value slightly increased by 0.6% to €2.6 billion, under the effect of small valuation gains. |

Leasing Review

New Leases

Our principal focus continues to be the prolongation of leases with existing tenants in our portfolio and the take-up of available spaces in standing properties and developments, maximising the utilization degree and efficiency of our buildings.

In the first six months of 2025, the Group successfully negotiated the take-up (including expansions) or extension of 52.3k sqm of commercial spaces in Poland (46.9% of transacted GLA) and Romania (53.1% of transacted GLA), with an average WALL of 5.1 years. Between 1 January and 30 June 2025, our leasing activity involved new take-up of available spaces, with such leases accounting for 45.9% of our total leasing activity signed at a WALL of 5.6 years, while renewals were signed at a WALL of 4.7 years.

The office leasing market has emerged more stable and vibrant from the challenges of the previous years, with a clear differentiation now seen between capital cities compared to regional cities and between grade A and grade B properties. CEE growth rates continue to be estimated higher compared to Western Europe, with inflation normalized and interest rates stabilizing. Hybrid work has set new trends and many of the office landlords have adapted and responded to the need for flexibility manifested by tenants.

In total, we signed new take-up for 24.0k sqm of GLA, with 68.4% involving spaces leased to new tenants, and the remaining areas being taken up by existing tenants who were expanding their operations.

New leases were signed with 25 tenants for 16.4k sqm of GLA at a WALL of 5.6 years. The majority were for office spaces, accounting for 76.7%, with the remainder involving mostly retail and other commercial spaces. The largest new leases in this period were with Polish Water Management Authority (3.1k sqm) in Tryton Business House (Gdansk), Schneider Electric (2.3k sqm) in Globalworth Campus (Bucharest) and Drager Polska (2.1k sqm) in Silesia Star (Katowice).

In addition, 14 tenants signed new leases, expanding their operations by 7.6k sqm at an average WALL of 5.6 years, with the most notable being the expansion of Banca Transilvania (3.1k sqm) in Green Court Complex (Bucharest).

We renewed leases for a total of 28.3k sqm of GLA with 37 of our tenants at a WALL of 4.7 years. The most notable extensions involved Regina Maria (3.3k sqm) in Globalworth Tower (Bucharest), Jaral Sp. Z.o.o. (3.0k sqm) in Rondo Business Park (Krakow), PGE Energia (2.3k sqm) in Skylight & Lumen (Warsaw) and Chain IQ Services (2.2k sqm) in Globalworth Campus (Bucharest), while c.59% of the renewals by GLA signed were for leases that were expiring in 2026 or later.

| Summary Leasing Activity for Combined Portfolio in H1-2025 |

|||

| |

GLA (k sqm) |

No. of Tenants* |

WALL (yrs) |

| New Leases (incl. expansions) |

24.0 |

37 |

5.6 |

| Renewals / Extensions |

28.3 |

37 |

4.7 |

| Total |

52.3 |

70 |

5.1 |

| *Number of individual tenants |

|||

Rental Levels

During the latest years, headline rental levels started to display a slight upward pressure, mostly influenced by indexation, but also by the limited new supply of high-quality spaces coming into the market. We expect this trend to continue, despite challenges in the market, but with different impact depending on the location, ESG credentials and office asset class.

Most of our leases typically adjust annually in the first quarter of the year, and in the first half, eligible leases were indexed at an average of 2.5%. However, this positive impact was partly offset by the rates at which leases were renewed or new leases signed throughout the period.

At the end of June 2025, our average headline rent in our standing properties for office, retail/commercial and industrial spaces were €16.1/sqm/month (€15.9 at YE-2024), €15.7/sqm/month (€16.2 at YE-2024) and €4.5/sqm/month (€4.4 at YE-2024) respectively.

Office leases signed in the first half of the year were at an average rent of €16.6/sqm/month while retail spaces were leased at an average of €13.3/sqm/month. The overall commercial GLA take-up during the first six months of 2025 was at an average rent of €15.9/sqm/month.

Contracted Rents (on annualised basis)

Total annualised contracted rent across our portfolio in Poland and Romania was stable during the first months reaching €187.7 million, only 0.1% higher compared to year-end 2024, as the impact of rent indexations was offset by negative net take-up.

Like for like total annualised contracted rents in our standing commercial portfolio were €181.0 million on 30 June 2025, slightly lower by 0.1% compared to 31 December 2024, increasing to €187.5 million when including rental income contracted in Renoma, our mixed-use property in Wroclaw, currently under refurbishment.

| Annualised Contracted Rent Evolution H1-2025 (€m) |

|||

|

|

Poland |

Romania |

Group |

| Rent from St. Comm. Props ("SCP") 31 Dec 2024 |

91.3 |

89.9 |

181.2 |

| Less: Assets sold |

- |

- |

- |

| Rent from SCP Adj. for Properties sold |

91.3 |

89.9 |

181.2 |

| Less: Space Returned |

(2.9) |

(4.4) |

(7.3) |

| Plus: Rent Indexation |

1.5 |

1.7 |

3.2 |

| Plus/Less: Lease Renewals (net impact) & Other |

(0.2) |

(0.2) |

(0.4) |

| Plus: New Take-up |

2.1 |

2.2 |

4.3 |

| Total L-f-L Rent from SCP 30 Jun 2025 |

91.8 |

89.2 |

181.0 |

| Plus: Standing Commercial Properties Acquired During the Period |

- |

- |

- |

| Plus: Developments Completed During the Period |

- |

- |

- |

| Total Rent from Standing Commercial Properties |

91.8 |

89.2 |

181.0 |

| Plus: Residential Rent |

- |

0.2 |

0.2 |

| Total Rent from Standing Properties |

91.8 |

89.4 |

181.2 |

| Plus: Active and Pre-lets of Space on Projects Under Development / Refurbishment |

6.5 |

- |

6.5 |

| Total Contracted Rent as at 30 Jun 2025 |

98.3 |

89.4 |

187.7 |

| Annualised Commercial Contracted Rent Profile as of 30 June 2025 |

|||

| |

Poland |

Romania |

Group |

| Contracted Rent (€ m) |

98.3 |

89.1 |

187.5 |

| Tenant origin - % |

|||

| Multinational |

65.1% |

80.8% |

72.6% |

| National |

33.5% |

17.3% |

25.8% |

| State Owned |

1.4% |

1.8% |

1.6% |

| Note: Commercial Contracted Rent excludes c.€0.2 million from residential spaces as of 30 June 2025

|

|||

| Annualised Contracted Rent by Period of Commencement Date as of 30 June 2025 (€m) |

|

||||

| |

Active Leases |

H2-2025 |

>2025 |

Total |

|

| Standing Properties |

178.4 |

2.8 |

- |

181.2 |

|

| Developments |

6.5 |

0.0 |

- |

6.5 |

|

| Total |

184.9 |

2.8 |

- |

187.7 |

|

| |

|

|

|

|

|

| Annualised Commercial Portfolio Lease Expiration Profile as of 30 June 2025 (€m) |

||||||||||

| Year |

H2-2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

>2033 |

| Total |

6.9 |

15.4 |

24.2 |

24.4 |

30.6 |

34.1 |

18.8 |

11.6 |

4.1 |

17.2 |

| % of total |

3.7% |

8.2% |

12.9% |

13.0% |

16.3% |

18.2% |

10.0% |

6.2% |

2.2% |

9.2% |

The Group's rent roll across its combined portfolio is well diversified, with the largest tenant accounting for 3.5% of contracted rents, while the top three tenants account for 9.5% and the top 10 account for 23.6%.

Cost of Renting Spaces

The headline (base) rent presents the reference point, which is typically communicated in the real estate market when a new lease is signed. However, renting spaces typically involves certain costs, such as rent-free periods, fitouts for the space leased, and brokerage fees, which the landlords incur. These incentives can vary significantly between leases and depend on market conditions, type of lease (new take-up or lease extension), space leased (office, industrial, other), contract duration and other factors.

In calculating our effective rent, we account for the costs incurred over the lease's lifetime, which we deduct from the headline (base) rent, thus allowing us to assess the profitability of a rental agreement.

Overall, in the first half of 2025, we successfully negotiated the take-up (including expansions) or extension of 49.5k sqm of commercial spaces in our portfolio, excluding leases signed with group entity for flexible office spaces or other leases granted in connection to our social commitments. The weighted average effective rent for these new leases was €13.0/sqm/month with a WALL of 5.4 years.

The difference between headline (base) and effective rents in the first half of 2025 was, on average, 18.2%, lower than FY2024 (average of 27.1%), considering the relatively low level of leasing activity in the first half of 2025.

In total, new leases signed in the first six months of the year will generate a future headline rental income of €53.2 million (including auxiliary spaces and revenues from GW flex offices), with leases from office properties accounting for 93.8% of future headline rental income.

| Weighted Average Effective Rent (€ / sqm / m) - H1-2025 |

|

|

|

||

|

|

Poland |

Romania |

Group |

||

| Headline Commercial Rent |

15.9 |

15.9 |

15.9 |

||

| Less: Rent Free Concessions |

(2.0) |

(1.0) |

(1.4) |

||

| Less: Tenant Fitouts |

(1.5) |

(1.0) |

(1.2) |

||

| Less: Broker Fees |

(0.5) |

(0.1) |

(0.3) |

||

| Effective Commercial Rent |

11.9 |

13.8 |

13.0 |

||

| WALL (in years) |

4.9 |

5.9 |

5.4 |

||

| |

|

|

|

|

|

Portfolio Valuation

In line with our practice of biannual valuations, our entire portfolio in Poland and Romania was revalued as of 30 June 2025.

The valuations were performed by Knight Frank for our properties in Poland, with Colliers and Cushman & Wakefield valuing our properties in Romania (more information is available under note 4 of the unaudited interim condensed consolidated financial statements as of and for the period ended 30 June 2025).

Assigning the appraisal of our portfolio to independent and experienced service providers makes the process of determining the value properties transparent and impartial. Through our oversight, we ensure that a consistent methodology, reporting, and timeframe are respected.

Our portfolio, since the inception of the Group, has been growing to reach €3.2 billion as of 31 December 2022, following series of acquisitions and development of high-quality office and logistic / light industrial assets in Poland and Romania. Subsequently, in the following, high-inflation, years our focus has switched to preserving the value of our core assets and towards liquidity enhancing initiatives resulting in the disposal of our non-core, industrial portfolio back in 2024.

The first half of 2025 was entirely focused on core-portfolio initiatives aimed at value preservation without any additions of newly acquired or developed assets or disposals of other non-core assets, except for units sold from Upground Residential project. Without such developments, the portfolio's third-party appraised value on 30 June 2025 was estimated at €2.6 billion, slightly up with 0.6% compared to the value as of December 2024, impacted mostly by a small positive valuation gain.

In valuing our properties, the key market indicators used by our independent appraisers, although they vary, consider factors such as the commercial profile of the property, its location and the country in which it is situated. These factors have remained consistent with year-end 2024, with ERVs displaying selective upward trend, especially in prime locations and for class A assets.

| Combined Portfolio Value Evolution 30 June 2025 (€m) |

|||

|

|

Poland |

Romania |

Group |

| Total Portfolio Value on 31 Dec 2024 |

1,404.0 |

1,195.7 |

2,599.7 |

| Less: Properties Held in Joint Venture (*) |

- |

(7.9) |

(7.9) |

| Total Investment Properties on 31 Dec 2024 |

1,404.0 |

1,187.8 |

2,591.8 |

| Plus: Transactions |

- |

(3.5) |

(3.5) |

| o/w New Acquisitions |

- |

- |

- |

| o/w Disposals |

- |

(3.5) |

(3.5) |

| Plus: Capital Expenditure |

9.3 |

10.6 |

19.8 |

| o/w Developments |

- |

- |

- |

| o/w Standing Properties |

9.3 |

10.6 |

19.8 |

| o/w Future Developments |

- |

- |

- |

| Plus: Net Revaluations Adjustments |

(1.7) |

1.7 |

(0.0) |

| o/w Developments |

4.7 |

- |

4.7 |

| o/w Standing Properties |

(6.4) |

1.7 |

(4.7) |

| o/w Lands, Future Developments & Acquisitions |

- |

- |

- |

| Total Investment Properties on 30 Jun 2025 |

1,411.6 |

1,196.6 |

2,608.2 |

| Plus: Properties Held in Joint Venture (*) |

- |

7.9 |

7.9 |

| o/w Capital Expenditure & Acquisitions |

- |

- |

- |

| o/w Net Revaluation Adjustments |

- |

- |

- |

| Total Portfolio Value on 30 Jun 2025 |

1,411.6 |

1,204.5 |

2,616.1 |

(*) Joint Venture Portfolio is shown at 100%; Globalworth owned 50% stake as of June 30th,2025.

STANDING PORTFOLIO REVIEW

| Standing portfolio footprint stable at 1,011.6k sqm valued at €2.5 billion as of 30 June 2025, reaching €2.6 billion after including the value of assets under refurbishment and of land plots. Average standing occupancy of our combined commercial portfolio of 85.9%, slightly lower vs. year-end 2024 (86.7%) Total contracted rent of €181.2 million in our standing properties (over 90% coming from office properties). All our properties in Poland are now internally managed, resulting in 96.4% of our combined standing commercial portfolio by value (96.6% of office and mixed-use standing properties) being internally managed by the Group. |

Standing Portfolio Evolution

The footprint of our standing commercial portfolio remained basically unchanged during the first half of 2025 just above 1 million sqm valued at €2.5 billion.

Overall, our standing portfolio is almost entirely focused on 28 Class "A" office (48 properties in total) and two mixed-use investments (with six properties in total) in central locations in Bucharest (Romania), Warsaw (Poland) and five of the largest office markets/cities of Poland (Krakow, Wroclaw, Katowice, Gdansk and Lodz), which account for more than 98.0% of our standing portfolio by value. In addition, in Romania we own a small logistic park in Craiova and part of a residential complex in Bucharest with a retail component at ground floor.

As of 30 June 2025, our combined standing portfolio comprised 32 investments with 56 buildings in Poland and Romania without any changes compared to the beginning of the year.

The appraised value of our combined standing portfolio as of 30 June 2025 was €2.5 billion (more than 99% in commercial properties), which was 0.5% higher compared to 31 December 2024, the small increase being mostly due to valuation gains. Our standing office and mixed-use properties were valued at €2,429.0m as of 30 June 2025, registering a €15.4m like-for-like uplift compared to 31 December 2024.

Globalworth Combined Portfolio: Key Metrics

| Total Standing Properties |

31 Dec. 2023 |

31 Dec. 2024 |

30 Jun. 2025 |

| Number of Investments |

41 |

32 |

32 |

| Number of Assets |

71 |

56 |

56 |

| GLA (k sqm) |

1,386.0 |

1,014.0 |

1,011.6 |

| GAV (€ m) |

2,736.4 |

2,449.2 |

2,460.9 |

| Contracted Rent (€ m) |

192.0 |

181.5 |

181.2 |

| Of which Commercial Properties |

31 Dec. 2023 |

31 Dec. 2024 |

30 Jun. 2025 |

| Number of Investments |

40 |

31 |

31 |

| Number of Assets |

70 |

55 |

55 |

| GLA (k sqm) |

1,367.4 |

1,003.7 |

1,003.0 |

| GAV (€ m) |

2,700.0 |

2,428.5 |

2,443.1 |

| Occupancy (%) |

88.3% |

86.7% |

85.9% |

| Contracted Rent (€ m) |

191.5 |

181.2 |

181.0 |

| Potential rent at 100% occupancy (€ m) |

217.7 |

205.5 |

207.1 |

| WALL (years) |

4.9 |

4.6 |

4.4 |

| Evolution of Combined Standing Portfolio over H1-2025 |

|

|

|

|

|

|||||

| |

31 Dec. 2024

|

LfL Change*

|

New Acquisitions |

Sales |

New Deliveries

|

Reclass. & Other Adj** |

30 Jun. 2025

|

|

||

| GLA (k sqm) |

1,014.0 |

- |

- |

(2.1) |

- |

(0.3) |

1,011.6 |

|

||

| GAV (€ m) |

2,449.2 |

15.1 |

- |

(3.5) |

- |

- |

2,460.9 |

|

||

| |

|

|

|

|

|

|

|

|

|

|

(*) Like-for-Like change represents the changes in GLA or GAV of standing properties owned by the Group at 31 December 2024 and 30 June 2025.

(**) Includes impact in areas (sqm) from the remeasurement of certain properties and other GAV adjustments (redevelopment capex, reclassification).

Standing Portfolio Occupancy

Our standing commercial portfolio's average occupancy as of 30 June 2025 was 85.9%, representing a small decrease of 0.9% over the past six months (86.7% as of 31 December 2024), mostly impacted by spaces becoming available in two of our office properties from Bucharest.

Across the portfolio, at the end of the first half of 2025, we had 861.1k sqm of commercial GLA leased to more than 630 tenants at an average WALL of 4.4 years, the majority of which is let to national and multinational corporates that are well-known within their respective markets.

In addition, we had 30.5k sqm leased in Renoma mixed-use property (Wroclaw, Poland), which was under refurbishment/repositioning as of 30 June 2025 and was not included in our standing portfolio metrics.

| Occupancy Evolution H1-2025 (GLA 'k sqm) - Commercial Portfolio |

||||||

|

|

Poland |

Occupancy Rate (%) |

Romania |

Occupancy Rate (%) |

Group |

Occupancy Rate (%) |

| Standing Available GLA - 31 Dec. 24 |

530.4 |

|

473.3 |

|

1,003.7 |

|

| Sold GLA |

- |

|

(0.5) |

|

(0.5) |

|

| Acquired GLA |

- |

|

- |

|

- |

|

| New Built GLA |

- |

|

- |

|

- |

|

| Remeasurements, reclassifications |

(0.3) |

|

0.0 |

|

(0.3) |

|

| Standing Available GLA - 30 Jun. 25 |

530.1 |

|

472.9 |

|

1,003.0 |

|

| Occupied Standing GLA - 31 Dec. 24 |

412.5 |

77.8% |

458.3 |

96.8% |

870.7 |

86.7% |

| Sold Occupied GLA |

- |

|

- |

|

- |

|

| Acquired/Developed Occupied GLA |

- |

|

- |

|

- |

|

| Expiries & Breaks |

(13.1) |

|

(21.0) |

|

(34.1) |

|

| Renewals* |

12.7 |

|

15.4 |

|

28.1 |

|

| New Take-up |

11.5 |

|

12.4 |

|

23.9 |

|

| Other Adj. (relocations, remeasurements, etc) |

(0.0) |

|

0.6 |

|

0.5 |

|

| Occupied Standing GLA - 30 Jun. 25 |

410.9 |

77.5% |

450.2 |

95.2% |

861.1 |

85.9% |

* Renewals are neutral to the occupancy calculation.

Standing Properties Operation and Upgrade Programme

Offering best-in-class real estate space to our business partners remains a key component of our strategy at Globalworth.

We believe that through a "hands-on" approach with continuous active management and investment in our portfolio, we can preserve and enhance the value of our properties, generate long-term income, and offer premium real estate space to our business partners.

To be able to provide spaces for our current and future business partners' requirements, we keep (re)investing in our properties, maintain and, where required, improve the quality of our buildings and our services.

We are pleased that all our properties in Poland are now internally managed by the Group. In Romania, we manage all but one of our offices in-house. Overall, we internally manage 954.8k sqm of high-quality commercial spaces with an appraised value of €2.4 billion. Of our total standing commercial portfolio, internally managed properties account for 96.4% by value (96.6% of office and mixed-use standing properties) as of 30 June 2025.

In the first half of 2025, we invested €19.8 million in select improvement initiatives in our standing commercial portfolio. As a result of our ongoing in-house initiatives and property additions, we hold a modern portfolio with 36 of our standing commercial properties, accounting for 68.6% by GLA and 70.1% by commercial portfolio value, having been delivered or significantly refurbished in the last 10 years.

| Internally Managed Commercial Portfolio as of 30 June 2025 |

Poland |

Romania |

Group |

| Internally Managed GLA (k sqm) |

530.1 |

424.7 |

954.8 |

| % of Commercial GLA |

100% |

90% |

95% |

| % of Office and Mixed-Use GLA |

100% |

91% |

96% |

| Internally Managed GAV (€ m) |

1,289.7 |

1,065.1 |

2,354.8 |

| % of Commercial GAV |

100% |

92% |

96% |

| % of Office and Mixed-Use GAV |

100% |

93% |

97% |

SUSTAINABLE DEVELOPMENT UPDATE / OTHER INITIATIVES

| Overall, we own 52 green certified properties in our portfolio valued at €2.5 billion, accounting for 96.8% of our total portfolio value. 6 properties were certified or recertified with LEED Platinum certifications in our Romanian portfolio during H1-2025. All our office properties in Romania have a WELL Health-Safety rating, further demonstrating the quality of our portfolio. Issued the seventh sustainable development report for the Group for FY 2024. Globalworth maintained its low-risk rating by Sustainalytics and A by MSCI. c.€130k donated to over17 initiatives in Romania and Poland . |

Green Buildings

Consistent with our commitment to energy-efficient properties, during H1-2025 we certified or recertified 6 properties in our Romanian portfolio with LEED Platinum, the highest certification of such type.

Overall, as of 30 June 2025, our combined standing portfolio comprised 51 green-certified properties, accounting for 99.0% of our standing commercial portfolio by value. BREEAM-accredited properties account for 59.7% of our green-certified standing portfolio by value, with the remaining properties being holders of other certifications (LEED Gold or Platinum). In addition, our mixed-use property Renoma, which is undergoing the last refurbishment works, has been recertified with BREEAM Excellent during 2024.

At Globalworth, we are aiming for 100% of our commercial portfolio to be green-accredited. We are currently in the process of certifying or recertifying 3 other properties in our portfolio, principally targeting BREEAM and LEED certifications.

Furthermore, as part of our overall green initiatives, we kept our policy of securing 100% of the energy used in our Polish and Romanian properties from renewable sources.

Social Initiatives

In the first half of 2025, Globalworth and the Globalworth Foundation continued with their very active social programme, contributing €130k to over 17 initiatives in Romania and Poland.

Initiatives to which we contributed included:

Real Estate Hackathon, pioneering event in real estate in Poland, an initiative designed to merge the world of commercial real estate with technology. Nearly 100 participants, a total of 21 projects submitted and 48 hours of intensive coding and innovation

· Virtual journeys with Globalworth:

· Continuation of the therapeutic project using virtual reality (VR) technology for cancer ill children in 2 pediatric hospitals in W r ocław and Krakow. Over 100 children participated .

· Completed the "Virtual Journeys with Globalworth" project, which enabled 250 young patients from oncology wards in 6 cities to benefit from therapeutic VR sessions. Each facility received a VR kit to continue the activities after the project ended.

Music workshops for children: A series of music workshops for children from families in need, in cooperation with the Serduszko Association which will be carried out till December. The workshops aim to support the emotional and creative development of the participants through regular music sessions.

Blood donation day: organised both in our offices in Romania and Poland for our community members

Race for the Cure - Our team took part in the 11th edition of Race for the Cure, Europe's largest charitable sports event dedicated to women's health, organized by the Fundația Renașterea pentru Sănătatea Femeii.

In addition to these we had several campaigns within our communities among which it is noteworthy to mention:

Book Clubs - organised for our Bucharest Globalworth Community - We shared our thoughts, sipped tea and wine, enjoyed cookies, and connected with fellow book lovers

Bike to Work and No Car Day campaigns - To celebrate World Environment Day, we dedicated the entire week to our No Car Day initiative across our office buildings. We supported our community members who chose to bike to work by offering dedicated bike parking, showers, and secure lockers across our buildings

Earth Hour - We turned off all non-essential lights in our buildings for Earth Hour, joining the global movement to protect our planet

Reporting

As part of our effort to improve disclosure in relation to our sustainable development strategy, initiatives and performance, we published Globalworth's "2024 Sustainable Development Report".

This is the sixth report published by the Group and has been prepared in accordance with the GRI Standards: Core option and with the European Public Real Estate Association's Sustainability Best Practice Reporting Recommendations (EPRA sBPR).

PORTFOLIO SNAPSHOT

Our real estate investments are in Poland and Romania, the two largest markets in the CEE. As at 30 June 2025, our portfolio was spread across 9 cities, with Poland accounting for 54.0% by value and Romania 46.0%.

| Combined Portfolio Snapshot (as at 30 June 2025) |

|||

|

|

Poland |

Romania |

Combined Portfolio |

| Standing Investments(1) |

18 |

14 |

32 |

| GAV(2) / Standing GAV (€m) |

€1,412m / €1,290m |

€1,205m / €1,171m |

€2,616m / €2,461m |

| Occupancy(3) |

77.5% |

95.2% |

85.9% |

| WALL |

3.7 years |

5.2 years |

4.4 years |

| Standing GLA (k sqm)(4) |

530.1k sqm |

481.8k sqm |

1,011.8 sqm |

| Contracted Rent (€m)(5) |

€98.3m |

€89.4m |

€187.7m |

| GAV Split by Asset Usage |

|

|

|

| Office |

80.0% |

95.7% |

87.2% |

| Mixed-Use |

20.0% |

0.0% |

10.8% |

| Industrial |

0.0% |

0.4% |

0.2% |

| Others |

0.0% |

3.9% |

1.8% |

| GAV Split by City |

|

|

|

| Bucharest |

0.0% |

98.9% |

45.6% |

| Constanta |

0.0% |

0.7% |

0.3% |

| Craiova |

0.0% |

0.4% |

0.2% |

| Warsaw |

42.7% |

0.0% |

23.1% |

| Krakow |

19.8% |

0.0% |

10.7% |

| Wroclaw |

17.6% |

0.0% |

9.5% |

| Katowice |

11.7% |

0.0% |

6.3% |

| Lodz |

4.1% |

0.0% |

2.2% |

| Gdansk |

4.0% |

0.0% |

2.2% |

| GAV as % of Total |

54.0% |

46.0% |

100.0% |

| |

|

|

|

| 1. Standing Investments representing income producing properties. One investment can comprise multiple buildings. e.g. Globalworth Campus comprises three buildings or one investment |

|||

| 2. Includes all property assets, land and development projects valued at 30 June 2025 3. Occupancy of standing commercial properties adjusted with the active leases related to our social commitments (1,954 sqm in BOC Tower, Bucharest, signed with social assistance authority) and with the available area of the spaces leased to GW Flex Sp. Z.o.o, our group entity overseeing the implementation of flex offices concept in our portfolio, was 76.7%, 94.8% and 85.2% as of 30 June 2025 for Poland, Romania and at group level, respectively. |

|||

| 4. Including 8.9k sqm of residential assets in Romania |

|||

| 5. Total rent comprises commercial (€181.0 million) and residential (€0.3 million in Romania) standing properties and rent in assets under redevelopment (€6.5 million in Poland)

|

|||

CAPITAL MARKETS UPDATE

| With inflation aligning more closely with central banks' targets, the pressure on capital markets is beginning to cool off. Trade and geopolitical risks remain elevated, but businesses have somehow adapted and acknowledged the importance of considering such risks. Globalworth's share price in this period continued to trade consistently below our last reported EPRA NRV, but historically, this is also attributable to the limited free float of our shares. After the 2024 successful exchange of our bonds, we consider ourselves better prepared for the challenges and opportunities ahead, having significantly strengthened our financial and debt maturity profile. Fitch reaffirmed the investment grade rating following their July review of Globalworth andmaintained a stable outlook, while S&P changed the group's corporate credit rating to BB (from BB+) with a stable outlook. |

Equity Capital Markets and Shareholder Structure Update

The first half of 2025 was characterised by a relatively calm macroeconomic environment with inflation stabilizing around central banks long term targets. Having this in mind, we look forward with confidence as capital markets should benefit from this relative stability. However, we keep an eye on the persistence of trade and geopolitical risks, to be prepared for future challenges and also opportunities coming from intensification or easing of such risks.

Real estate valuations have somehow stabilized after several years of higher uncertainty, which incurred high capital costs. Supported by rental upward pressure generated by the limited supply of the latest years and by a more predictable macroeconomic environment, we are starting to see some small positive valuation uplifts for some of our prime, high-quality assets.

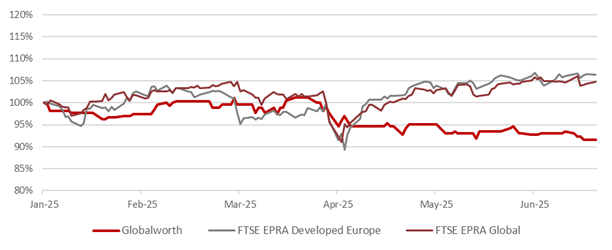

As of 30 June 2025, FTSE EPRA Developed Europe and the FTSE EPRA Global indices recorded a performance of +6.4% and +4.7%, respectively, for the six months starting on 1 January 2025, while Globalworth's share price evolution was at -8.5%, however, we must underline the limited free float of our shares.

Globalworth's share price in this period has been trading consistently below its last reported 31 December 2024 EPRA NRV level of €5.89 / share, reaching its lowest closing price on 26 June 2025 at €2.37 per share and its highest price on 24 Mar 25 at €2.62 per share.

Zakiono Enterprises Ltd, which is jointly and equally owned by CPI Property Group S.A. ("CPI") and Aroundtown SA ("Aroundtown"), holds 60.9% of the share capital of the Group, followed by Growthpoint Properties Ltd with 29.6%. As further proof of their commitment to the business, more than 98% of our shareholders have chosen the scrip dividend alternative for the dividend announced and paid during the first semester of 2025.

| Globalworth Shareholding |

|||

| |

|

30 June 24 |

30 June 25 |

| CPI Property Group |

Together: Zakiono Enterprises |

60.8% |

60.9% |

| Aroundtown |

|||

| Growthpoint Properties |

|

29.5% |

29.6% |

| Oak Hill Advisors |

|

5.3% |

4.7% |

| Others |

|

4.4% |

4.8% |

| Basic Data on Globalworth Shares (Information as of 30 June 2025) |

||

| Number of Shares |

290.5m plus 0.8m shares held in treasury |

|

| Share Capital |

€1.8bn |

|

| WKN / ISIN |

GG 00B979FD04 |

|

| Symbol |

GWI |

|

| Free Float |

7.4% |

|

| Exchange |

London AIM |

|

| |

|

|

| Globalworth Share Performance |

|||

| |

H1-2024 |

H1-2025 |

|

| Market Capitalisation (€ million) - 30 June |

649 |

689 |

|

| 30-June Closing Price (€) |

2.44 |

2.37 |

|

| 52-week high (€) |

3.07 |

2.69 |

|

| 52-week low (€) |

2.05 |

2.23 |

|

| Dividend paid per share (€) |

0.11 |

0.09 |

|

| |

|

|

|

| Globalworth H1-2025 Share Price Performance |

| |

Bonds Update

We finance ourselves through a combination of equity and debt, and we compete with many other real estate companies for investor trust to support our initiatives.

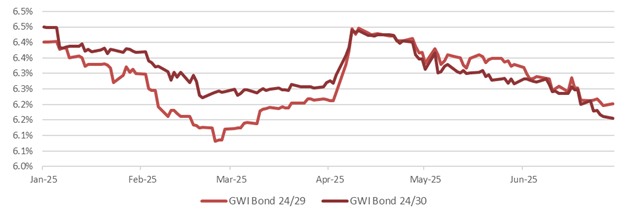

To issue Eurobonds efficiently and benefit from market opportunities, we have established a Euro Medium Term Notes (EMTN) programme in 2018, allowing the Group to issue up to €1.5 billion of bonds. From this programme, €950 million was raised through bonds issued in March 2018 and July 2020 (inaugural green bond), with maturities in 2025 and 2026.

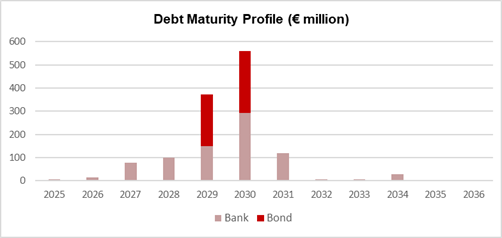

During last year, confronted with high interest rates, investor risk aversion and the two significant bond maturities, we have refinanced the two bonds maturing in 2025 and 2026 with new bonds expiring in 2029 and 2030. Furthermore, following the completion of sale of our industrial portfolio, we have redeemed additional amounts reaching an aggregated value of €492.3m as of 30 June 2025.

This proactive approach to managing debt and liquidity underscores GWI's commitment to maintaining financial health and strategic flexibility in an evolving market landscape.

Globalworth is rated by two of the three major agencies, with Fitch maintaining their investment credit rating following their July review of the Group while keeping the stable outlook and S&P changing the group's corporate credit rating to BB with a stable outlook.

| Rating |

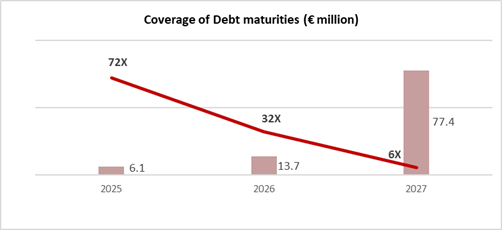

|

|

| |

S&P |

Fitch |

| Rating |

BB |

BBB- |

| Outlook |

Stable |

Stable |

| Basic Data on the Globalworth Bonds |

|

|

|

| |

GWI bond 24/29 |

GWI bond 24/30 |

|

| ISIN |

XS2809858561 |

XS2809868446 |

|

| Segment |

Euronext Dublin |

Euronext Dublin |

|

| Minimum investment amount |

€100,000 and €1,000 thereafter |

€100,000 and €1,000 thereafter |

|

| Coupon |

6.250% |

6.250% |

|

| Issuance volume |

€307.1 million |

€333.4 million |

|

| Outstanding 30 June 2025 |

€223.9 million |

€268.4 million |

|

| Maturity |

31 March 2029 |

31 March 2030 |

|

| Performance of the Globalworth Bonds |

|

|

| |

H1-2025 |

|

| GWI bond 24/29 |

|

|

| 30 June closing price |

101.77 |

|

| Yield to maturity on 30 June |

6.2% |

|

| GWI bond 24/30 |

|

|

| 30 June closing price |

101.85 |

|

| Yield to maturity on 30 June |

6.2% |

|

| |

|

|

| Globalworth H1-2025 Eurobond Yield Performance |

| |

FINANCIAL REVIEW

Introduction and Highlights

In the first half of 2025, we focused on preserving our cash position and securing our future financing costs by entering fixed rated financial instruments, reaching 95.9% from total debt to carry fixed interest rates.

We hold 45% unsecured financing from public debt markets, comprising of two Eurobonds maturing in 2029 and 2030 accounting for €492.3 million and €85.0 million facility from the IFC.

Our commitment to responsible financial management remains unwavering therefore we continue to invest in our standing assets and prioritise ESG initiatives focused on energy efficiency and tenant comfort.

We measure our performance using a range of metrics widely recognized in the real estate sector, based on consolidated figures, incorporating our joint ventures, to show in the best way possible how we manage our portfolio and operations. Additionally, we report like-for-like metrics and adopt standards set by EPRA, aimed at enhancing transparency and ensuring comparability across the European real estate industry.

| Revenues €115.7 -7.5% on H1 2024 |

Combined Portfolio Value (OMV) 1 €2.6bn 0.6% on 31 Dec. 2024 |

| NOI 1 €67.0m -7.4% on H1 2024 |

NOI 1 Like-for like €68.6m 2.9% on H1 2024 |

| Adjusted normalised EBITDA 1 €57.3m -9.9% on H1 2024 |

Adjusted normalised EBITDA 1 Like-for-Like €58.9m 1.6% on H1 2024 |

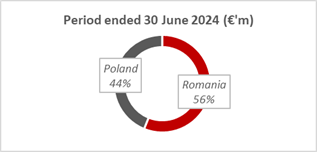

| IFRS Earnings per share 2 3 cents -24 cents in H1 2024 |

EPRA NRV per share 1,3 €5.67 -3.7% on 31 Dec. 2024 |

| EPRA NRV 1,3 €1,644.8m 0.4% on 31 Dec. 2024 |

EPRA Earnings per share 1,2 6 cents 11 cents in H1 2024 |

| LTV 1,4 38.0% 38.1% at 31 Dec. 2024 |

Dividends paid in H1 2025 per share 9 cents 11 cents in H1 2024 |

1. See Glossary for definitions.

2. See note 12 of the unaudited condensed consolidated financial statements for calculation.

3. See note 20 of the unaudited condensed consolidated financial statements for calculation.

4. See note 17 of the unaudited condensed consolidated financial statements for calculation.

2. Revenues and Profitability

Total consolidated revenue generated by our properties in the first half of 2025 was €115.7 million, with €9.3 lower revenue generated compared to the same period 2024, reflecting a 7% decrease.

From our core revenue stream, we recorded €74.9 million in H1 2025 as rental income with €74.9 million rental income recorded same period of 2024. However, on a like for like basis, excluding the €5.9 million recorded in 2024 from disposed properties, our rental income increased with €1.9 million, or 3%, with €3.0 million more income recorded in Poland, while Romania generated €1.1 million lower rental income.

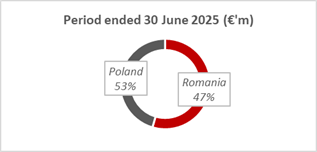

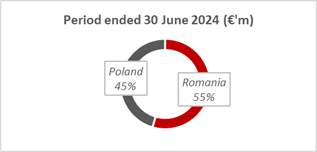

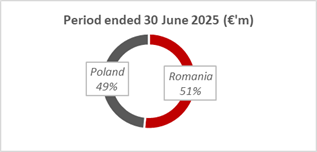

Overall, our revenues remained relatively evenly split between our two markets of operation, with Poland taking the lead and accounting for 53% (45% in H1-2024) and Romania 47% (55% in H1-2024), after the disposal of industrial properties in 2024.

Revenue share per country

Our Net Operating Income ("NOI"), on a like for like basis, was €68.6 million, €2.0 million higher than H1 2024. However, after considering €1.6 million one-off non recoverable operating costs recorded in H1 2025 and €5.6 million NOI generated in 2024 by the disposed properties, the overall NOI for H1 2025 was 7% lower reaching €67.0 million.

Majority of our leases are triple net thus most of our operating expenses, c.83% (c. 83% in H1 2024) on consolidated Group level are reinvoiced to tenants, or 92% recoveries in Romania and 76% in Poland.

NOI share per country

Adjusted normalised EBITDA lower by 9.9% or €6.3 million, reaching €57.3 million for H1 2025 (€63.6 million for H1 2024) resulted from €5.3 million decrease in NOI and €1.0 million increase in administrative expenses in first half. Excluding the industrial contributions from 2024, the like-for-like adjusted normalised EBITDA, is higher by €1.0 million.

Our finance costs for H1 2025 were €34.7 million (€48.4 million in H1 2024), excluding the one-off debt close-out cost related to bond exchange exercise in April 2024, of €12.8 million, the cost decreased with €0.9 million, from:

€0.5 million increase in fixed rated bonds interest,

€0.8m lower interest expense for secured and unsecured loans; and

€0.6m lower debt cost amortization

Finance income was €5.5 million, lower by €2.0 million:

€0.9 million less income from short-term and overnight placement with banks,

€0.9 million less interest income on loans receivable from the joint ventures and

€0.9 million less interest income on discounting.

During H1 2025 we also recorded €0.05 million loss from one joint venture investment (€13.2 million in H1 2024) since in July 2024 we disposed entire investment held in the joint venture companies.

The earnings before tax generated in H1 2025 was a gain of €21.2 million, with only €1.7 million revaluation loss accounted as compared with €50.5 million loss in H1 2024, additional one-off loss recorded from sale of wholly owned industrial properties of €24.1 million and the loss recorded from joint ventures of €13.2 million in H1 2024 contributed to total loss of €65.1 million loss in prior period.

The current income tax expense of €7.6 million (€3.5 million for H1 2024) include one of withholding tax payable in Poland of €5.9 million and deferred tax expense increased up to €5.5 million compared to H1 2024 when we recorded €3.3 million deferred tax income.

EPRA earnings for the first six months of 2025 were €17.7 million (or 6 cents per share), lower by €12.0 million mainly from the decrease in EBITDA due to properties disposed in 2024 of €5.6 million and additional withholding tax expense recorded in Poland of €5.9 million. EPRA earnings per share decline is also amplified by the increase in weighted average number of shares being of 285.2 million in H1 2025 (259.8 million in H1 2024) following the issue of scrip dividend shares in October 2024 and April 2025.

IFRS earnings per share of 3 cents (€8.0 million loss) in H1 2025 (24 cents negative in H1 2024 or €65.3 million loss).

3. Balance Sheet

As of 30 June 2025, we own real estate that makes up most of our assets, with investment properties and cash equivalents accounting for over 97% of our total value.

Our combined market value of the investment property portfolio is €2,616 million increased by €16.4 million (31 Dec. 2024: €2,600 million), out of which €2,608 million is wholly owned investment property and €8 million (31 Dec. 2024: €8 million) represents the 100% value of the properties owned by the joint venture company in which we own a 50% stake.

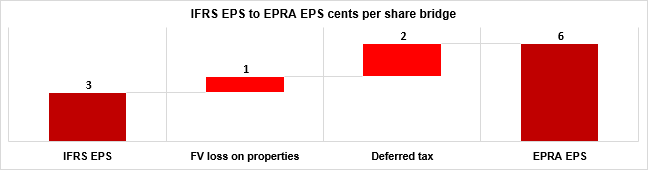

The balance sheet value of our freehold investment property increased under the effect of small valuation uplift, to €2,608 million, €1,197 million in Romania and €1,411 million in Poland. We invested in our properties €25.7 million (€10.6 million in Romania and €15.1 million in Poland) and recorded €207 million fair value losses of €1.7 million. We continued disposals of residential properties from Romania, with €3.5 million total fair value of assets sold.

The pie chart below presents further details of our capital expenditure:

CAPEX H1 2025 (€ million)

€25.7m

Our cash position at the end of the first half of 2025 is still strong at €325.5 million (€333.6 million on 31 December 2024) with €115 million additional liquidity available from the undrawn facilities.

Total assets at the end of the period were €3,060.4 million, 0.3% higher compared to 31 December 2024 (€3,049.7 million).

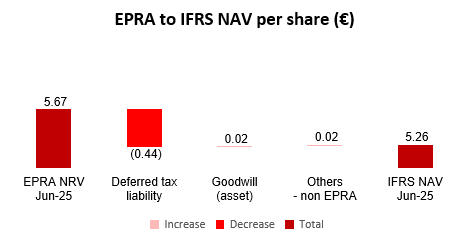

EPRA NRV was €1,644.8 million as of 30 June 2025, 0.4% higher compared to 31 December 2024 (€1,639.0 million). EPRA NRV per share was €5.67 per share (31 December 2024: €5.89 per share), 3.7% lower. The decrease in EPRA NRV per share was driven by the increase in the fully diluted number of shares, with 11.8 million shares issued in April 2025 following the distribution of scrip divided shares.

4. Dividends

Globalworth distributes bi-annually at least 90% of its EPRA Earnings to its shareholders. During the first half of 2025, the distributions included the option to a scrip dividend alternative so that qualifying shareholders can elect to receive new ordinary shares in the Company instead of cash in respect of all or part of their entitlement to the dividend. Qualifying shareholders who validly elect to receive the Scrip Dividend Alternative become entitled to a number of Scrip Dividend Shares in respect of their entitlement to the Dividend that is based on a price per Scrip Dividend Share calculated on the basis of a discount of 20% to the average of the middle market quotations for the Company's shares on the five consecutive dealing days from and including the Ex-Dividend Date, the "Reference Price".

The dividend declared for the six-month period ended 31 December 2024 was 9 cents per share. Following the election of scrip dividend 11.8 million new shares were issued in April 2025, while the Group paid in total €0.5 million as cash dividend, resulting in 98.2% shareholders opting to reinvest in the Company.

The results for the period are set out in the consolidated statement of comprehensive income on page 28.

5. Financing and Liquidity Review

Our key priorities included maintaining strong cash reserves, managing debt maturities, reduction in weighted average cost of debt and ensuring access to revolving credit facilities for unexpected needs.

We close monitor our cost of debt with strategies like hedging or adjusting the fixed versus floating rate debt mix to protect against rising rates. Additionally, regular compliance checks with debt covenants and exploring opportunities for further cost of debt reduction is crucial to maintaining financial flexibility.

Debt Summary

The total debt of the Group at 30 June 2025 was €1,305.5 million (31 December 2024: €1,310.8 million) comprising mainly of medium to long-term debt, denominated entirely in Euro, out of which €84.6 million is unsecured loans, €504.9 million New unsecured Notes and €716.0 million secured loans.

In the first half of 2025 we successfully refinanced €100 million secured facility, which was expiring in May 2025, by extending it for another five years. The extension involved swapping two mortgaged properties from guarantees structure with a new one.

In addition, the Group continued its focus to decrease the cost of debt by hedging through interest rates swaps additional circa 9% of its debt facilities reaching total 95.9% fixed debt (31 December 2024: 86.5%) .

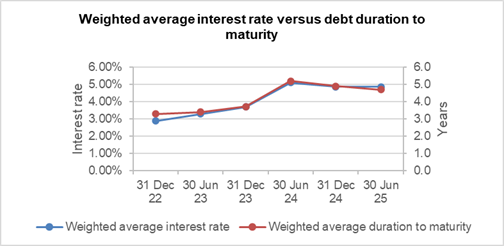

Therefore the Group continues to maintain a low weighted average interest rate cost, which as of 30 June 2025 was 4.86% (4.87% as of 31 December 2024), while the average maturity period is 4.7 years (4.9 years as of 31 December 2024), as depicted in the chart below.

| Strong liquidity |

€ million |

| Cash balance as at 30 June 2025 |

325 |

| (+) RCF - undrawn amount |

50 |

| (+) Other undrawn facilities |

65 |

| Total Liquidity as at 30 June 2025 |

440 |

|

|

|

Group's strong cash position is sufficient to cover debt maturities over the next two years

Liquidity & Loan to value ratio (LTV")

Managing our financial and operational resources has been a key area of focus for the Group and this careful management has carried on throughout this period of higher volatility and uncertainty.

From total Group's €325.5 million cash and cash equivalents balance of 30 June 2025 (31 December 2024: € 333.6 million) €28.9 million was restricted due to various conditions imposed by the financing Banks. In addition, the Group had available liquidity from committed undrawn loan facilities of €115 million.

The Group's loan to value ratio on 30 June 2025 was 38.0% (38.1% as of 31 December 2024). This is consistent with the Group's strategy to manage its long-term target LTV of around or below 40%.

Debt Structure as at 30 June 2025

Debt Structure - Secured vs. Unsecured Debt

Our debt as of 30 June 2025 comprises unsecured facilities 44.6% (31 December 2024: 44.4%) of the total debt outstanding. Unsecured facilities included the two Eurobonds maturing in 2029 and 2030 accounting for €509.2 million and the €85.0 million facility from the IFC. The remainder debt (55.4%) is secured with real estate mortgages, pledges on shares, receivables and loan subordination agreements in favour of the financing banks.

Debt Denomination Currency and Interest Rate Risk

Our loan facilities are entirely Euro denominated, and bear interest based either on three months or six months Euribor plus a margin (4.1% of the outstanding balance compared to 13.5% as of 31 December 2024), or at a fixed interest rate (66.7% of the outstanding balance compared to 66.3% as of 31 December 2024).

As of 30 June 2025, the majority of our debt (66.7% compared to 66.3% 31 December 2024) carries fixed interest rates and 20.5% of debt facilities are hedged through interest rate swaps.

The high degree of fixed interest rate debt ensures a natural hedging to the Euro, the currency in which the most significant part of our liquid assets (cash and cash equivalents and rental receivables) is originally denominated and the currency for the fair market value of our investment property. Based on the Group's debt balances on 30 June 2025, an increase of 100 basis points in the EURIBOR will result in an increase of interest expense of €0.5 million per annum.

Debt Covenants

As of 30 June 2025, the Group is in compliance with all of its debt covenants.

The Group's financial indebtedness is arranged with standard terms and financial covenants, the most notable as of 30 June 2024 being the following:

Unsecured Eurobonds, Revolving Credit Facility and IFC loan

the Consolidated Coverage Ratio, with minimum value of 150% (covenant value was aligned for all debt facilities).

the Consolidated Leverage Ratio, with maximum value of 60%.

the Consolidated Secured Leverage Ratio with a maximum value of 30%, and

the Total Unencumbered Assets Ratio, with minimum value of 125% (additional covenant applicable for the Revolving Credit Facility and IFC loan).

Secured Bank Loans

the debt service cover ratio ('DSCR') / interest cover ratio ('ICR'), with values starting from 120% (be it either historic or projected), and

the LTV ratio, with contractual values ranging from 45% to 83%.

6. Principal Risks and Uncertainties

The key risks which may have a material impact on the Group's performance, together with the corresponding mitigating actions, are presented on pages 67 to 71 of the Annual Report for the year ended 31 December 2024, which is available at www.globalworth.com .

These risks comprise the following:

Market conditions and the economic environment, particularly in Romania and Poland

Changes in the political or regulatory framework in Romania, Poland or the European Union

Inflation in Romania and Poland

Execution of investment strategy

Valuation of the portfolio

Inability to lease space

Counterparty credit risk

Sustainable portfolio risk and response to climate change

Lack of available financing and refinancing

Breach of loan covenants

Changes in Interest and foreign exchange rates

Compliance with fire, structural, health and safety, or other regulations, and

Cyber security

There have been no new risks identified during the six-month period ended 30 June 2025, and the identified risks are expected to continue to remain relevant during the second half of 2025.

7. Going Concern

The Directors have considered the Company's ability to continue to operate as a going concern based on the Management's cash flow projections for the 15 months subsequent to the date of approval of the unaudited interim condensed consolidated financial statements. The Directors believe that the Company would have sufficient cash resources to meet its obligations as they fall due and continue to adopt the going concern basis in preparing the unaudited interim condensed consolidated financial statements as of and for the six months ended 30 June 2025.

GLOBALWORTH REAL ESTATE INVESTMENTS LIMITED

UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS FOR THE PERIOD ENDED 30 JUNE 2025

INTERIM CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE SIX-MONTH PERIOD ENDED 30 JUNE 2025

| |

|

30 June 2025 |

30 June 2024 |

|

| |

|

Unaudited |

Unaudited |

|

| |

Note |

€'000 |

€'000 |

|

| Revenue |

7 |

115,697 |

125,034 |

|

| Operating expenses |

8 |

(48,654) |

(52,652) |

|

| Net operating income |

|

67,043 |

72,382 |

|

| Administrative expenses |

9 |

(9,764) |

(9,287) |

|

| Fair value loss on investment property |

3 |

(1,659) |

(50,527) |

|

| Share-based payment expense |

21 |

(128) |

(167) |

|

| Loss on disposal of subsidiary |

|

- |

(24,111) |

|

| Depreciation and amortisation expense |

|

(554) |

(404) |

|

| Other expenses |

|

(1,468) |

(1,204) |

|

| Other income |

|

141 |

1,162 |

|

| Foreign exchange loss |

|

(1,268) |

(249) |

|

| Profit/(Loss) from fair value of financial instruments at fair value through profit or loss |

|

(2,021) |

1,368 |

|

| Profit/(Loss) before net financing cost |

|

50,322 |

(11,037) |

|

| Finance cost |

10 |

(34,657) |

(48,386) |

|

| Finance income |

10.2 |

5,544 |

7,528 |

|

| Share of (loss)/ profit of equity-accounted investments in joint ventures |

22 |

(59) |

(13,198) |

|

| Profit/(Loss) before tax |

|

21,150 |

(65,093) |

|

| Income tax expense |

11 |

(13,119) |

(154) |

|

| Profit/(Loss) for the period |

|

8,031 |

(65,247) |