NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, IN, INTO OR FROM THE UNITED STATES, AUSTRALIA, CANADA OR JAPAN OR ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND THE INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE AN OFFER TO SELL OR ACQUIRE SECURITIES IN THE UNITED STATES, AUSTRALIA, CANADA, JAPAN OR IN ANY OTHER JURISDICTION.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS CONSIDERED BY THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION (EU) NO. 596/2014 ("MAR"), AND THE UK VERSION OF MAR WHICH IS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018, AS AMENDED BY THE MARKET ABUSE (AMENDMENT) (EU EXIT) REGULATIONS 2019 (AS FURTHER AMENDED, VARIED, OR SUBSTITUTED FROM TIME TO TIME AS A MATTER OF UK LAW). UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

Jangada Mines plc / EPIC: JAN.L / Market: AIM / Sector: Mining

11 August 2025

Jangada Mines plc ('Jangada')

Strategic Acquisition of 33.3% Stake in Brazilian Gold Project

Excellent potential for a large-scale high grade gold deposit

Jangada Mines plc ("Jangada"), a natural resources development company with assets in Brazil and other jurisdictions, is delighted to announce, further to its announcement on 21 July 2025 , that it has conditionally completed the acquisition of an initial 33.3% equity interest in MTGOLD MINERAÇÃO LTDA ("MTgold"), the owner of the highly prospective Paranaíta Gold Project ("Paranaíta" or the "Project"), located in Brazil's historically significant Alta Floresta - Juruena Gold Province ("AFGP"). This acquisition marks an entry point for the Company into the gold arena where the market fundamentals for high grade development projects, with excellent data, are extremely strong.

The consideration for the acquisition of the initial 33.3% interest comprises of £1 million in new Jangada Ordinary Shares (based on a 20-day VWAP calculated at the point of closing) and £250,000 in cash. As previously announced, the Company has convened a general meeting for 19 August 2025 to seek the necessary shareholder approvals to issue such new Ordinary Shares to the vendors, which it has been agreed will be subject to a 12 month lock-up, save for certain limited circumstances. Jangada also holds an option to increase its stake in MTgold to 50.1% through the issue of a further £500,000 in new Ordinary Shares, again priced using a 20-day VWAP at the time of exercise.

Paranaíta Gold Project Highlights:

· 7,211-hectare Paranaíta Gold Project is a gold-rich porphyry-epithermal system with extensive historical data, artisanal mining history and structural similarities to nearby producing high grade gold deposits

· Key factors driving the acquisition include:

o 15 primary high grade gold occurrences already identified along an 8 km east-west (EW) mineralised corridor

o Internally generated Measured, Indicated and Inferred resource estimate currently stands at a Comissão Brasileira de Recursos e Reservas (CBRR) compliant c.210,000 oz Au grading c.3.165 g/t, which is anticipated to be easily converted to JORC standard and scaled with the implementation of further exploration work

o $2m+ spent on exploration to date including 1,756m of diamond drilling with results including 5.0m @ 5.48 g/t Au (including 1.0m @ 18.81 g/t Au)

o Board believes that the alignment of widespread gold mineralisation, with geochemical anomalies and their correlation with magnetic structures, strongly indicates the potential presence of a large-scale gold deposit

o Next phase of exploration, comprising geophysics, trenching, drilling, and metallurgical testing, will target multiple gold structures open in all directions to rapidly upscale the Project

· Rapid development strategy being implemented including mobilisation of a drill rig to provide data for the upgrading of the current gold resource

· Jangada also holds an option to increase its stake in MTgold to 50.1%.

Jangada Executive Chairman, Brian McMaster, said: "Jangada's strategic acquisition of a significant stake in MTgold marks the entry into an exciting gold exploration opportunity in Brazil. The Paranaíta asset, located in a well-established mining district with excellent infrastructure, is underpinned by robust geological fundamentals and substantial scalability potential. Data generated from approximately US$2 million of investment to date indicates the presence of a potentially significant gold system, reinforcing our confidence in the project's potential as we move to unlock its value."

"Historic exploration has already identified more than 15 concentrated gold occurrences, supported by strong drill results, trenching, geophysical surveys, and metallurgical testing. An initial resource estimate of approximately 210,000 ounces of gold has been delineated, which we believe can be rapidly upgraded to JORC-compliant status. This provides a clear pathway toward resource expansion and the development of a large-scale gold asset."

"This acquisition offers compelling re-rating potential with limited capital requirements. With gold market fundamentals remaining strong and investor sentiment favouring quality exploration stories, we believe this is the ideal time to advance such a high-quality asset in a supportive and mining-friendly jurisdiction."

FURTHER DETAILS ON THE PROJECT

The 7,211-hectare Paranaíta Gold Project ('the Project') is situated within the prolific Alta Floresta - Juruena Gold Province (AFGP) - a region with an estimated 7-10 million ounces of historical gold production and over 30 years of continuous artisanal mining activity.

The Project is interpreted as a gold-rich porphyry-epithermal system comparable to intrusion-hosted disseminated, stockwork, and vein-type gold deposits, such as the X1 and Pé Quente deposits in the eastern AFGP. It lies within a structurally complex area aligned with multiple mineralised trends and hosts extensive surface workings and primary gold occurrences.

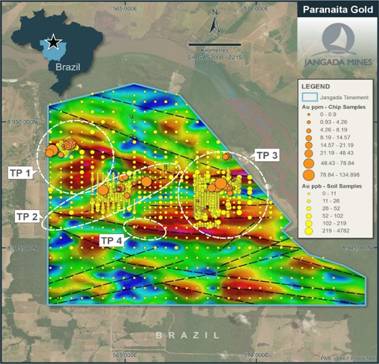

Approximately 15 primary gold occurrences have already been identified, distributed along an east-west (EW) 8km gold-mineralised trend. These are associated with structural trends (EW, NE, NS, NW), some extending individually up to 2km.

Approximately 5km west of Paranaíta, on the adjacent claim, lies the Zé Vermelho Gold Deposit. This deposit shares significant geological similarities with Paranaíta, including comparable lithologies, structural settings, hydrothermal alteration patterns, and styles of gold mineralisation. Notably, the primary gold deposits in both areas are structurally aligned, suggesting a common mineralising system or regional control on gold emplacement.

Furthermore, infrastructure in the area is excellent, with paved road access, grid power, water availability, and a skilled local workforce providing a positive impact on exploration and development works.

Image 1 - Location of the Project within the Alta Floresta Gold District - a proven gold producing region

|

Past Exploration & Resource:

Extensive exploration and test work to the value of c. US$2m has been conducted to date on the Project, including 1,756m of DD across 6 targets, 432m of auger drilling and >1,270m of trenching. Geophysics in the form of regional airborne data integration & 3D inversion, soil geochemistry via semi-detailed grids (200×200m, 100×100m, and selected 50×50m) and geological mapping, rock sampling and induced polarisation (IP) surveys (5 targets on 25×25m grids to a 120m depth and one test line on 50×50m grid (to 200m depth) totalling ~80km have been completed. All these have underscored the prospectivity of the Project.

Multiple gold-bearing structures have been identified by trenching (1,270m) and diamond drilling (1,756m) yielded excellent results for gold mineralisation, including:

· High-grade quartz-sulphide veins: intersections such as 1m @ 10 g/t Au, trenches with up to 3.8m @ 12.5 g/t Au, and 2.1m @ 19.3 g/t Au

· Disseminated pyrite within sericite-chlorite hydrothermal zones: widths ranging from 1 to 6m and grades from 0.5 to 2.6 g/t Au

· Low-grade potassic-altered and silicified granites: zones up to 6m with grades up to 5.0 g/t Au

A resource estimate reported according to the guidelines of the CBRR (equivalent in Brazil to CRIRSCO, the Committee for Mineral Reserves International Reporting Standards), currently stands at 210,043 ounces Au, but importantly there are multiple mineralised structures with open drill targets in all directions and along the 8km mineralise corridor. The resource is anticipated to be quickly upgraded and significantly expanded with the implementation of further exploration work.

| Category |

(t) |

Au (g/t) |

Total Au (oz) |

| Measured |

23,120 |

3.21 |

2,385 |

| Indicated |

1,044,860 |

1.45 |

48,721 |

| Measured + indicated |

1,067,980 |

1.49 |

51,106 |

| Inferred |

1,020,800 |

4.84 |

158,937 |

| Total |

2,088,870 |

3.16 |

210,043 |

Metallurgical tests produced excellent recovery rates highlighting the production potential of the project. These included:

· Saprolitic ore (TP01): gravity (40%) + cyanidation of gravity tailings (40.4%), total 80.4% extraction

· Sulphide ore (TP02, TP03): flotation (8%) followed by cyanidation of flotation tailings (78%), total 86% recovery

All tests were conducted at bench scale using representative bulk samples at the Brastecno laboratory in Belo Horizonte, Brazil.

The past studies have also supported a geological model in which gold mineralisation is linked to cross-cutting fault systems and widespread hydrothermal alteration. The data is strongly correlated and there is coincidence of gold anomalies in rock and soil, with magnetic structures. For the main targets, gold anomalies are correlated with magnetic anomalies.

Image 2

|

Image 3

Images 2 & 3 above, together indicate the match of gold anomalies in rock, soil with magnetic structures. For the main targets, gold anomalies are always correlated with magnetic anomalies, with their top between 70 and 150m.

Advancement:

The Board believes that the alignment of widespread gold mineralisation, including several additional targets, with geochemical anomalies in rock and soil, and their correlation with magnetic structures, strongly indicates the potential presence of a large-scale gold deposit on the property.

The proposed next phase of exploration, which is fully funded, will build on the existing results to date and includes:

· Infill RC drilling programme to detail the best targets of Phase I exploration with commencement in Q3 2025

· Publication of a Resource Upgrade

· Extension of 3D regional geophysics inversion modelling to the west part of property

· Detailed IP and Mag

· Infill grid soil sampling

· Metallurgical testwork

· The preparation of a Preliminary Economic Assessment under JORC guidelines

Jangada will immediately commence this exploration and development programme following closing of the transaction. With extensive structural and gold soil geochemistry, tectonic and hydrothermal trends and anomalies, the Company has already identified proposed targets for the exploration phase. With rapid development anticipated, the Board expects to create regular updates. Jangada has committed to solely funding the first £4 million of exploration expenditures.

Upcoming General Meeting:

The Company encourages Shareholders to read the circular posted by the Company on 1 August 2025 (as announced on 31 July 2025) convening the necessary general meeting to seek authority to complete the acquisition of the initial 33.3% interest in MTgold, as well as the further authority that would be needed should Jangada increase its interest to 50.1% in MTgold and for the future potential exercise of warrants issued to incoming placees pursuant to the Company's fundraising announced on 21 July 2025.

Qualified Person Signoff:

The resource information in this announcement has been reviewed by Mr. Peter Heinrich Müller who is a member of the South African Council of Natural Scientific Professions (#114766). Mr. Müller is a senior professional geologist with +17 years of experience in the mining industry, which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he has undertaken to qualify as a Competent Person as defined in the 2012 edition of the JORC Code. Mr. Müller also meets the requirements of a competent person under the AIM Note for Mining, Oil and Gas Companies. Mr. Müller has no economic, financial or pecuniary interest in the Company, and he consents to the inclusion in this document of the matters based on his technical information in the form and context in which it appears.

**ENDS**

For further information please visit www.jangadamines.com or contact:

| Jangada Mines plc |

Brian McMaster (Chairman) |

Tel: +44 (0)20 7317 6629 |

| Strand Hanson Limited (Nominated & Financial Adviser) |

Ritchie Balmer James Spinney |

Tel: +44 (0)20 7409 3494 |

| |

|

|

| Tavira Securities Limited (Broker) |

Jonathan Evans |

Tel: +44 (0)20 7100 5100 |

| |

|

|

| Investor Relations |

Hugo de Salis |

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.