02 September 2025

Tertiary Minerals plc

("Tertiary" or the "Company")

Initial analytical results from Phase 2 drill programme extend the footprint of thick, near surface silver mineralisation at Target A1, Mushima North

Tertiary Minerals plc (AIM: TYM) is pleased to announce the laboratory analytical results from the first two drill holes in the recent follow-up drill programme at Target A1 at its Mushima North Project in Zambia ("Mushima North" or the "Project"). The results extended the previously announced thick, near surface intervals of silver mineralisation (with lower grade copper and zinc) for a further 225m to the north.

Mushima North is located in the prospective Iron-Oxide-Copper-Gold region of Zambia. Target A1 is a polymetallic, silver-copper-zinc prospect located 28km to the east of the historic Kalengwa copper-silver mine which is currently under redevelopment.

Highlights:

· Thick intersections of silver mineralisation (along with copper and zinc) extend the known mineralisation. S ilver, zinc and copper mineralisation extend for a further 225m to the north with mineralisation remaining open to the north and at depth.

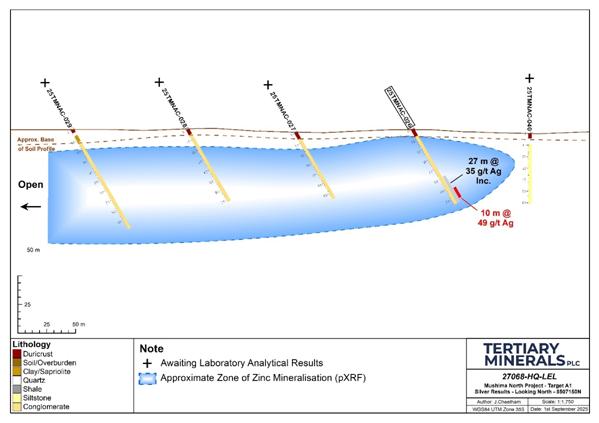

· Drill intersections comprise (downhole widths, true widths unknown):

· 73m at 32 g/t Ag , 0.16% Cu and 0.24% Zn from 11m downhole (25TMNAC-025).

§ Including: 21m at 66 g/t Ag, 0.21% Cu and 0.30% Zn from 50m downhole.

§ And: 11m at 94 g/t Ag, 0.28% Cu and 0.34% Zn from 60m downhole.

· 27m at 35 g/t Ag , 0.08% Cu and 0.42% Zn from 48m downhole (25TMNAC-026).

§ Including: 10m at 49 g/t Ag, 0.07% Cu and 0.48% Zn from 62m downhole.

· Highest grades of both silver (223 g/t) and copper (1.01%) from certified laboratory analytical results intersected to date in drilling results on the Project.

· Additional analytical results expected in the coming weeks testing strike and width continuations.

· Initial mineralogical/metallurgical work to commence.

Richard Belcher, Managing Director of Tertiary Minerals plc, commented:

"We are excited to report the first laboratory analytical results from the recent Phase 2 drill programme, including our highest intercepts for both silver and copper so far. These results increase the extent of the thick, near surface intervals of silver mineralisation a further 225m to the north of the previous drilling. The silver mineralisation remains open and is supported by the recently announced portable X-Ray Fluorescence results which indicate the mineralisation footprint is larger, at least approximately 350m by 300m.

"The results, albeit for only the first two drill holes of the programme, are very encouraging and provide further support for the potential of Target A1 as a primarily silver target. Wide intervals of near surface silver with higher-grade intervals, for example 73m at 32 g/t silver, including 11m at 94 g/t silver, support our bulk tonnage, open pit silver exploration model. These silver grades and widths (supported by copper and zinc values) are comparable to silver grades and widths from open pit silver deposits elsewhere in the world. As such we are also now looking at undertaking mineralogical studies as part of the initial metallurgical testing to better understand the mineralisation style and metallurgical properties and potential processing options.

"We eagerly await the additional analytical results in the coming weeks for the other drill holes and the mineralogical/metallurgical work thereafter."

Phase 2 Drill Programme

A programme of 1,116m of combined Air Core ("AC") and Reverse Circulation ("RC") drilling has now been completed, with a series of east-west drill lines spaced between 100 and 250m apart (north-south). Holes were collared approximately 100m apart along the east-west lines and drilled to the maximum depth possible based on the drill rig capabilities and geological ground conditions (the bit refusal depth). The deepest drill hole in this programme was 90m and the average hole depth 70m. Combined Phase 1 and 2 drilling covers a surface footprint of approximately 1,680m by 550m.

The two holes reported here are:

· 25TMNAC-025: Located on drill line 8506925N and collared between holes 24TMNAC-005 and 25TMNAC-015 (Phase 1 drilling). This hole was drilled vertically and to a depth of 90m to test the depth of oxide-related mineralisation in this area and infill between previously reported holes 24MNAC -05 and 24MNAC-15.

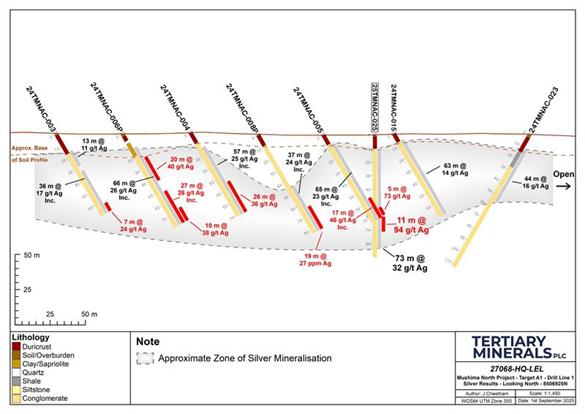

· 25TMNAC-026: Located on new drill line 8507150N approximately 225m to the north of line 8506925N, the most northerly line drilled in Phase 1. Line 8507150N is made up of five holes collared over a width of approximately 400m and was designed to test the continuation of mineralisation to the north. Analytical results for the other four holes on this drill line are awaited.

Target A1

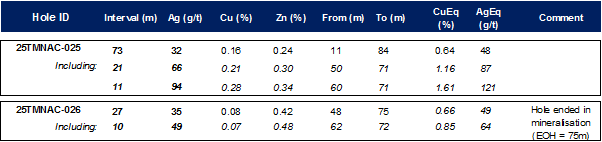

Target A1 is a large copper-in-soil anomaly (3.1km by 1.7km) with copper values up to 350ppm (per Portable X-Ray Fluorescence, "pXRF" ) associated with a 1.7km by 0.5km zinc- and coincidental 1.3km by 0.3km silver-in-soil anomaly. Phase 1 drilling in 2024 over the silver- and zinc-in-soil anomaly (drill line: 8506925N ) identified wide and thick, near surface silver mineralisation associated with low-grade copper and/or zinc mineralisation. Elevated bismuth (up to 991 g/t), and the critical minerals antimony (up to 824 g/t) and gallium (up to 40 g/t) are also associated with the mineralisation in places.

PXRF analyser results indicate a current extent of mineralisation over a footprint of approximately 350m by 300m and to a depth from near surface to 84m. However, zinc and copper mineralisation remains open-ended to the north and at depth, whilst the potential extent of silver mineralisation remains to be determined from the on-going laboratory analysis.

The mineralisation at Target A1 is associated with a massive, haematitic and carbonaceous silty-sandy conglomerate. Where visible, copper mineralisation is in the form of secondary copper minerals malachite and chrysocolla. The mineralogical speciation of silver and zinc is yet to be determined.

Table 1. Initial Phase 2 (Target A1) analytical results (two holes only, other analytical results from remainder of the drilling programme awaited). Equivalent grades ("Eq") are for illustrative purposes only.

Note to Table 1:

· Calculated intersections (downhole, true widths unknown) are weighted averages based on silver, using a cut-off grade of 10 g/t Ag. Intervals start and end with ≥10 g/t Ag and with up to 3m consecutive internal dilution allowed.

· Silver values rounded to whole numbers.

· EOH means End of Hole.

· CuEq (%) and AgEq (g/t) are the copper and silver equivalent grades, respectively. Calculations are based on commodity prices of Cu: US$4.5 lb, Ag: US$41 oz, Zn: US$1.2 lb and 100% recovery. No information on beneficiation recoveries is available at this stage. These are for illustrative purposes only.

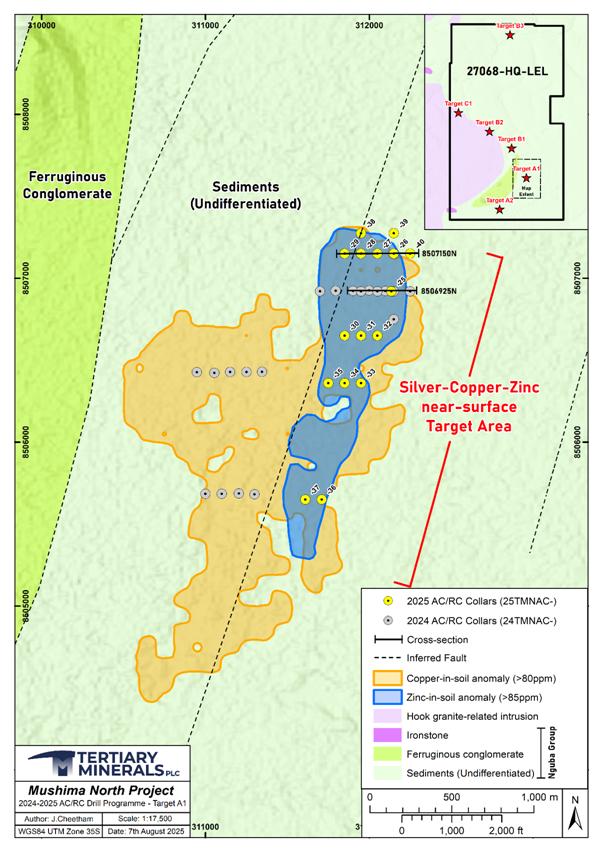

Drilling results from the Phase 1 drilling programme undertaken in late 2024 included:

· 65m at 23 g/t Ag , 0.14% Cu, 0.27% Zn from 9m downhole (24TMNAC-005).

o Including: 5m at 73 g/t Ag, 0.16% Cu, 0.31% Zn from 69m downhole.

· 66m at 26 g/t Ag , 0.13% Cu, 0.26% Zn from 13m downhole (24TMNAC-006P).

o Including: 20m at 40 g/t Ag, 0.21% Cu, 0.40% Zn from 23m downhole.

· 57m at 25 g/t Ag , 0.2% Cu, 0.16% Zn from 14m downhole (24TMNAC-004).

o Including: 26m at 36 g/t Ag, 0.20% Cu, 0.20% Zn from 45m downhole.

Mushima North Project

The Mushima North (silver-copper-zinc) Project (Licence 27068-HQ-LEL) is held through Group company Copernicus Minerals Limited, which is 90% owned by Tertiary Minerals (Zambia) Limited and 10% owned by local partner, Mwashia Resources Limited.

The Project's western boundary lies 20km to the east of the Kalengwa copper-silver mine in northwest Zambia, one of the highest-grade copper deposits ever to be mined in Zambia (approximately 4 million tonnes at 5.2% copper and 40-80 g/t silver). In the 1970s, high-grade ore, reportedly averaging approximately 11% copper, was trucked for direct smelting at other mines in the Copperbelt. The Kalengwa mine is currently under redevelopment and is expected to produce 15,000 tonnes of copper annually.

Several prospective targets have been defined thus far within the Project based on reviews of historic geochemical and geophysical survey data against the current exploration model developed by Tertiary (Targets A1, A2, B1, B2, B3, C1 and C2). At the end of the summer 2024, Tertiary completed an initial (Phase 1) 25 AC drill hole programme (1,274m) to test parts of geochemical (copper-in-soil) anomalies at Targets A1 and C1. This limited and shallow drilling indicated wide downhole intervals of largely coincidental copper, zinc and silver mineralisation at Target A1. Numerous other geochemical and/or geophysical targets (A2, B1, B2, B3, C2) are yet to be drill tested.

The Project is held under a technical cooperation agreement with First Quantum Minerals Limited ("FQM"), which allows Tertiary to benefit from FQM's historic exploration data in the area, as well as FQM's geological team's extensive experience and understanding of the area's geology. The agreement is non-binding to any further agreement and there are no commercial restrictions for Tertiary, nor does FQM have a right of first refusal over the Project. Further details can be found in the news release of 15 September 2022.

Sampling, Analysis and QAQC

Sampling from the drilling programme was undertaken at 1m intervals and two subsamples were collected from each interval using a riffle splitter: one for potential laboratory analysis, the other for future reference.

Samples have been initially analysed on site using a pXRF analyser for zinc and copper. Analysis protocol included multiple point (three) analyses per sample (unprepared sample analysed through a thin plastic sample bag) and the inclusion of Certified Reference Material, blanks and duplicate samples as part of an internal Quality Assurance ("QA") procedure. Given the nature of the unprepared sample and point analysis, this method is used as a preliminary exploration technique to provide an approximate quantitative measure of copper and zinc mineralisation only.

Samples from selected drill holes based on the initial pXRF results will now be sent to the independent laboratory ALS Global in South Africa for analysis for a range of elements using a four-acid digest, method code ME-ICP61 ( including silver, copper, zinc, bismuth, antimony and gallium ). QA samples (Certified Reference Material, duplicates, blanks) will be inserted and monitored as part of the Quality Assurance Quality Control ("QAQC") protocol.

Reported drill hole intersection thicknesses are downhole thicknesses and true thicknesses are unknown. Intersections are weighted averages based on silver, using a cut-off grade of 10 g/t Ag with up to 3m consecutive internal dilution and intervals starting and ending with ≥10 g/t Ag.

Further Information:

| Tertiary Minerals plc: |

|

| Richard Belcher, Managing Director |

+44 (0) 1625 838 679 |

| SP Angel Corporate Finance LLP Nominated Adviser and Broker |

|

| Richard Morrison/Jen Clarke |

+44 (0) 203 470 0470 |

| Peterhouse Capital Limited Joint Broker |

|

| Lucy Williams/Duncan Vasey |

+44 (0) 207 469 0930 |

Market Abuse Regulation

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulation (EU) No. 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ('MAR'). Upon the publication of this announcement via Regulatory Information Service ('RIS'), this inside information is now considered to be in the public domain .

Cautionary Note Regarding Forward-Looking Statements

The news release may contain certain statements and expressions of belief, expectation or opinion which are forward looking statements, and which relate, inter alia, to the Company's proposed strategy, plans and objectives or to the expectations or intentions of the Company's directors. Such forward-looking statements involve known and unknown risks, uncertainties, and other important factors beyond the control of the Company that could cause the actual performance or achievements of the Company to be materially different from such forward-looking statements. Accordingly, you should not rely on any forward-looking statements and, save as required by the AIM Rules for Companies or by law, the Company does not accept any obligation to disseminate any updates or revisions to such forward-looking statements.

Competent Persons Statement

The technical information in this release has been compiled and reviewed by Dr. Richard Belcher (CGeol, EurGeol) who is a qualified person for the purposes of the AIM Note for Mining and Oil & Gas Companies. Dr. Belcher is a chartered fellow of the Geological Society of London and holds the European Geologist title with the European Federation of Geologists.

About Tertiary Minerals plc

Tertiary Minerals plc (AIM: TYM) is an AIM-traded mineral exploration and development company whose strategic focus is on energy transition metals. The Company's projects are all located in stable and democratic, geologically prospective, mining-friendly jurisdictions. Tertiary's current principal activities are the discovery and development of copper and precious metal mineral resources in Nevada and in Zambia.

Figure 1. Location map of Target A1 showing soil sample results for copper and zinc and the collar locations for the 2024 and 2025 drill programme.

Figure 2. Drill cross-section 8506925N (location on Figure 1) showing analytical results for silver. Drill hole 25TMNAC-025 from Phase 2 drilling, other holes from Phase 1. Reported weighted average grades from laboratory analysis from Phase 1 drilling (see press release 25 March 2025). See Table 1 notes for further information.

Figure 3. Drill cross-section 8507150N (location on Figure 1) showing analytical results for silver for drill hole 25TMNAC-026. Analytical results for the other holes awaited. See Table 1 notes for further information.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.