This announcement contains inside information for the purposes of Article 7 of the UK version of Regulation (EU) No 596/2014 which is part of UK law by virtue of the European Union (Withdrawal) Act 2018, as amended ("MAR"). Upon the publication of this announcement via a Regulatory Information Service, this inside information is now considered to be in the public domain.

12 January 2026

Nativo Resources Plc

("Nativo" or the "Company")

Operations Updates: Bonanza Surface Sampling

Bonanza sampling programme confirms required gold grades for economic mining and expands wider Tesoro Concession prospectivity

Further to the announcement dated 18 November 2025, Nativo Resources plc (LON:NTVO), a gold-focused mining company with interests in Peru, is pleased to announce that initial assays from surface trenching along interpreted veins within the Tesoro Concession confirm historical data and support Nativo's plan to recommence gold production activities at Bonanza. This confidence is underpinned by positive near-mine sample results and the successful completion of underground rehabilitation and preparation of existing mine workings. Additional prospectivity within the Tesoro Concession has also been confirmed.

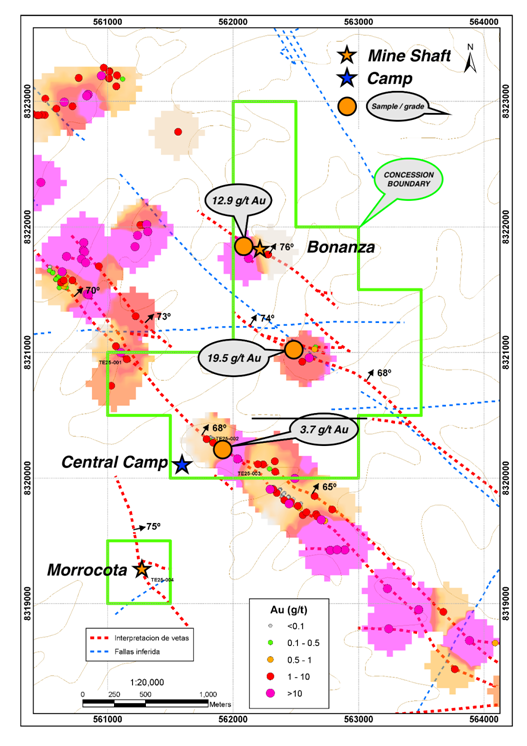

The programme (completed and ongoing) covers approximately 400 hectares gathering approximately 250 samples. 20 trenches were excavated at 25-metre intervals to depths of 1.2-1.5 metres to expose the vein structures beneath the colluvial cover. Systematic channel sampling was completed within the surface trenches, with samples taken at 1-metre intervals across the exposed mineralised structures to characterise grade variability along strike. The sampling programme focused on geological mapping, trenching, and geochemical sampling, with the objective of verifying and augmenting the historical gold grades and locations originally identified by St Elias Mines (Figure 1), whose surveys were evaluating near-mine gold mineralisation and structural controls to support production planning and early-stage mining activities, and verifying the geological vein model.

For the Bonanza mine, Nativo's Qualified Person, who designed the ongoing underground mine sampling programme (over 150 samples) has reviewed the sampling and results available, including the St Elias Mines legacy work and the Nativo commissioned sampling programmes, selecting three key surface results (Figure 1), which he considers are representative of the mineralisation along the Bonanza, Tesoro-01 and Tesoro veins and which validate the original St Elias Mines results.

Highlights

Near-Mine High-Grade Gold Mineralisation

Surface sampling returned localised values reaching Au 19.5g/t and averaging Au 10g/t, confirming gold mineralisation associated with narrow mesothermal veins and veinlets in close proximity to existing Bonanza workings. A total of 102 surface rock samples, including rock chip and chip-channel samples, were collected and analysed by Fire Assay with full QA/QC controls at the Certimin laboratory in Lima.

Figure 1: 288 legacy samples were taken by St Elias Mines between 2004-2014 based on the identified anomalies. Interpretation of the geophysical surveys confirmed anomalies associated with the Bonanza, Tesoro 01, Tesoro and Morrocota veins. The three annotated results, within the main Tesoro/Bonanza area (large orange circles) confirm the mineralisation and potential and uphold the legacy results.

Structural Controls Favourable

Mineralisation is predominantly controlled by NW-SE-trending shear zones and their interaction with the parallel and cross cutting faulting, with three principal structural systems identified (including the Bonanza Vein), each extending up to 1 km in strike length within the concession. These structures are considered favourable for lateral and vertical continuity, an important factor for sustainable mining operations.

Basis For Mine Development

The combination of sample results and completed underground preparation establishes a strong basis for mine planning and development, confirming grades and providing structural model refinement.

Restart of Mining Operations at Bonanza

Discussions with qualified mining contractors are in progress combined with finalisation of the mine plan.

Next Steps

Nativo will continue refining the geological and structural model of the Bonanza vein while advancing underground geological mapping and grade control sampling focused on shear zones and high-priority anomalies proximal to existing workings.

This will be undertaken dynamically as the Company restarts mining in the existing Bonanza mine. As part of this process of refinement, the Company has taken 34 samples from within the Bonanza mine galleries and shaft to date and is waiting for these to be analysed and interpreted to update the current Mine Plan.

The programme will close out with 117 further samples from focus areas. These activities are intended to support the commencement of production in the near future, optimise mine planning for Bonanza and Morrocota, and progressively expand the gold footprint at the Tesoro Concession.

Stephen Birrell, Chief Executive Officer of Nativo, commented:

"The sampling programme has confirmed, in the view of the Directors, that the Bonanza vein has the required grades for mining to restart. In addition, it is pleasing to see high surface grades south of Bonanza which indicate potential for at least one - and potentially two - further mine sites in addition to Morrocota."

For further information please contact:

| Nativo Resources Stephen Birrell, Chief Executive Officer |

Via Vigo Consulting |

|

|

|

| Zeus (Nominated Adviser and Joint Broker) James Joyce James Bavister

|

Tel: +44 (0)20 3829 5000 |

|

|

|

| AlbR Capital Limited (Joint Broker) Duncan Vasey Lucy Williams |

Tel: +44 (0)20 7469 0930 |

|

|

|

| Vigo Consulting (Investor Relations) Ben Simons Peter Jacob |

Tel: +44 (0)20 7390 0234 |

About Nativo Resources plc

Nativo has interests in gold projects in Peru. The Company's strategy is based on three core activities: primary gold mining, gold ore processing, and the recovery of gold from tailings. The Company has already acquired or optioned several projects for development and has identified additional opportunities for expansion. Nativo's nearest-term objective is to scale operations on the Tesoro Gold Concession, focusing on the Bonanza and Morrocota mines. Nativo intends to allocate portions of free cash flow from mining and processing activities and future fundraises to Bitcoin purchases, and to hold Bitcoin as a long-term treasury reserve asset.

Follow us on social media:

LinkedIn: https://uk.linkedin.com/company/nativoresources-plc

X (Twitter): https://x.com/nativoresources

Qualified Persons Statement

The scientific and technical information contained within this announcement has been reviewed and approved by Harold Villena Carhuaricra, a geological engineer with over 15 years' experience. Mr Villena Carhuaricra has a master's degree in Geological Processes and Resources from The Complutense University of Madrid and is registered and certified by AusIMM Chartered Professionals. Mr Villena Carhuaricra has worked for Cerro de Pasco Resources and Compañía Minera Volcan among other companies in Peru. He is a Qualified Person as defined by the AIM Guidance Note on Mining and Oil & Gas Companies dated June 2009.

Glossary

| Au |

gold |

| g/t

|

grams per tonne |

| km

|

kilometres |